If you’re a rental property manager or landlord, chances are you’re using– or considering using– QuickBooks for your rental property accounting.

It’s no surprise because QuickBooks is the most popular accounting platform in the property management business.

With that said…

It’s not designed for property accounting, and that can and does lead to some issues.

But with a bit of duct tape and some workarounds, the QuickBooks property management setup process isn’t too arduous.

Below, we’ll help you set up your rental property business in QuickBooks with detailed, step-by-step instructions better than any you’ll find online.

After that, we’ll talk about what some of those limitations are in doing your property management with QuickBooks and what property owners can do about it to streamline things.

Can you use QuickBooks for property management?

Yes, you can. QuickBooks is pretty good for property management accounting.

You can create invoices, pay bills, manage accounts, reconcile accounts, and QuickBooks has the most robust reporting of virtually any accounting platform, as expected.

It’s far from perfect, though.

The first problem arises when you try to set up your rental properties in QuickBooks.

In the next section, we’ll go through step-by-step instructions for doing this, so don’t worry.

However, it’s important to understand that we’ll be using a sort of simple workaround, as QuickBooks isn’t designed for property accounting.

What is the problem, then?

Well, there are no ‘properties’ or ‘tenants’ in QuickBooks, or any of the other typical property accounting items.

So, you have to use things like QuickBooks’s ‘Customers’ category for your properties and use ‘Vendors’ for your owners.

Other problems arise when you want to optimize any other area of your property management.

You can bill a vendor for a maintenance project, and pay them out when it’s done, but you can’t send the work order to that vendor from QuickBooks, unless you use something like the purchase order section as your make-shift work orders.

It’s not ideal, and can create some big confusion when you do your accounting depending on the workaround. But again, you can work around it.

We’ll talk more about how you can pair property management software together with QuickBooks if you prefer to use it for your property accounting.

First, let’s talk about how to set up your rental properties in QuickBooks.

QuickBooks property management setup: How to set up your rental properties

Below are step-by-step instructions for setting up the company file in QuickBooks that you’ll use to record all transactions related to the properties you manage.

Those transactions can include:

- Recording security deposits

- Collecting rent from tenants

- Collecting other fees and payments including pet rent and parking fees

- All maintenance and upgrades attached to the property

If you’re a property management company, you’ll also want to create the company file for your company activities as well, so be sure to check the section just after this.

To set up your company file in QuickBooks to record transactions for your properties, the steps are:

- Set up your properties

- Set up tenants

- Set up owners

- And, finally, set up your accounts

First, let’s set up your properties:

1. Set up your properties

Ready?

We talked about the workarounds earlier, so keep in mind that this won’t be clean and easy.

Remember when we said that QuickBooks doesn’t offer a way to add properties, so you need to add them in as customers? That’s what we’re doing here.

First, starting from your main QuickBooks Online dashboard, click “Add customer”:

