Entering college is one of the most significant milestones of a student’s educational journey. It’s also the first time a lot of young people live far away from home, making college student housing an essential component of education. Student housing used to only be considered as a space to accommodate students who primarily come out of town. Nowadays, however, it’s used by higher education institutions to strategically advance the success of their students.

For students, rental housing is an introduction to the real estate market, as well as to their obligations as a tenant all while having their first taste of independence. Knowing student housing facts and statistics can lead to a deeper understanding of how accommodation preferences and costs are changing.

KEY TAKEAWAYS

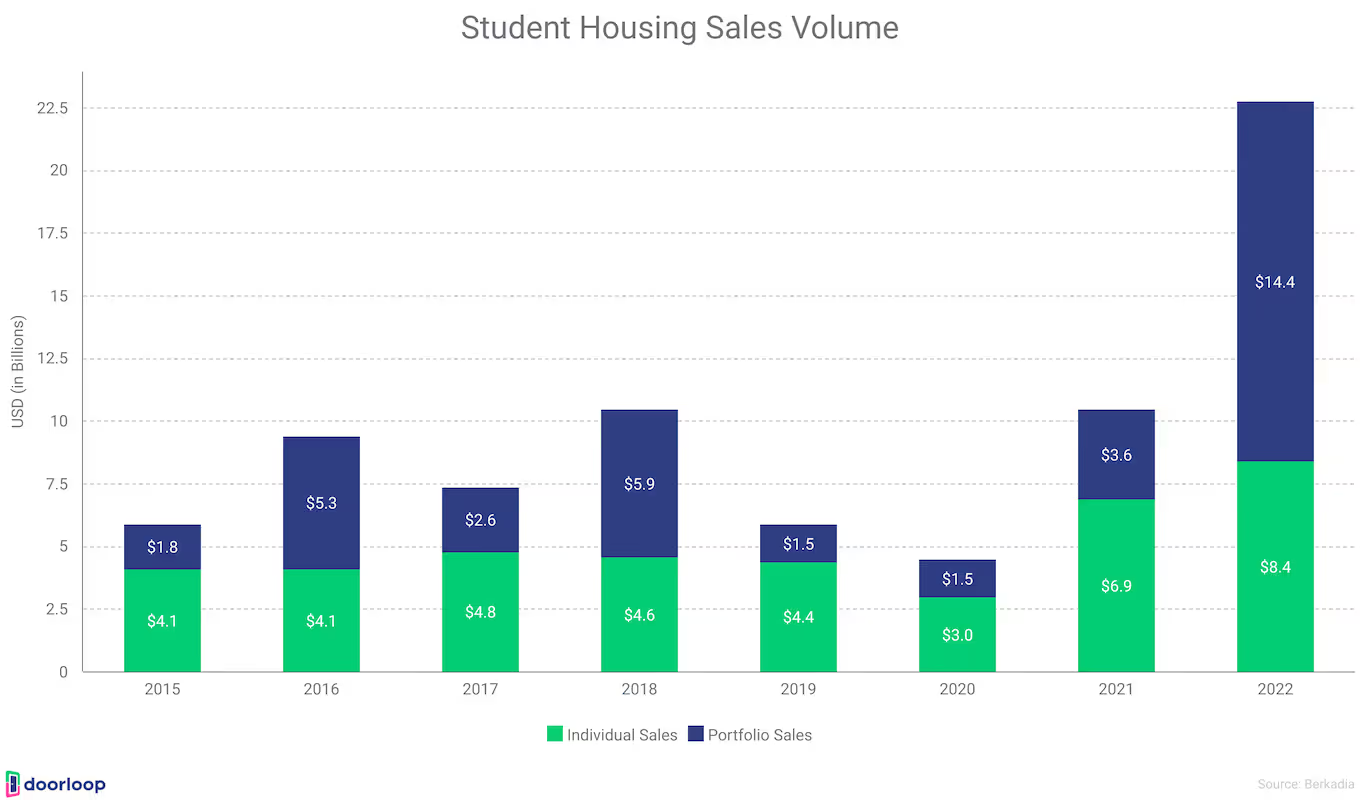

- Student housing has become one of the most preferred assets for investors. In 2019, it came in 5th in non-traditional assets preferred by investors with a rate of 29% increase in preference. And as of 2022, the student housing sector has reached $22.9 billion in total transactions

- The United States offers a huge opportunity for investors in the student housing sector, provided that the number of college students is projected to reach 19.25 million in 2024 and an average of 95% occupancy within the best universities in the nation

