Real estate investment trusts (REITs) have become a prominent fixture within the investment portfolio. As an accessible way for investors to gain exposure to real estate assets, REITs have seen massive growth over the past few decades. This compilation of statistics provides a comprehensive overview of the REIT industry and illustrates the key trends impacting these companies.

The data presents insights into the size and composition of the REIT market, historical performance benchmarks, valuation metrics, capital structure analysis, and forecasts. Metrics are included for total assets owned, market capitalization, property sectors, dividend payments, leverage ratios, interest expense, and more. Regional, national, and global-level statistics are incorporated to depict the worldwide rise of REITs.

KEY TAKEAWAYS

- REITs own over $4.5 trillion in gross real estate assets and 535,000+ properties.

- Public REIT market cap grew 17.6% annually from 1990-2021 to $1.75 trillion.

- REITs paid $92.3 billion in dividends in 2021 and support over 3 million jobs.

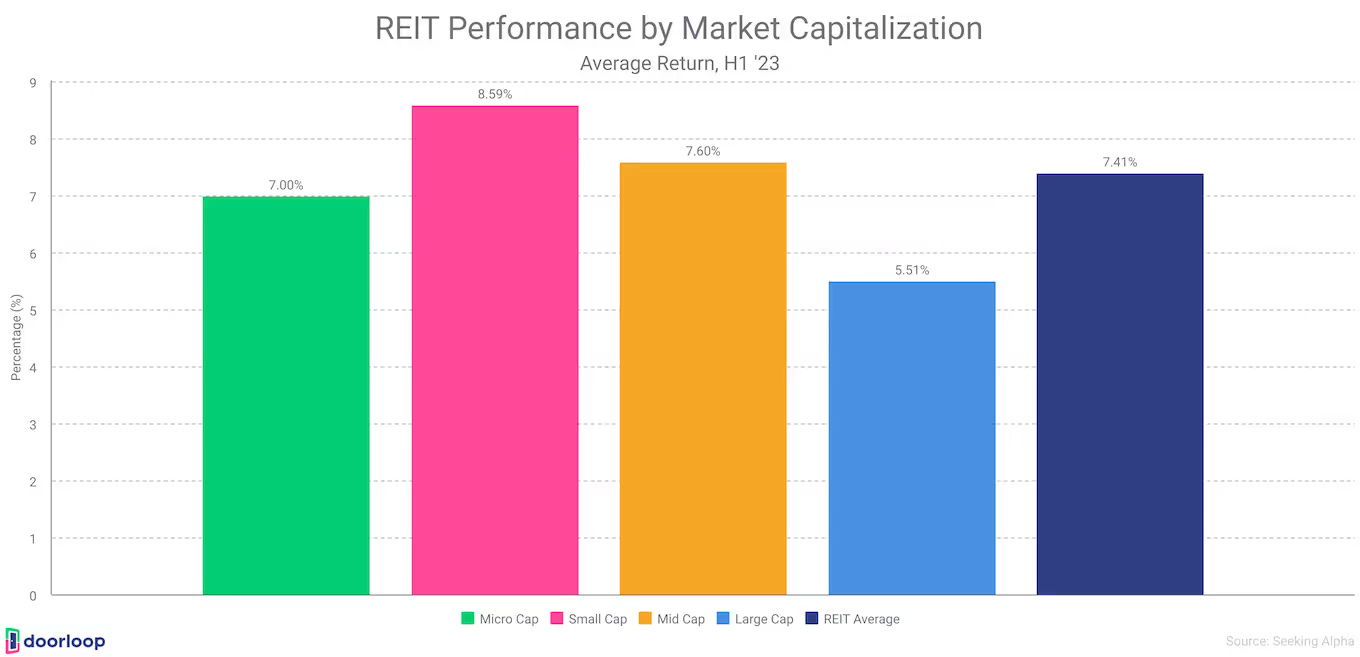

- Small-cap REITs outperformed with +8.59% return in June 2023.