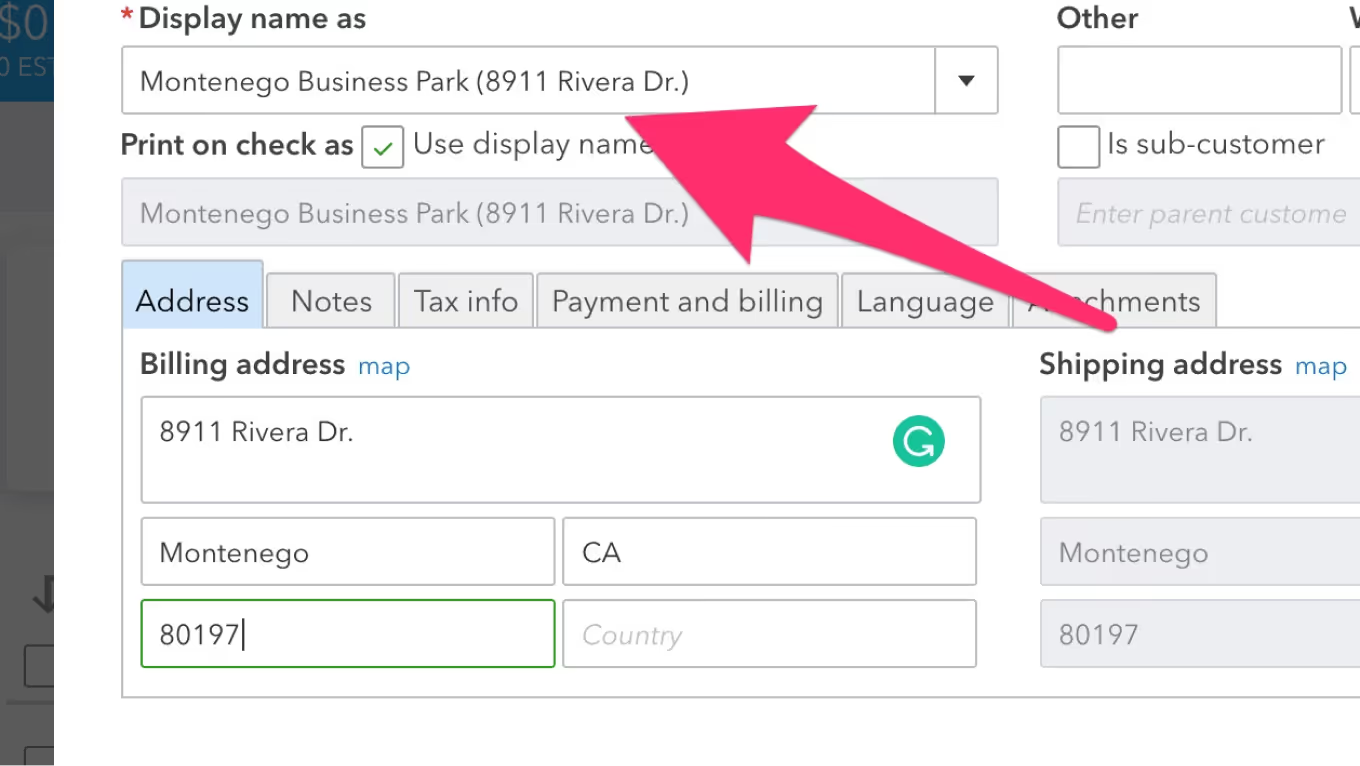

A popup should come up where you can input all the information about your property. So, fill in your property’s information, then click to add:

Keep in mind that no other information than the display name is required to be inputted right now.

If you’re just making placeholders, the name is enough.

2. Set up your tenants

Next, let's add your tenants.

Once again, start from your dashboard and click “Add customer”.

Notice a problem?

Yes, we’re adding tenants the same exact way we added properties.