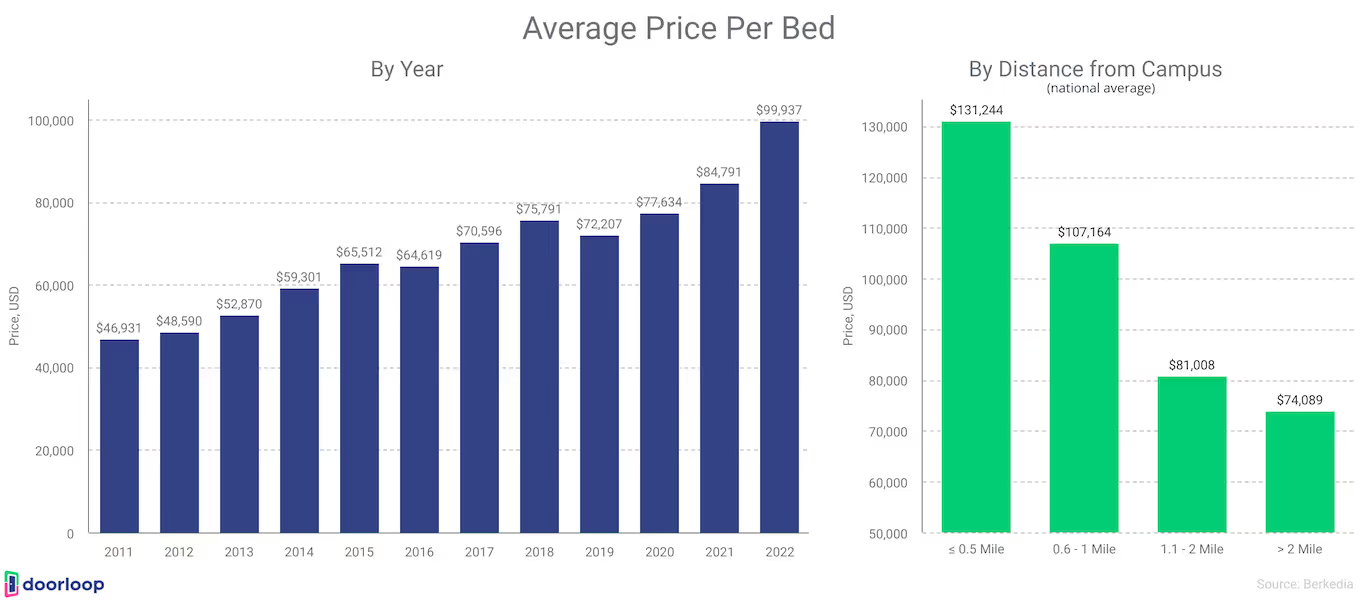

- Rentals that are less than 0.5 miles away from campus have the highest national price per bed ($131,244). The national price per bed of student housing 0.6 to 1 mile away from campus is $107,164, $81,008 for rentals that are 1.1 to 2 miles away from campus. And, $74,089 for student housing rentals beyond 2 miles of campus.

- In December 2022, only 5 universities reached a pre-leasing rate that exceeded 90%. These include Purdue, the University of Wisconsin Madison, and the University of Tennessee Knoxville. As of March 2023, 6 universities reached a 100% pre-leasing rate; these schools are known to have a limited number of properties off campus.

- Only 20% of on-campus student housing is equipped with full kitchens–62% of which are apartment units. Only 13 out of 22 universities provide rooms with microwaves and 9 out of 22 schools offer housing that comes with a refrigerator.

The Student Housing Sector for Investors

The student housing market is a huge sector that benefits students and investors. Student housing is a non-traditional asset preferred by investors globally. For students, accommodations are an essential factor in their success.

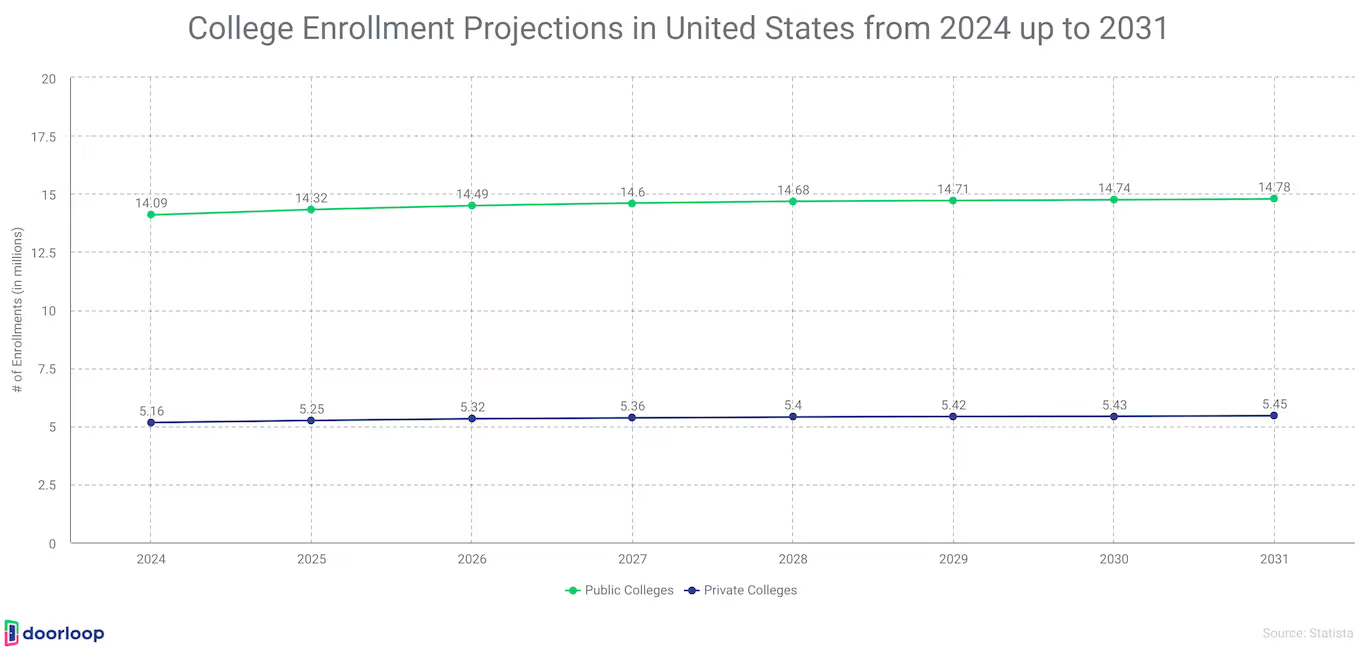

- The number of college students is projected to reach 19.25 million in 2024. Private schools are expected to have 5.25 million enrollees, while public colleges are projected to have 14.09 enrollees. The numbers are expected to remain relatively constant over the next few years, so we can expect that the number of student housing will grow as well.