- Infrastructure and office were the worst performing sectors YTD 2023.

- Top retail REIT market caps fell in 2022, but 3-year returns are still positive.

- REITs trade at discounts to NAV, especially offices and hotels.

- Leverage has stayed below 40% since 2011, limiting interest expense.

- Fitch downgraded the 2023 REIT outlook on recession risk.

- Global REIT market forecast to grow 2.8% CAGR through 2027.

SIZE AND SCOPE OF THE REIT INDUSTRY

The REIT industry is expansive, owning over half a trillion dollars in assets across property types, including apartments, offices, malls, and more. REITs support millions of jobs and provide housing and workplaces for a significant portion of the U.S. population. Here are some data on the size and scope of the industry.

- U.S. REITs own nearly $4.5 trillion of gross real estate as of 2021.

- Public U.S. REITs own $3 trillion in assets as of 2021.

- U.S.-listed REITs have an equity market capitalization of over $1.3 trillion as of 2021.

- There are approximately 535,000 properties owned by REITs as of 2021.

REITs owned 535,000+ properties in 2021, including:

<table><thead><tr><th>REIT Assets by Sector</th><th>Number of Properties/Acreage</th></tr></thead><tbody><tr><td>Timberland Acreage</td><td>14,951,700</td></tr><tr><td>Outdoor Advertising</td><td>212,119</td></tr><tr><td>Tower</td><td>99,406</td></tr><tr><td>Retail</td><td>31,601</td></tr><tr><td>Single-Family Rentals</td><td>156,641</td></tr><tr><td>Health Care</td><td>8,479</td></tr><tr><td>Industrial</td><td>7,963</td></tr><tr><td>Self-Storage</td><td>7,207</td></tr><tr><td>Residential</td><td>4,268</td></tr><tr><td>Specialty</td><td>2,709</td></tr><tr><td>Office</td><td>2,415</td></tr><tr><td>Mixed Use</td><td>381</td></tr></tbody></table>

The diversity of real estate assets covered by REITs are diverse. REIT property types include data centers, hospitals, hotels, housing, industrial facilities, offices, shopping centers, malls, retail, storage centers, telecom infrastructure, and timberlands.

- Industrial, retail, and apartment occupancy rates remained elevated compared to pre-pandemic levels at the end of 2022. .

- Office occupancy dropped nearly 3% from 2019 average in 2022. (Nareit)

- Rent growth positive for industrial, retail, apartments, office working to maintain gains. .

- REIT capital raising in Q3 2022 was the lowest since 2009 due to high rates/valuations. .

- The broad reach and popularity of REITs as an investment vehicle is evident. As of 2021, 150 million Americans (45% of the U.S. population) live in households with investments in REITs through accounts and retirement plans..