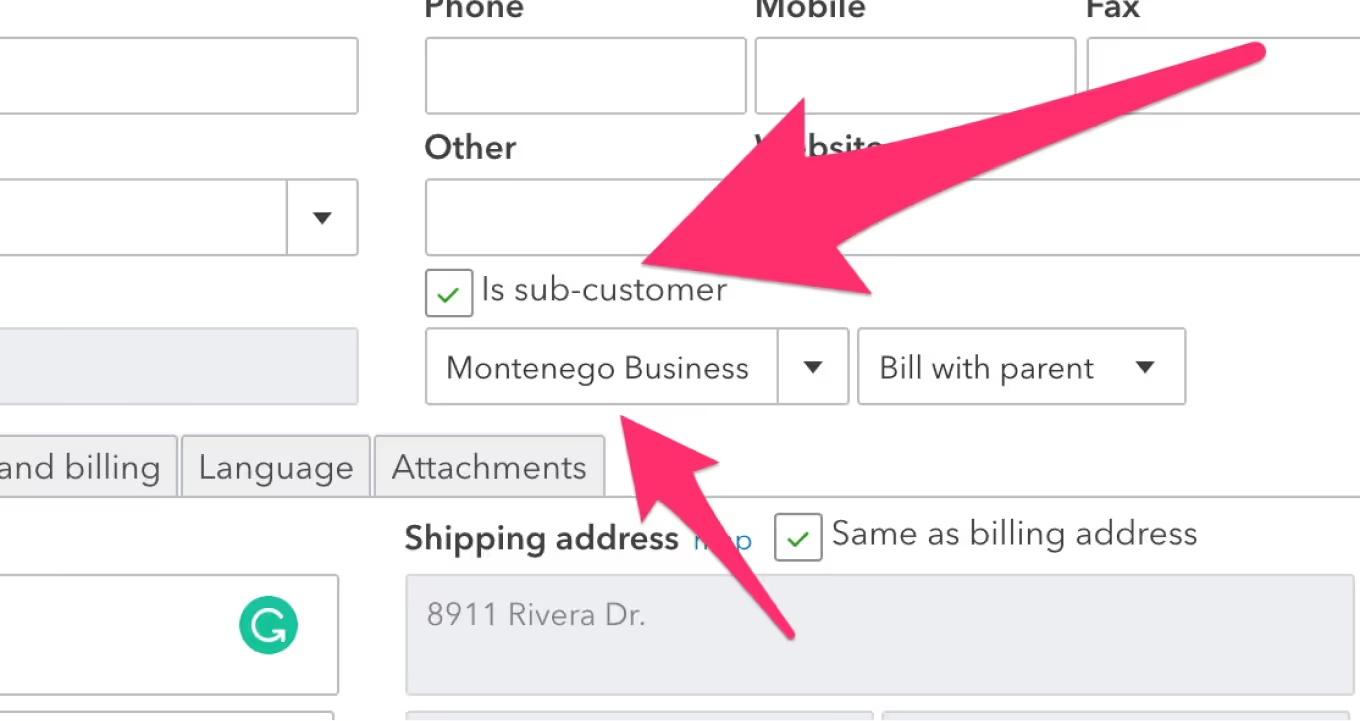

However, there is a workaround– like we mentioned– that you can use to make a customer a ‘sub-customer’ under another. That’s what we’ll use to place tenants under the properties you inputted.

Check this box on the customer info popup to make one customer a sub-customer of another:

Next, select the property or “customer” this tenant is a part of.

As we said, it’s not ideal, but now at least each of your tenants can be input as sub-customers of a property, allowing you to see each of them placed neatly under that property.

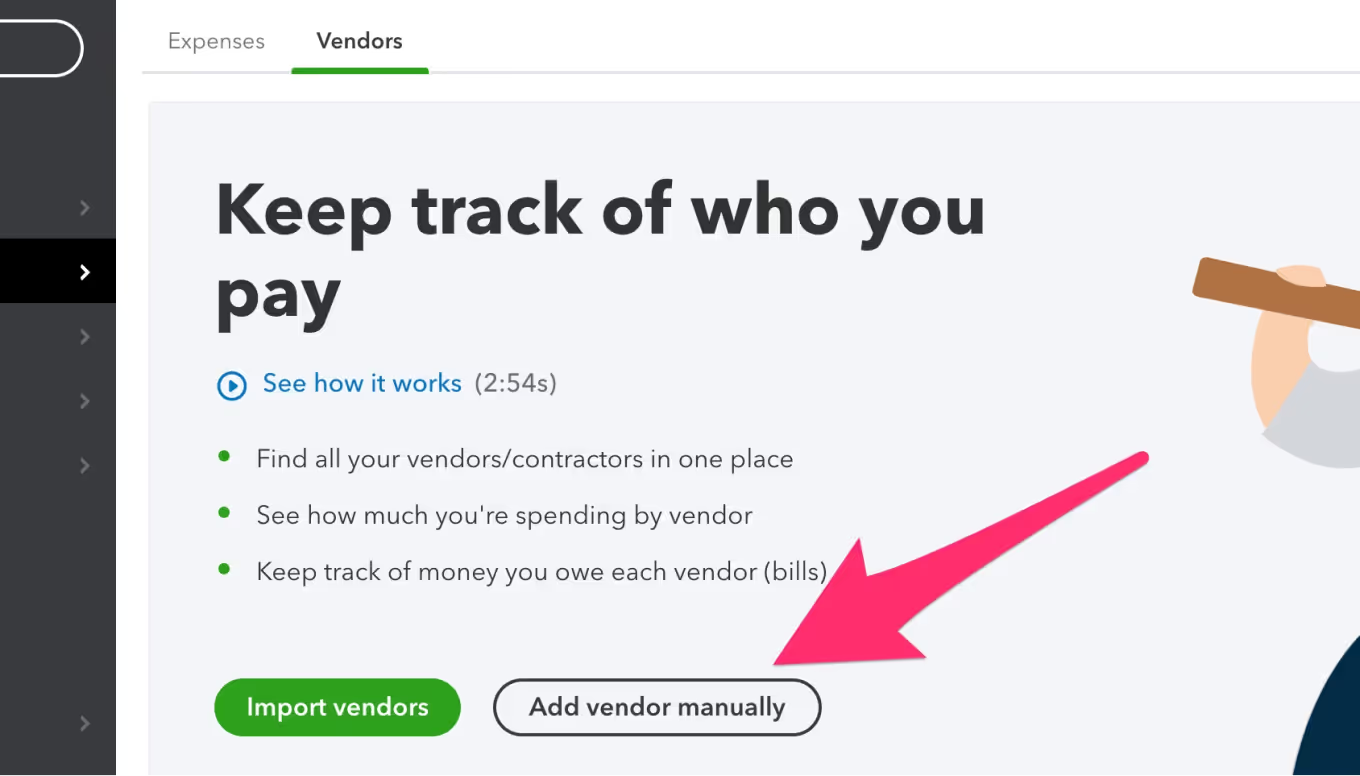

3. Set up your owners

Next, let’s set up your owners.