- In 2019, student housing came in 5th in non-traditional assets investors preferred with a 29% increase in preference. Data centers came in first with a 67% increase in interest, followed by health care like senior housing (55%), mobile towers (49%), and single-family housing (47%).

- The total transaction of the student housing market in 2022 reached $22.9 billion. The privatization of ACC by Blackstone alone accounted for $12.8 billion of the overall transactions.

- The average student housing cap rate in 2022 was 4.92%. This was the first year that the average cap rate in this sector fell below 5.00%.

- The core student housing cap rates fell by 81 points during the first six months of 2022. However, it rose 66 basis points during the second half of the year due to the changing capital market environment.

- In 2022, Berkadia’s student housing sales volume had a 21% increase from 2021. This increase is nearly double from five years prior. It shows that the student housing market continues to perform well.

- The total sales volume of student housing in 2022 is $22.8 billion, while the average price per unit is $260k. A total of 470 properties were sold with a 4.87% average cap rate.

- According to Berkadia, the average price per bed in 2022 is $99,937. This price is 17.9% higher than it was in 2021, which was $84,791.

- The national price per bed of student housing beyond 2 miles of campus is $74,089. Rentals from 1.1 to 2 miles away from campus have an average price per bed of $81,008; $107,164 for rentals 0.6 to 1 mile away from campus, and $131,244 for rentals less than 0.5 mile away from campus.

- As of January 2023, there are a total of 111 student housing properties with a total of 64.6K beds nationwide. The West Coast has 13 properties and 5.7K total beds. The Rocky Mountains has a total of 8 properties with 4.3K beds. The Midwest has 26 properties with 16.1K total beds. The Northeast has a total of 15 properties with 7.9K beds. Texoma has 12 properties and 9.1K beds. The Southeast region has the highest number of properties and beds with 37 student housing properties and 21.5K beds.

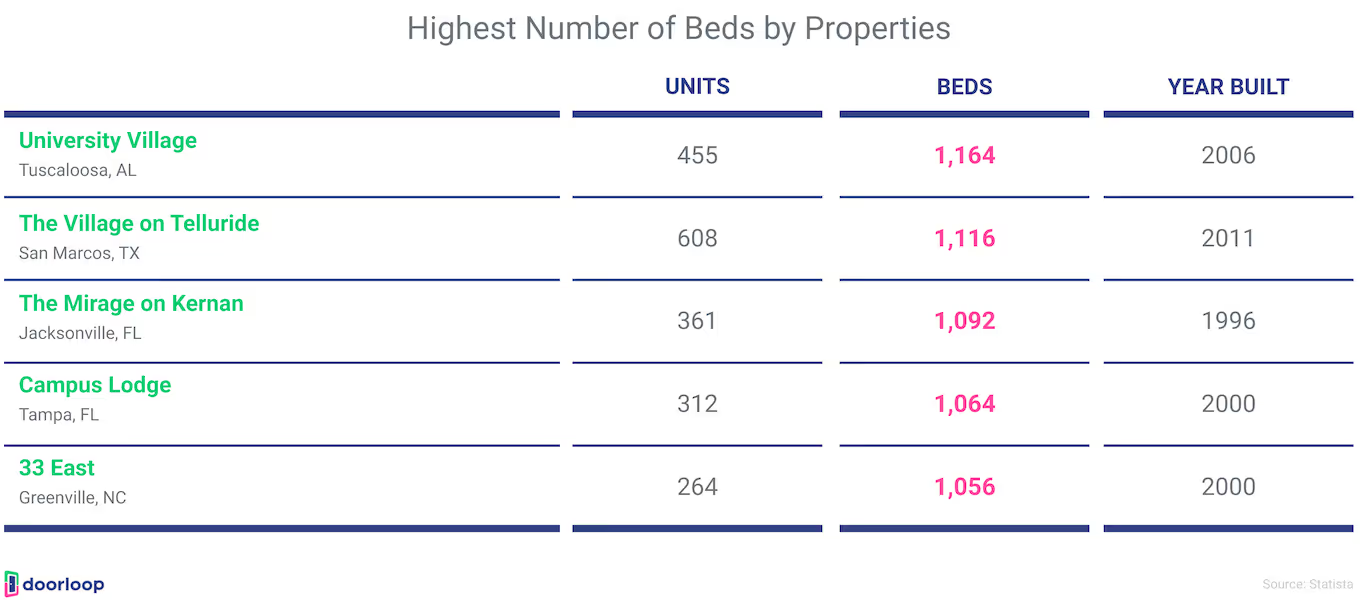

- University Villages in Tuscaloosa, AL has the highest number of beds (1,164 beds in 455 units) in terms of student housing. This is followed by The Village on Telluride in San Marcos, TX with 1,116 beds in 608 units, and The Mirage on Kernan in Jacksonville, FL with 1,092 beds in 361 units.

- The average annual number of student housing delivery is about 50,000 beds throughout the 2010s decade. The student housing supply baseline is expected to have a new baseline at a lower annual rate this 2020 decade.

- The University of Wisconsin-Madison will receive 2,814 new beds for the Fall 2024 school year. This is followed by the University of Texas at Austin with 2,814 new beds, Florida State with 1,627 new beds, and the University of Cincinnati with 1,516 new beds in Fall 2024.

- The average occupancy at the best universities in the US is approximately 95%. The student market in the nation represents significant opportunities for investors.