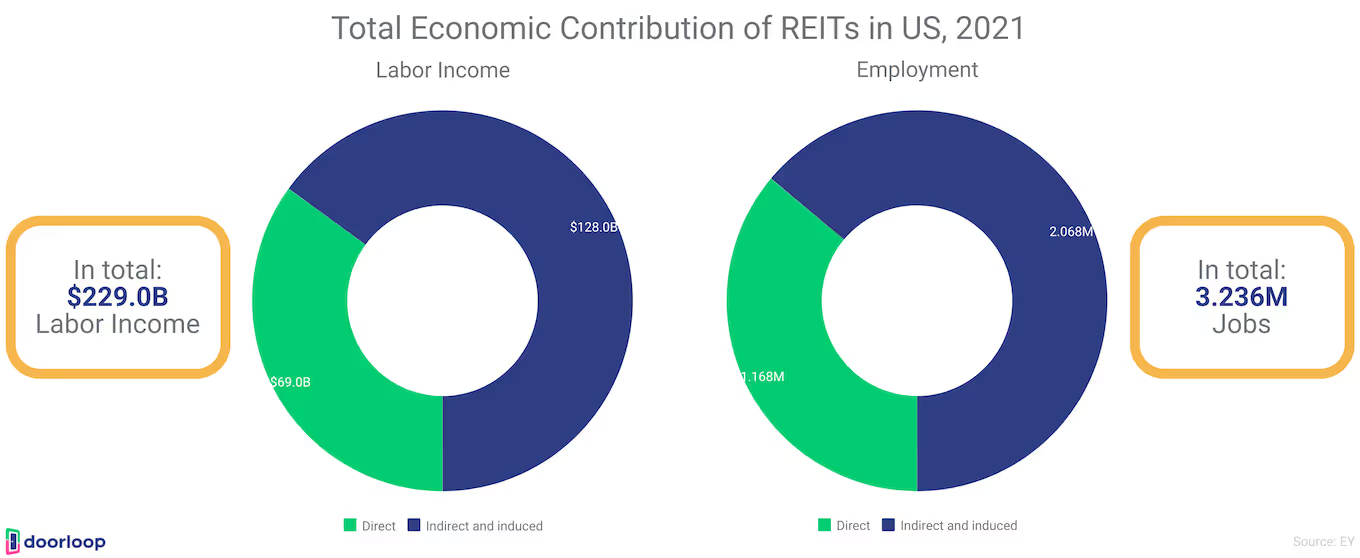

- In 2021, REITs supported an estimated: 3.2 million jobs, and $229 billion in labor income.

- Public REIT equity market cap has grown at 17.6% annually from 1990 to 2021, from $9 billion to $1.75 trillion. (NAREIT)

- Listed REITs have a year-end 2021 equity market capitalization of around $1.7 trillion.

- Bloomberg survey in November 2022 placed the odds of a U.S. recession in the next 12 months at 62.5%, up from 15% at the start of the year.

Below are numbers from a study conducted by Ernst & Young to estimate REITs' economic contribution.

- Total REIT contribution includes direct operations, dividend/interest payments, and construction spending. Direct REIT operations support 307,000 jobs and $22.7 billion in labor income.

- Dividend/interest payments support 380,000 jobs and $26.1 billion in income.

- REIT operations and dividend/interest payments contributed $109.9 billion in labor income.

- REIT operations, excluding dividends, contributed an additional $61.1 billion in U.S. labor income.

- REIT construction supports 861,000 direct jobs and $58.6 billion in income.

- Total direct REIT contribution: 1.17 million jobs, $69 billion income.

- Total indirect/induced contribution: 2.07 million jobs, $128 billion income.

REIT PERFORMANCE

REITs have historically delivered competitive total returns-driven by steady dividends and long-term capital appreciation. They provide diversification benefits for investor portfolios, given their low correlation with other assets. REIT performance can be measured through benchmark indexes tracking the overall industry.

Beyond returns, REITs have experienced rapid growth in the number of listings, total market capitalization, and global adoption of the REIT approach. The statistics in this section provide insights into the performance, expansion, and increasing relevance of REITs within real estate capital markets. Both historical returns and the growth of REITs demonstrate their rise as an important component of investor portfolios.

- In 2021, REITs paid an estimated $92.3 billion in dividends to shareholders.

- REITs have historically delivered competitive total returns through high, steady dividends and long-term capital appreciation.

- REITs have a relatively low correlation to other assets, making them good portfolio diversifiers.

- Studies suggest an optimal REIT allocation between 5-15%.

- Mortgage REITs provide $1 trillion in financing for U.S. real estate by investing in mortgages and mortgage-backed securities.

- 64% of the top 25 largest global institutional investors use REITs in their portfolios.

- The FTSE Nareit U.S. All Equity REIT Index tracks over 200 REITs and is a widely used benchmark.

- Over 28 REITs are included in the S&P 500 as of 2021.

- REITs have brought institutional capital into innovative real estate sectors like data centers, cell towers, self-storage, healthcare, lodging, billboards, and timberlands.