This is similar to the first two steps of adding properties and tenants to Quickbooks, but we’re going to head to “Expenses” -> “Vendors” then click “Add vendor manually” to do it:

The window will look familiar, that’s because it’s essentially the same thing as adding a customer.

Once you’re done adding all your owners, you’re ready for the final step…

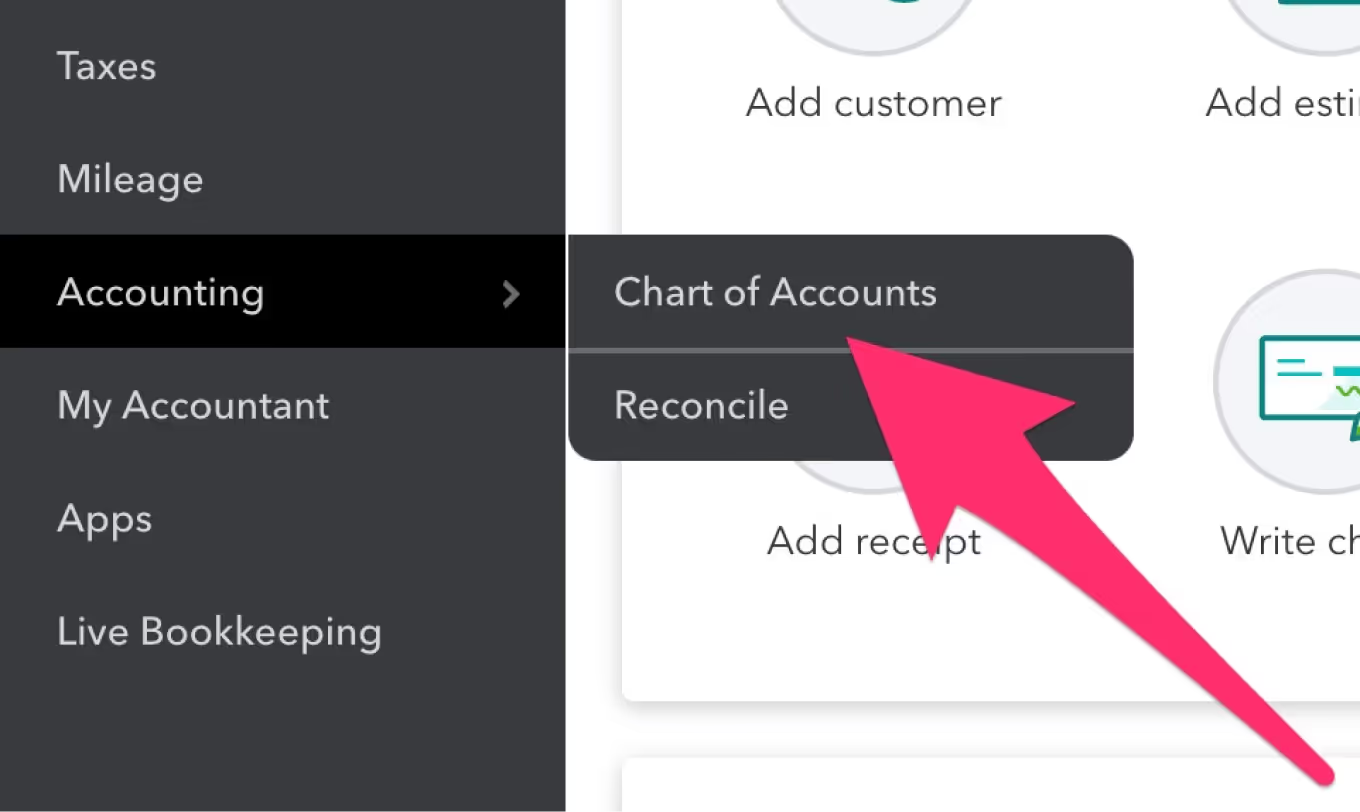

4. Set up your accounts

This last step is a big one, so it’s important to make sure it gets done right from the start.