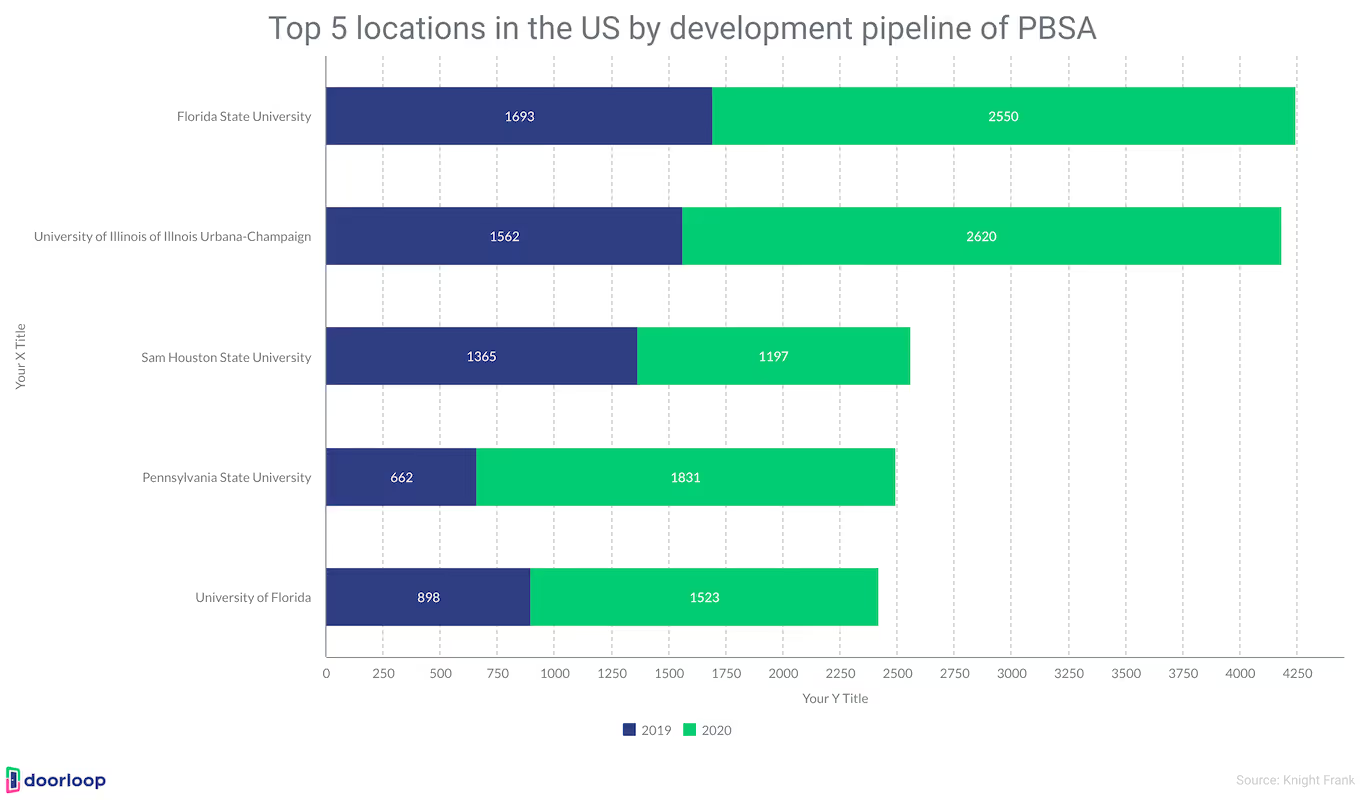

- The University of Illinois Urbana-Champaign had the most number of developed private purpose-built student accommodations with 2,620 beds in 2020. This was followed by Florida State University with 2,550 beds, Pennsylvania State University with 1,831 beds, and the University of Florida with 1,523 beds.

Living Costs for Students

As real estate prices rise, student housing costs become expensive as well. This is incredibly detrimental, especially to students who are attending schools out-of-state.