- There are 893 listed REITs globally with a total market capitalization of $2.5 trillion as of December 2021 (NAREIT).

- REIT legislation has been adopted in over 40 countries and regions worldwide.

- Nearly 5 billion people live in countries with REIT legislation.

- All G7 countries have REITs.

- Global growth in listed real estate is being driven by the appeal of the U.S. REIT investment model. Mutual funds and ETFs provide an easy way for investors to add global REIT exposure.

- The REIT Total Property Value is at $2.6T in the United States, this is from NAREIT analysis of S&P Capital IQ Pro data, member company data, and market capitalization from Factset.

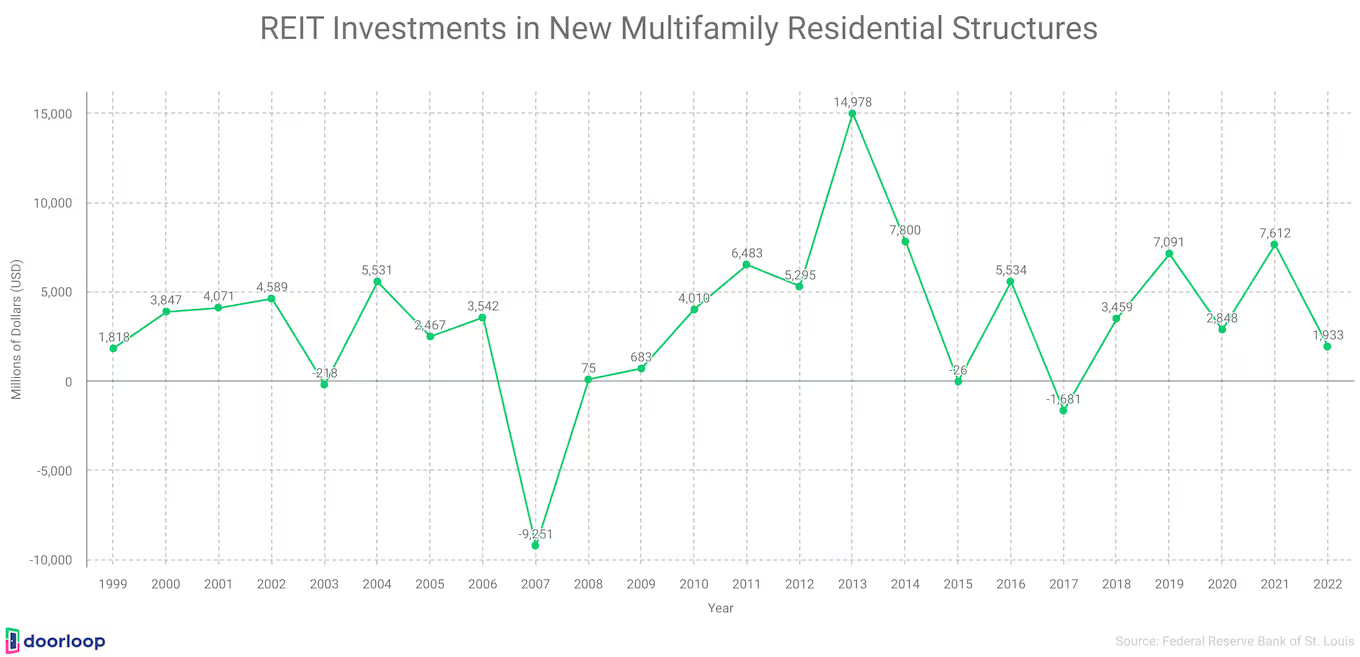

- In 2022, REIT investment in new multifamily residential construction projects was $1,933 million on a seasonally adjusted annual rate basis. This represents a decrease from $7,612 million invested in 2021, indicating REIT multifamily construction spending dropped significantly year-over-year in 2022.