Head to “Accounting” then “Chart of accounts”:

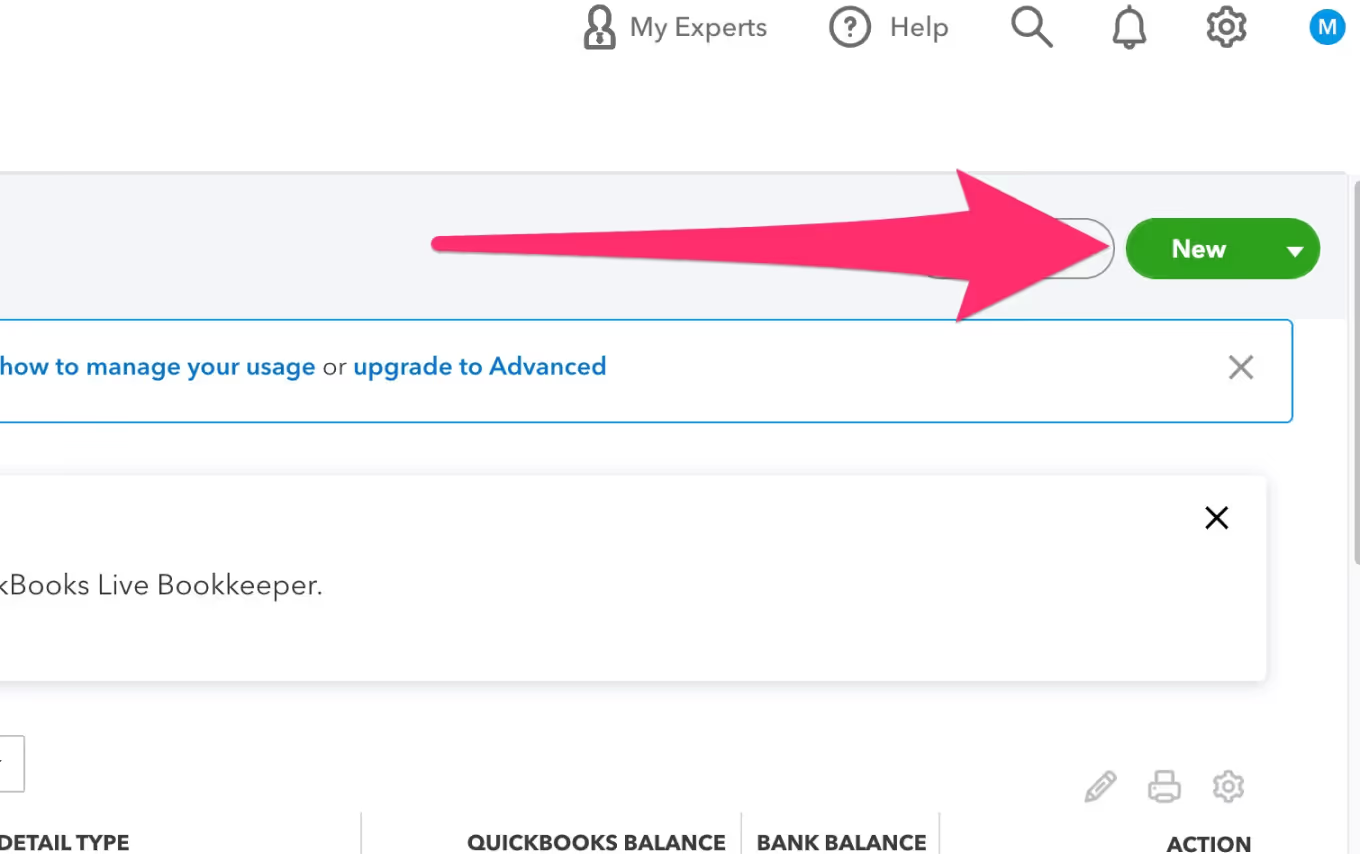

Click the little green “New” button at the top right:

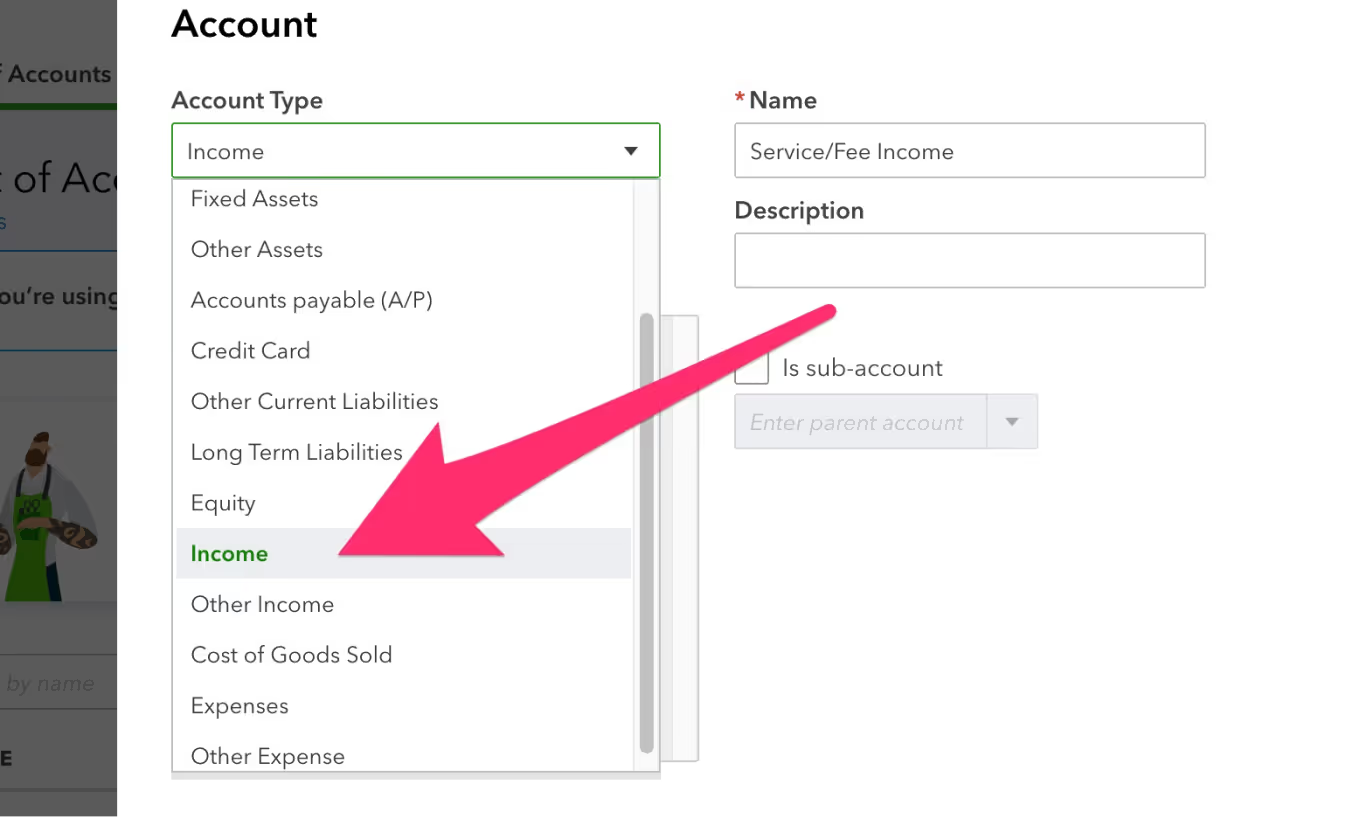

Next, select the correct account type category based on where the account fits:

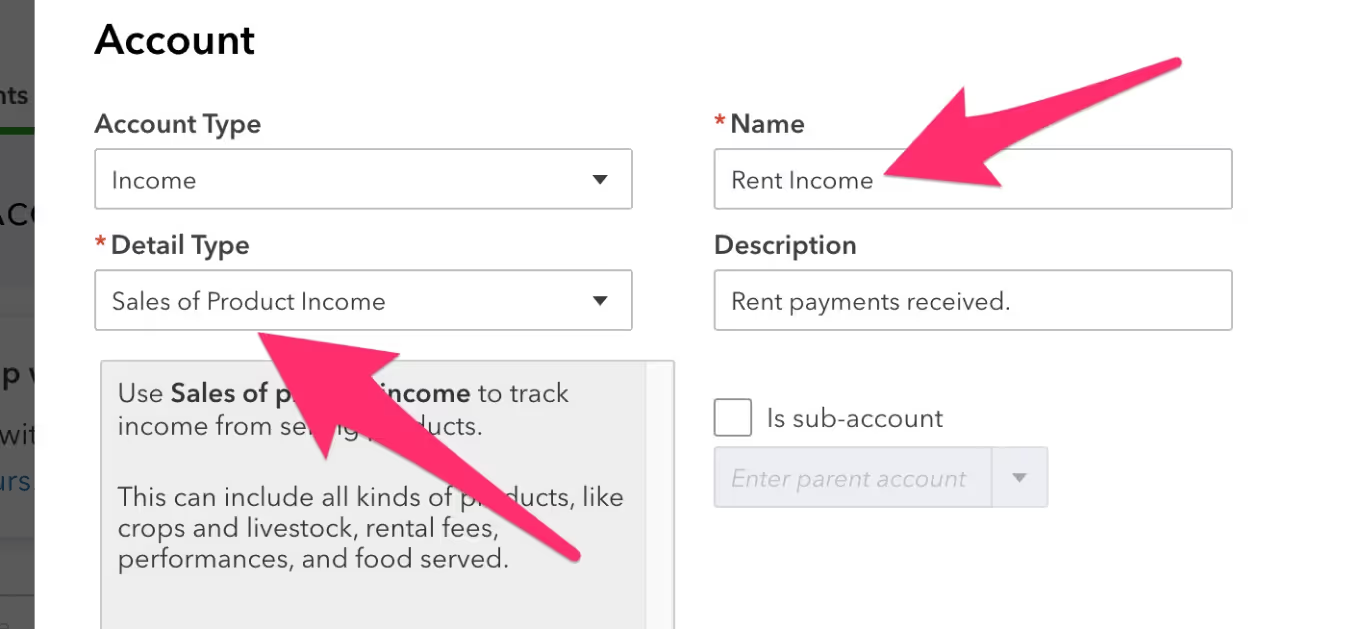

Let’s go over an example: rental income.

Type in rental income under ‘Name’, then under ‘Detail Type’ you’re going to select ‘Sales of Product Income’:

Again, not exactly the category we’d ideally use, but another workaround is necessary.

You’ll then create an account for every other type of income, asset, and expense in this same way.

For example:

- Security deposits go under Liabilities

- Pet rent goes under Income

- While the bank accounts you use to collect rent payments go under Assets

And with that, you’re ready to go.

I’m a property management company–how do I set up my company file?

If you’re a property management company, you might also be wondering how to set up your company file.

That includes all business activity related directly to the management of your company itself, such as the accounts you use to accept payment for your property management services and where you issue payments to owners.

One of the biggest challenges of a property management company is keeping accounting between the company and your client’s properties separate.

It’s possible with QuickBooks, but it’s one of the larger and more arduous workarounds you’ll need to employ.

For more on how to set up your company file in QuickBooks, check out our comprehensive guide to QuickBooks for property management, where we go over step-by-step instructions on how to set up your QuickBooks company file: QuickBooks vs. Property Management Software: Which Is Best?

Where QuickBooks for property management falls short

As we touched on earlier, while QuickBooks has a ton of functionality and versatility, and is easily the most robust accounting platform there is, it has its limits.

Especially when it comes to property management.

So, while we managed to set up our entire file for managing property management activity, it wasn’t exactly pretty.

But let’s get a 1,000-foot view of what those limitations are to better understand what it can’t do and how you can accomplish those things.

Each of these we mentioned above, so let’s recap them:

1. QuickBooks makes it difficult to separate business and property activity

Easily one of the biggest challenges of using QuickBooks for property management is that QuickBooks makes it difficult to separate your business and client’s property activity.

Property management is unique in that it needs to simultaneously manage:

- Its own accounting– payroll for your staff, utilities for your own workplace, taxes

- With that of its client’s properties, including everything from rent collection to maintenance fees

There are workarounds– there’s that word again– but it’s never optimal and always requires more work than should be necessary.

2. QuickBooks requires multiple workarounds that can be both confusing and problematic

As you likely saw above, because QuickBooks isn’t designed for property management, it requires multiple somewhat confusing workarounds to function properly for property management.

QuickBooks is great if you have a smaller to medium-sized portfolio, as that won’t cause too many issues.

However, the larger your portfolio grows, and the more complex your operation gets, that will only cause more problems.

Particularly, the logistical nightmare of having things like properties and tenants both down as customers when running reports and the like.

So, these workarounds may not seem like a big deal right now if you have a smaller portfolio. However, they’ll quickly become a thorn in your side as your portfolio grows.

3. Managing properties is disjointed with QuickBooks

If you’ve never used property management software like DoorLoop before, you might not have realized this yet.

However, the final way that QuickBooks falls short– but where it can work really well in combination with property management software– is in the lack of integrated systems.