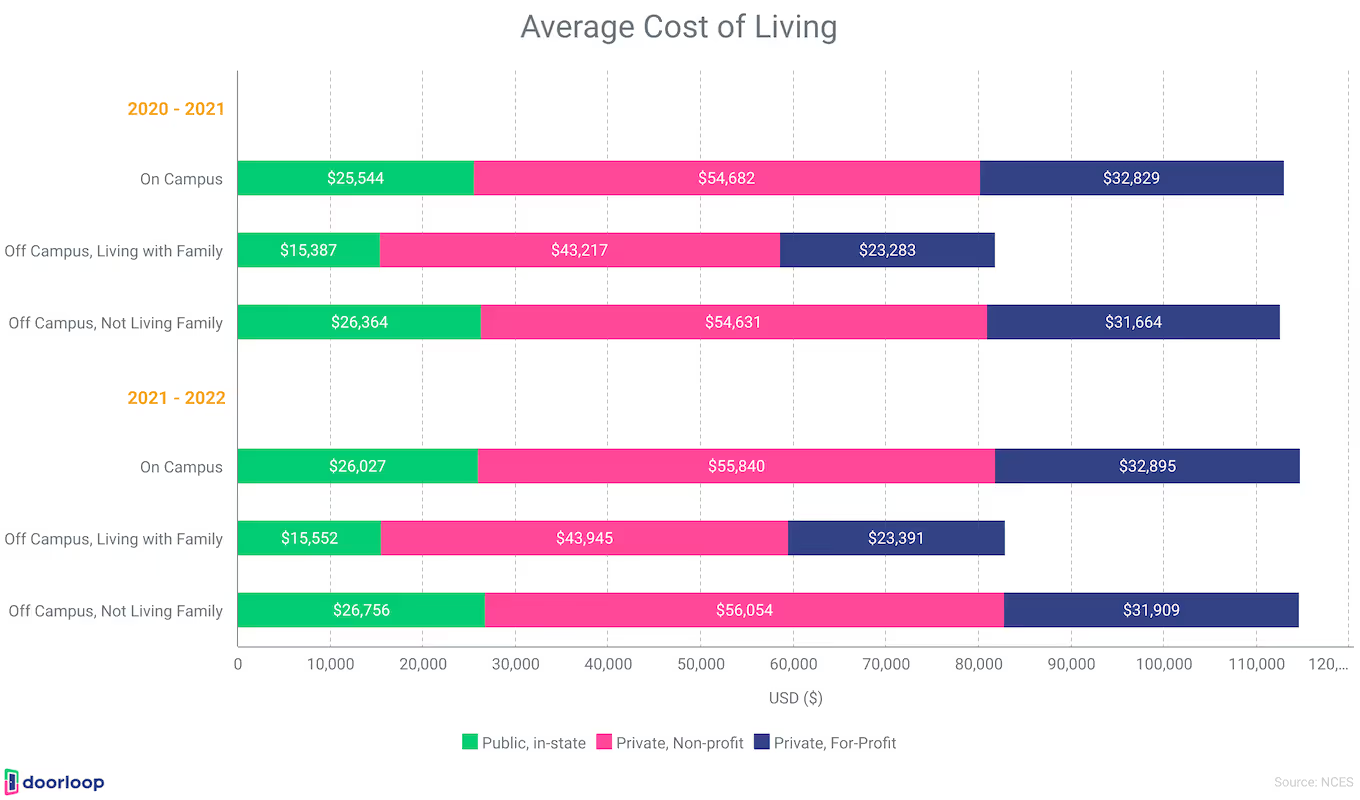

- The average total cost of on-campus living for students of 4-year public, in-state institutions in the academic year 2020-21 was $25,544. Off-campus living has an average cost of $26,364.

- The average total cost of on-campus living for students of 4-year public, in-state institutions in the academic year 2021-22 was $26,027. Off-campus living has an average cost of $26,756.

- The average total cost of on-campus living for students of 4-year private, non-profit institutions in the academic year 2020-21 was $54,682. The average cost of students living on campus in private, for-profit institutions was $32,829.

- The average total cost of on-campus living for students of 4-year private, non-profit institutions in the academic year 2021-22 was $55,840. The average cost of students living on campus in private, for-profit institutions was $32,895.

- The average total cost of off-campus living for students of 4-year private, non-profit institutions in the academic year 2020-21 was $54,631. The average cost of students living off-campus in private, for-profit institutions was $31,664.

- The average total cost of off-campus living for students of 4-year private, non-profit institutions in the academic year 2021-22 was $56,054. The average cost of students living off-campus in private, for-profit institutions was $31,909.

- The national average price per bed for communities beyond 2 miles of campus had an increase of 21.1% in 2022. From 2021 to 2022, these rentals have the largest rent growth.

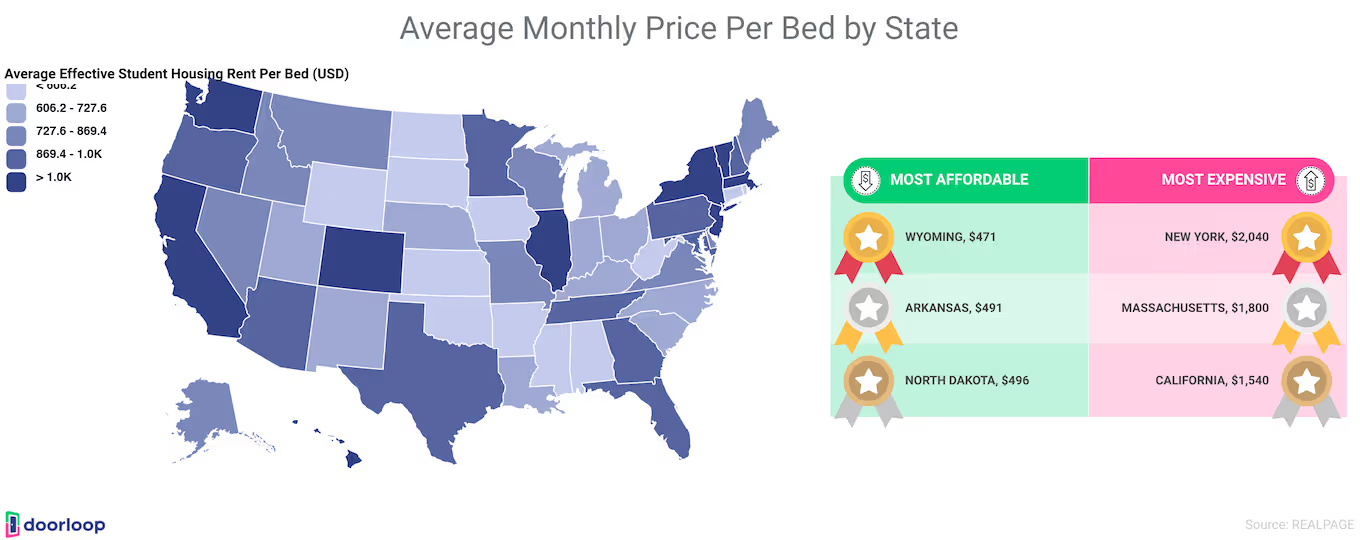

- As of 2022, the average monthly asking rent per bed in private student housing units in 175 universities is about $860. However, in some states, the price per bed is significantly higher. New York has an average of $2,040 per month, Massachusetts has $1,800, Washington, DC has $1,640, and California has $1,540.