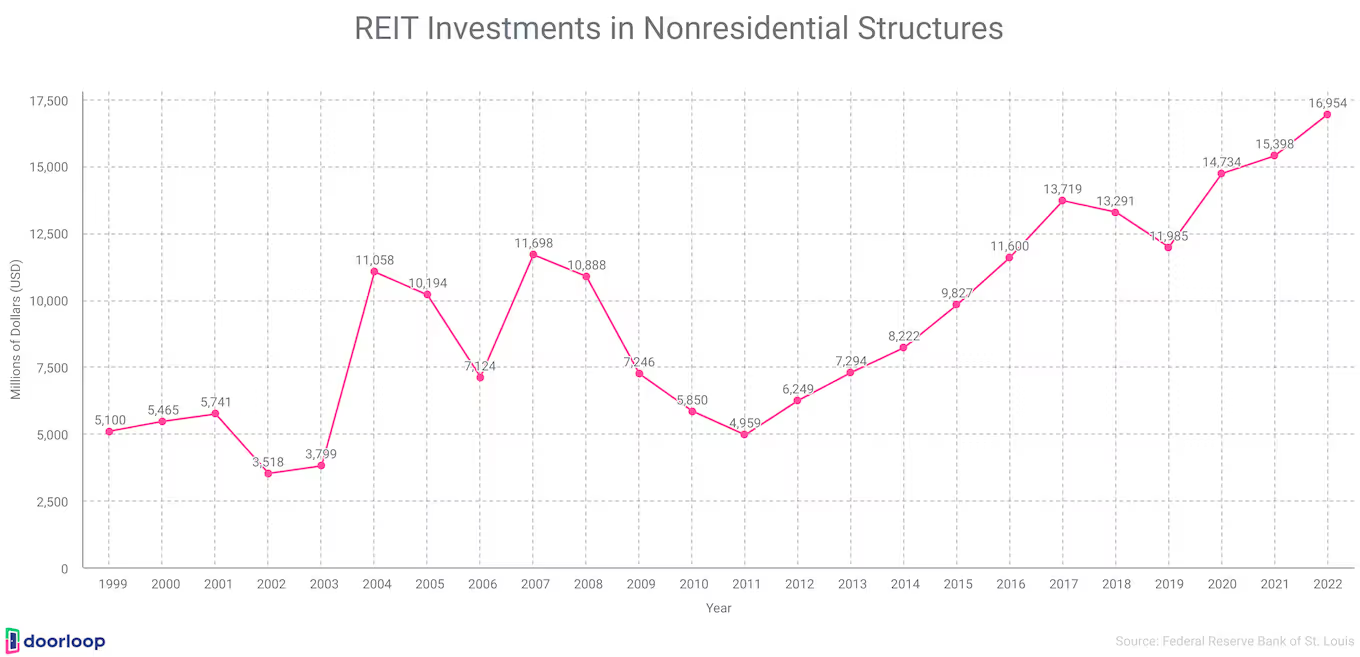

- Data from the Federal Reserve shows that gross fixed investment by REITs in nonresidential structures, equipment, and intellectual property increased in 2022 to $16,854 million compared to $15,398 million in 2021. The nearly 10% year-over-year increase suggests REITs were active in acquiring and developing more commercial real estate, likely taking advantage of opportunities in the market.