Typically, you might receive a maintenance request online or via text or call. Then, you need to create a purchase order or similar in QuickBooks. Finally, you need to contact your vendor to complete the maintenance.

Oh, then you need to go back to QuickBooks to pay them when the work is done. Oh… don’t forget to call or message the tenant when the work order is complete.

Seeing the problem?

There’s a lot of back-and-forth, which equals wasted time and a lot of headache.

With DoorLoop, you could have:

- Received the maintenance request

- Created the work order

- Assigned it to a vendor

- Contacted the tenant when it was complete

- And paid out that vendor

… all from one place.

… even your smartphone.

Yeah, that’s big.

Needless to say, by optimizing each one of your systems in exactly this same way, you’ll be saving tons of time and gaining a whole lot of efficiency, productivity, and peace of mind.

What can DoorLoop do for you?

If you’re just starting out, QuickBooks will do most of what you need it to do decently well, with some lost efficiency.

However, for any medium to larger-sized portfolio, with DoorLoop’s all-in-one property management tools you’ll be able integrate every one of your systems into one place.

That will not only save you time and money, but streamline and optimize your entire operation as we whole.

Not to mention, avoid a whole lot of headache.

Whether you:

- Manage dozens, hundreds, or even thousands of properties and need a custom way to integrate all of your systems into one place

- Or simply want to take advantage of additional features that QuickBooks can’t handle, like maintenance management, tenant portal, and automatic listings

Then give DoorLoop a try and schedule a free demo.

With DoorLoop, you’ve got options.

You can handle your entire property accounting with extensive accounting features, including:

- Multiple ways to accept rent via CC, ACH, and more

- Bill pay

- Bank reconciliations

- Easy bank account syncing with Plaid

- Design custom reports

- Keep a full chart of accounts

- And more

Plus, you get access to a whole array of invaluable features that allow you to integrate the rest of your property management tasks together into one place:

- Maintenance management, including the ability to communicate directly with tenants on work orders from within the app, assign to a vendor, pay them out when it’s done, and let the tenant know

- Easier rent collection, with automatic rent payments, a convenient tenant portal where they can pay rent, fees, and keep up with payments

- Awesome marketing and leasing features, such as eLeasing, tenant screening, automatic listings, and a professional IDX website

- Owner portal where you can print checks and run key reports for your owners (to learn more about property management reports, read this material)

- And more

Rather keep your property accounting with QuickBooks while taking advantage of the other great features DoorLoop has?

DoorLoop plays nice with QuickBooks, with DoorLoop’s convenient QuickBooks Online integration.

Simply hop into DoorLoop and sync your QuickBooks Online account with DoorLoop in a matter of minutes.

Now, you can get the best of both worlds without having to give up a thing.

Frequently Asked Questions

How many properties can I manage in QuickBooks?

QuickBooks doesn't impose a strict limit on the number of properties you can manage. However, as your portfolio grows, the complexity of tracking and reporting increases. For instance, managing 80 properties is feasible but requires careful setup using features like classes or tags to organize transactions by property.

Can QuickBooks track rent payments and late fees?

Yes, QuickBooks can track rent payments and late fees, but it requires manual setup using recurring invoices or classes for each tenant or property. You’ll need to enter rent charges, monitor due dates, and apply late fees yourself or through custom rules. While possible, it’s more time-consuming than using property management software designed specifically for rentals.

Can QuickBooks integrate with property management software?

Yes, QuickBooks can integrate with several property management software platforms, including DoorLoop, Buildium, and Rentec Direct. These integrations help sync financial data like rent payments, expenses, and owner distributions directly into QuickBooks. This allows property managers to streamline accounting tasks while still using industry-specific tools for day-to-day operations.

Is QuickBooks compliant with property management regulations?

QuickBooks can be adapted for property management; however, it isn't specifically designed to ensure compliance with property management regulations. For instance, managing trust accounts—a common requirement in property management to keep tenant funds separate from business funds—requires careful setup and monitoring in QuickBooks. This often involves creating separate company files or using workarounds like class tracking, which can be complex and may not fully align with legal requirements.

Is QuickBooks or property management software better?

QuickBooks is a strong choice for general accounting, but it lacks many property-specific features like tenant communication, lease tracking, and maintenance management. Dedicated property management software, such as DoorLoop, is better suited for landlords and managers because it combines accounting with operational tools in one platform. For most property managers, using specialized software is more efficient and scalable than relying on QuickBooks alone.

.svg)

.svg)