- Northeast and Western states tend to have an average monthly price of $1,000 to $1,499 per bed. The region seems to play a role in the price too. Connecticut in the Northeastern region, for example, has an average monthly rent of $1,358. Hawaii in the Western region has an average of $1,037/month.

- Southern states tend to have monthly rents within the range of $750 to $900. These states also have massive student populations. Florida has an average monthly rent of $927, Arizona has $922, and Texas has $912.

- Midwest and Southeast States have an average monthly price of $500 to $749. North Dakota has an average price of $496, Arkansas with $491, and Wyoming with $471. These three states also have the biggest bargains for student housing.

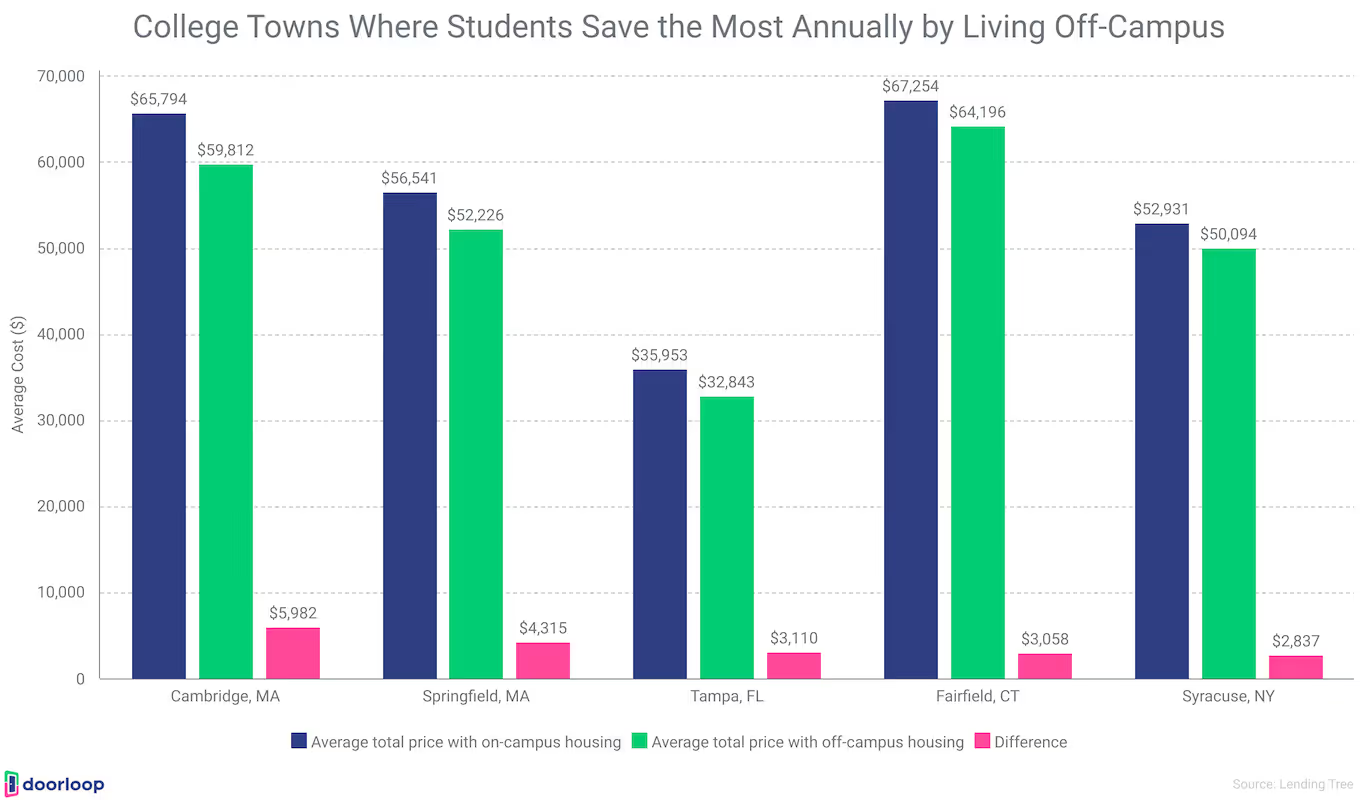

- An average of up to $5,982 can be saved by living off-campus in some of the largest college towns nationwide. Students can save an average of $5,982 annually by living off-campus in Cambridge, MA. This is followed by Springfield, MA with $4,315, and Tampa, FL with $3,110 of average annual savings.