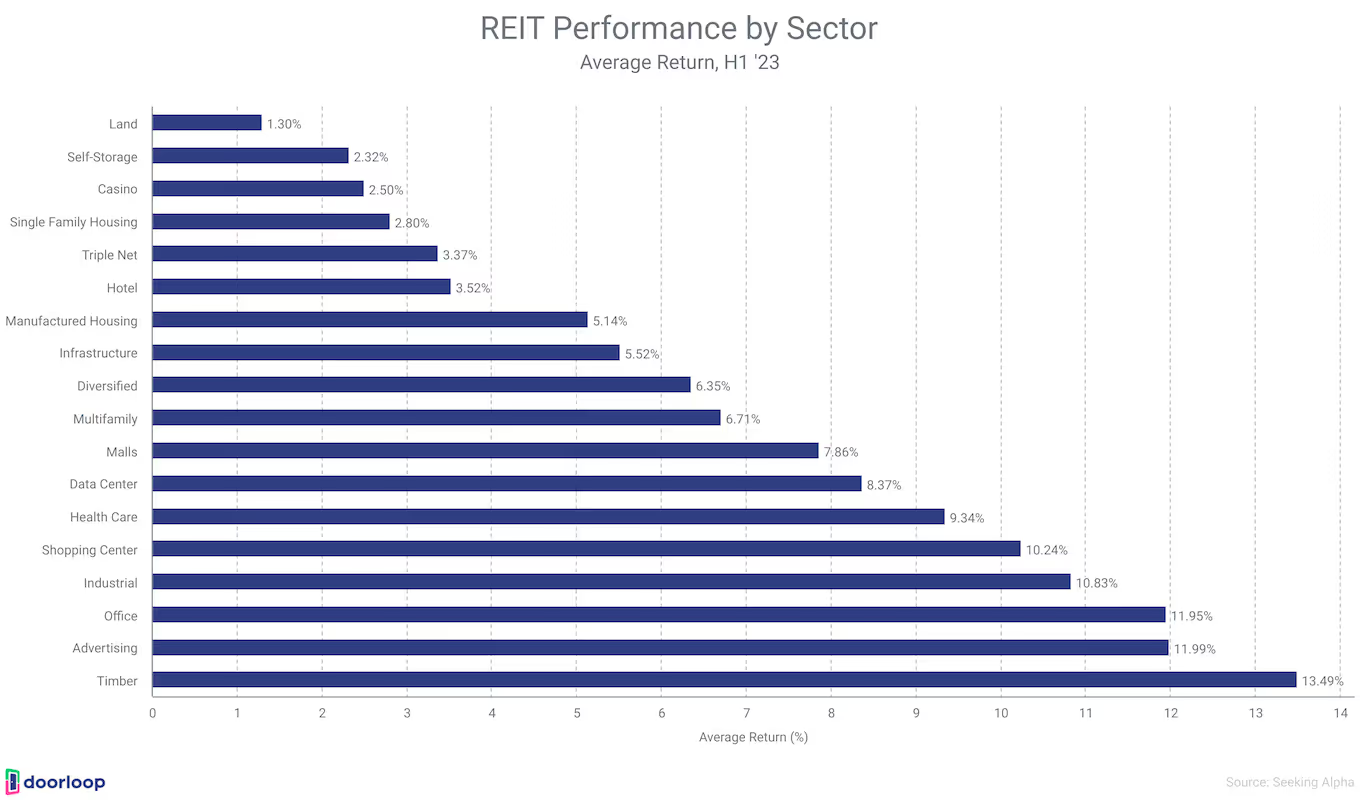

REIT Performance (H1 2023)

Here are some notable insights from the State of REITs: July 2023 edition published by Seeking Alpha.

- The REIT sector gained 7.41% in June, turning positive year-to-date after 4 straight monthly declines. REIT outperforms major indexes like S&P 500, NASDAQ, and Dow.

- Small-cap REITs outperformed with 8.59% returns in June compared to 5.51% for large caps.

- 87.34% of REITs had a positive total return in June, with 49.69% now positive year-to-date.

- Infrastructure (-25.39%) and Office (-16.02%) remain the worst performing property types YTD.

- Land, Self-Storage, and Casinos had the lowest returns in June at +1.30%, +2.32%, and +2.50%.

- Health Care REITs lead all property types YTD at +18.87%.

- The average REIT NAV discount narrowed from -26.57% to -22.44% in June.

- The median NAV discount narrowed from -24.41% to -20.48% in June.

- Average REIT P/FFO (2023) multiple increased from 12.6x to 13.1x in June.