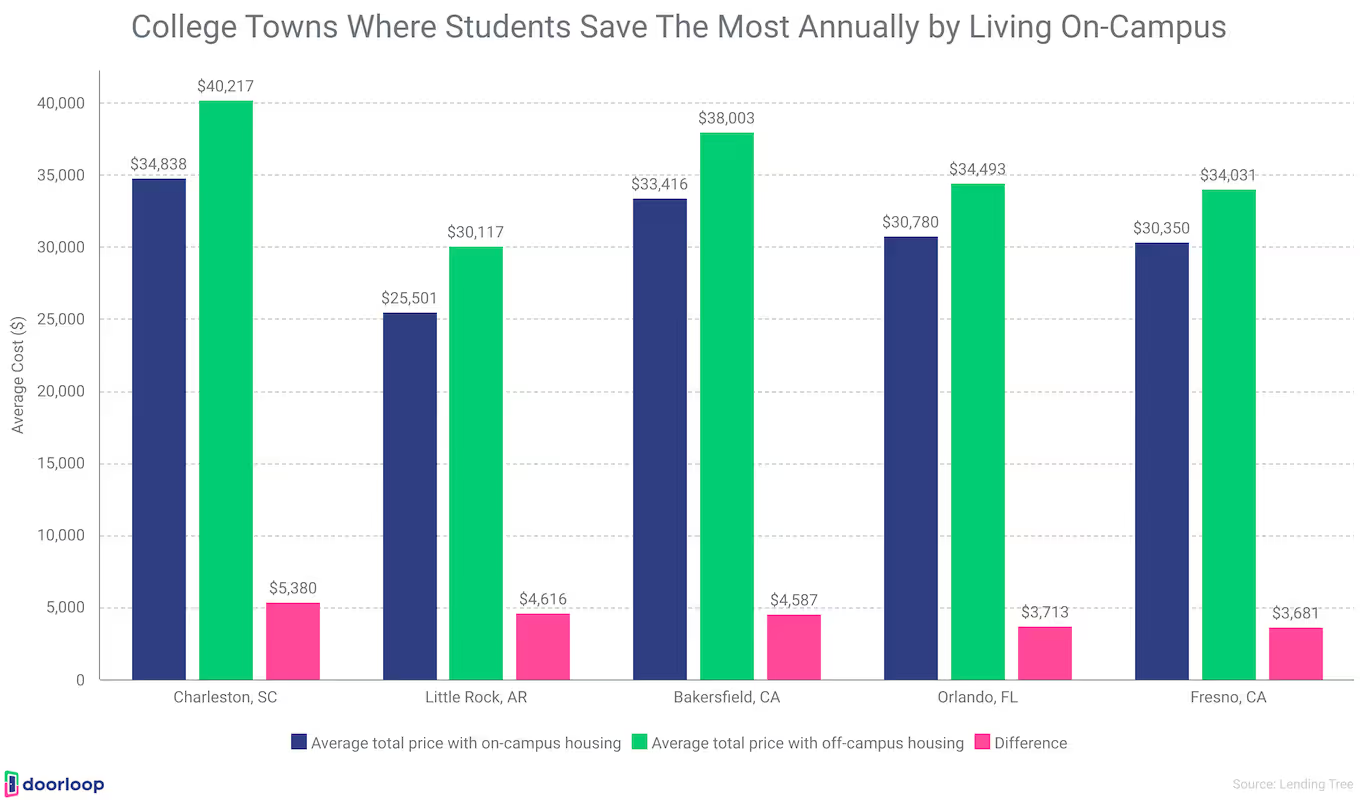

- On the other hand, students can save up to $5,380 annually by living on campus in some of the largest college towns. Students in Charleston, SC can save an average of $5,380 by living on campus. This is followed by Little Rock, AR with $4,616 in savings, and Bakersfield, CA with $4,587 of average annual savings.

- Students can save up to an average of $219 per month by living off-campus with a roommate. In a 2018 survey by Trulia, living off-campus in 28 of the biggest college towns in the US can be a lot cheaper for students who want to live with roommates.

- A student can save an average of $221 per month by living on campus. In the same survey, it was found that it’s cheaper for students to live on campus rather than splitting a two-bedroom unit outside the campus.

Student Housing Pre-Leases

Pre-leasing before Fall is an important obligation for students and their families. Pre-lease activities tend to rise during mid-summer as students secure their rentals both on and off campus.

- As of December 2022, 48% of beds at top 200 universities were leased. At least one-third of these institutions have at least a 50% pre-leasing rate.

- Only 5 universities achieved pre-leasing rates that exceeded 90% in December 2022. These universities include Purdue, the University of Wisconsin Madison, and the University of Tennessee Knoxville.

- John Hopkins University had the biggest jump in the year-over-year percentage of beds pre-leased in December 2022 with 66.7%. This was followed by Texas Christian University with 60.1% and the University of Arkansas with 54.2%.

- In January this year, roughly 124,000 beds across universities were in various stages of development. The rising interest rates also affected the sector of student housing as the pipeline shrunk by 2.6% or 3,000 bedrooms starting in December.

- As of March 2023, plenty of schools reported an ultra-high pre-lease occupancy rate above 90% in their student housing. These schools include Purdue, the University of Wisconsin–Madison, Clemson, the College of Charleston, the University of North Carolina, the University of Pittsburgh, the University of Arkansas, and the University of Tennessee.

- Only 6 universities were 100% pre-leased in March. These schools have a limited number of properties in terms of off-campus student housing.

- Q1 2023 had an annual rent growth of 7.0% for student housing properties. This rent growth rate is remarkably strong considering that the average rent is $829 per bed.

- As of June this year, about 85.7% of beds at the core of 175 universities are already pre-leased for Fall 2023. Last year, the final pre-lease rate was 95.7%, which was the highest pre-lease rate on record.

- Student housing rentals that are less than 0.5 miles from campus have the highest pre-lease occupancy in June with a rate of 87.0%. This is followed by rentals that are beyond 1 mile away from campus (85.3%) and properties 0.5 to 1 mile from campus (81.6%).

- About 21 universities were already fully leased in mid-summer. However, at least 13 universities had a pre-leasing rate of at least 10% – many of these schools recorded a decline in enrollment.

- Universities with 99.9% pre-leasing rates have the highest rent growth in July 2023. Purdue, the University of Arkansas, and Arizona State University’s annual rent growth surpassed 20%.

Student Housing Features and Amenities

Student housing offers plenty of features and amenities that can help students live comfortably despite being so far away from home. However, some units offer better amenities than others.