P/FFO

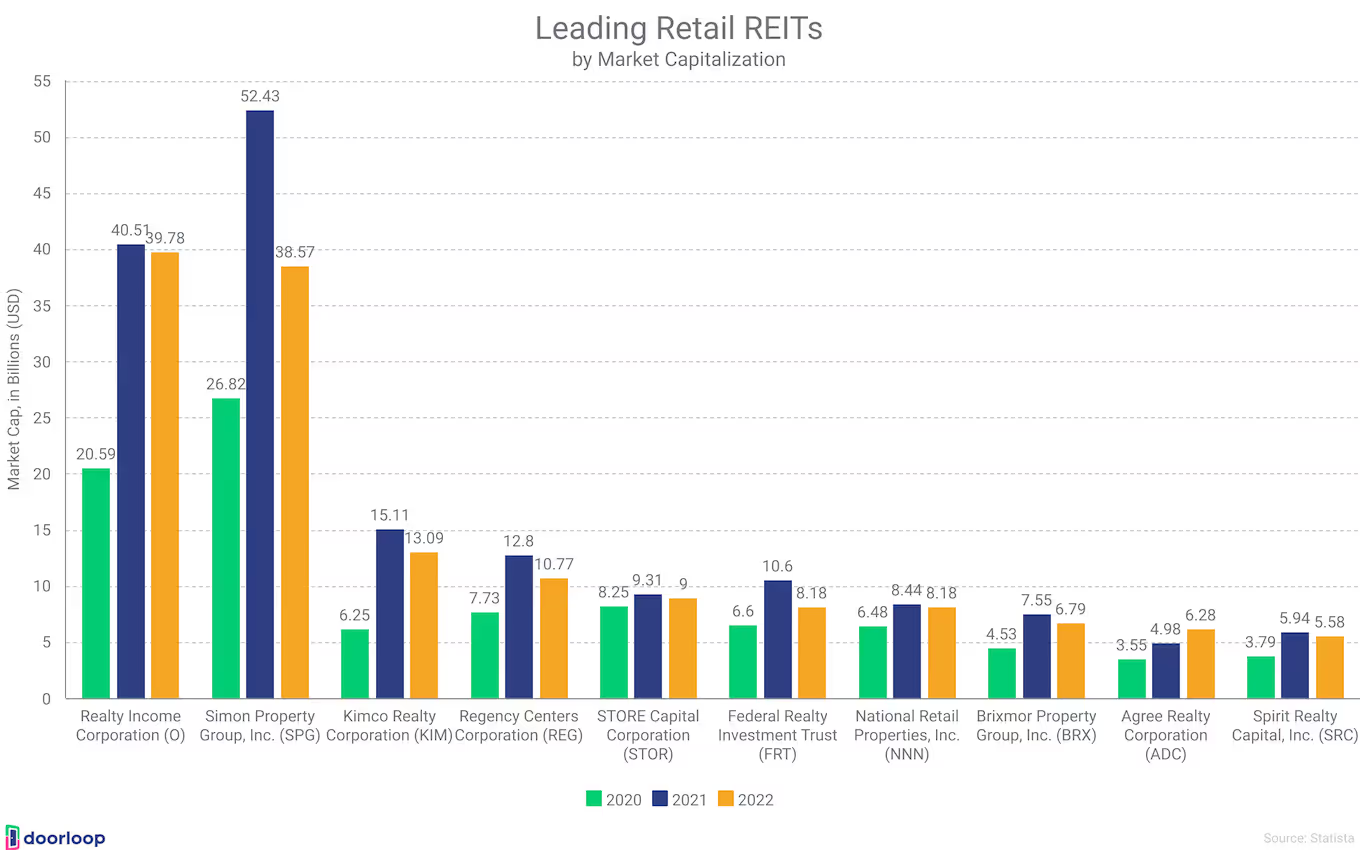

Evaluating the performance and valuation of top retail REITs provides insights into the health of the retail real estate market.

- In Dec 2022, the top 10 retail REITs had $146 billion combined market capitalization.