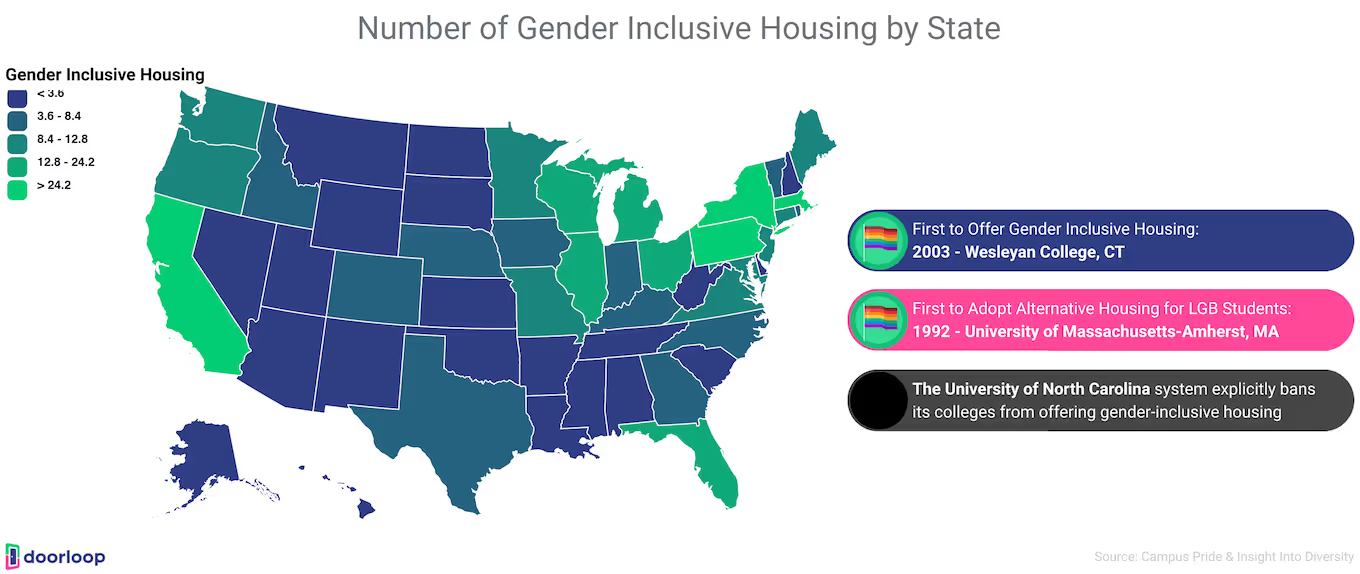

- There are at least 450 colleges and universities that offer gender-inclusive housing. Wesleyan College in Connecticut became the first institution to offer gender-inclusive housing to its students in 2003. The University of Massachusetts-Amherst, however, was the first to adopt alternative housing for lesbian, gay, and bisexual students in 1992.

- In 2018, residence halls made up 87% of on-campus housing types. The remaining 13% accounts for apartment units inside the campus.

- On-campus apartments have an average price of $7,056. Despite having more amenities and features, on-campus apartments tend to have a lower annual average rent compared to on-campus residence halls ($7,717).

- About 53% of all floorplans of on-campus housing are made of double rooms–two students per bedroom. These are followed by single rooms (39%), triples (7%), and quads (1%).

- The average per-bed rent for single rooms across 18 universities in 2018 was $8,296. Annual per-bed rents are lower for rooms that accommodate more students. Double rooms have an average of $7,304 and $6,254 for rooms that accommodate three or more students.

- In a 2018 survey among 22 universities, only 9 offer refrigerators in their housing options. About 35% of the 10 universities have refrigerators in their floor plans. Only 3 schools didn’t provide a fridge.

- About 13 universities offer on-campus rooms that come with microwaves. Microwaves are the most common kitchen amenity included in student housing. Around 3 schools offered them to all students, while 6 universities didn’t supply any microwaves in their housing units.

- Only 20% of on-campus housing is equipped with full kitchens. About 62% of these units are apartment units, which makes their average price more surprising.

- On-campus residence halls with private in-unit bathrooms tend to charge an average annual per-bed rent of $9,063. On-campus residence halls with shared in-unit bathrooms have an average annual rent of $7,748.

FAQs

Is it cheaper to live on or off campus?

It depends on the place. In some college towns, like Cambridge, MA, you can save up to an average of $5,982 by living off-campus. You can also save a lot living off-campus in college towns located in Springfield, MA ($4,315) and Tampa, FL ($3,110). However, in Charleston, SC, living on campus would help save you an average of $5,380 annually. The same holds true for college towns located in Little Rock, AR ($4,616) and Bakersfield, CA ($4,587).

How much is the average cost of on-campus housing in the US?

As of the AY 2021-2022, the average cost of on-campus living in 4-year public, in-state institutions was $26,027. For 4-year private, non-profit institutions, the average total cost of on-campus living was $55,840.

Which states have the highest student housing rent?

States in the Northeast and West tend to have the highest rents. Those located in New York have an average monthly rent per bed of $2,040. Connecticut has an average of $1,358. Hawaii in the West has an average of $1,037/month.

Which schools have the highest number of student accommodations?

The University of Wisconsin-Madison is about to receive 2,814 new beds for the Fall 2024 school year. This is followed by the University of Texas at Austin with 2,814 new beds, Florida State with 1,627 new beds, and the University of Cincinnati with 1,516 new beds in Fall 2024.

Are there a lot of students living in dorms?

Yes. As of the end of Q1 2023, the annual rent for student housing properties grew at a rate of 7.0%. This is a strong growth rate considering that the average rent is $829 per bed. And there were about 21 universities that were already fully leased in mid-summer.

Sources

- base.berkadia.com

- realpage.com

- nces.ed.gov

- deloitte.com

- statista.com

- nmhc.org

- cbre.com

- campuspride.org

- insightintodiversity.com

- lendingtree.com

- knightfrank.com

- trulia.com

- yardimatrix.com

.svg)

.svg)