- All top 10 retail REITs saw market caps fall in 2022 except Agree Realty.

- Despite 2022 decline, 3-year returns for most top retail REITs remain positive.

- In Feb 2023, over half of the top retail REITs by market cap had negative 1-year returns.

- Some smaller retail REITs focused on supermarkets saw much higher gains in 2022.

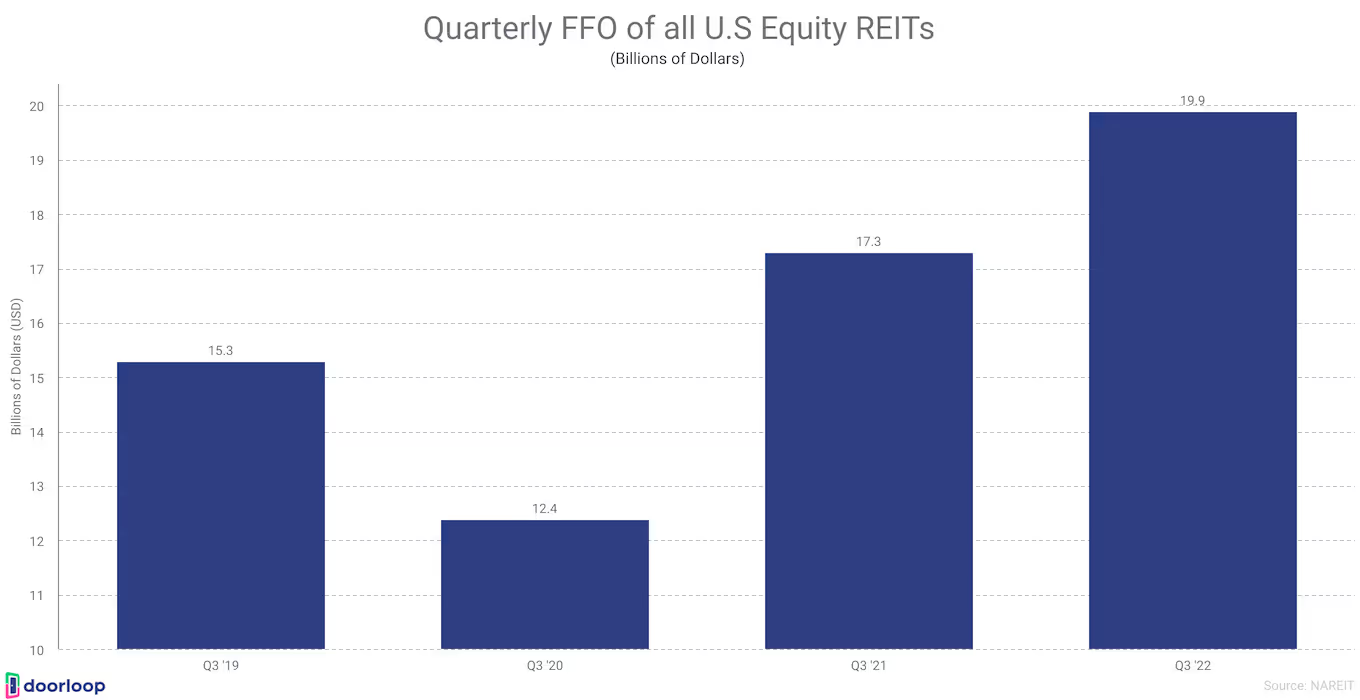

- Equity REIT FFO increased 14.9% year-over-year to $19.9 billion in Q3 2022, an all-time high.

- Equity REIT NOI increased 8.1% over the past 4 quarters as of Q3 2022.

- Equity REIT same-store NOI grew 7.1% year-over-year in Q3 2022.

- Operational growth in FFO, NOI, and same-store NOI show the resilience of REITs despite economic uncertainty.

- Strong operations and balance sheets position REITs well to navigate uncertainty in 2023.

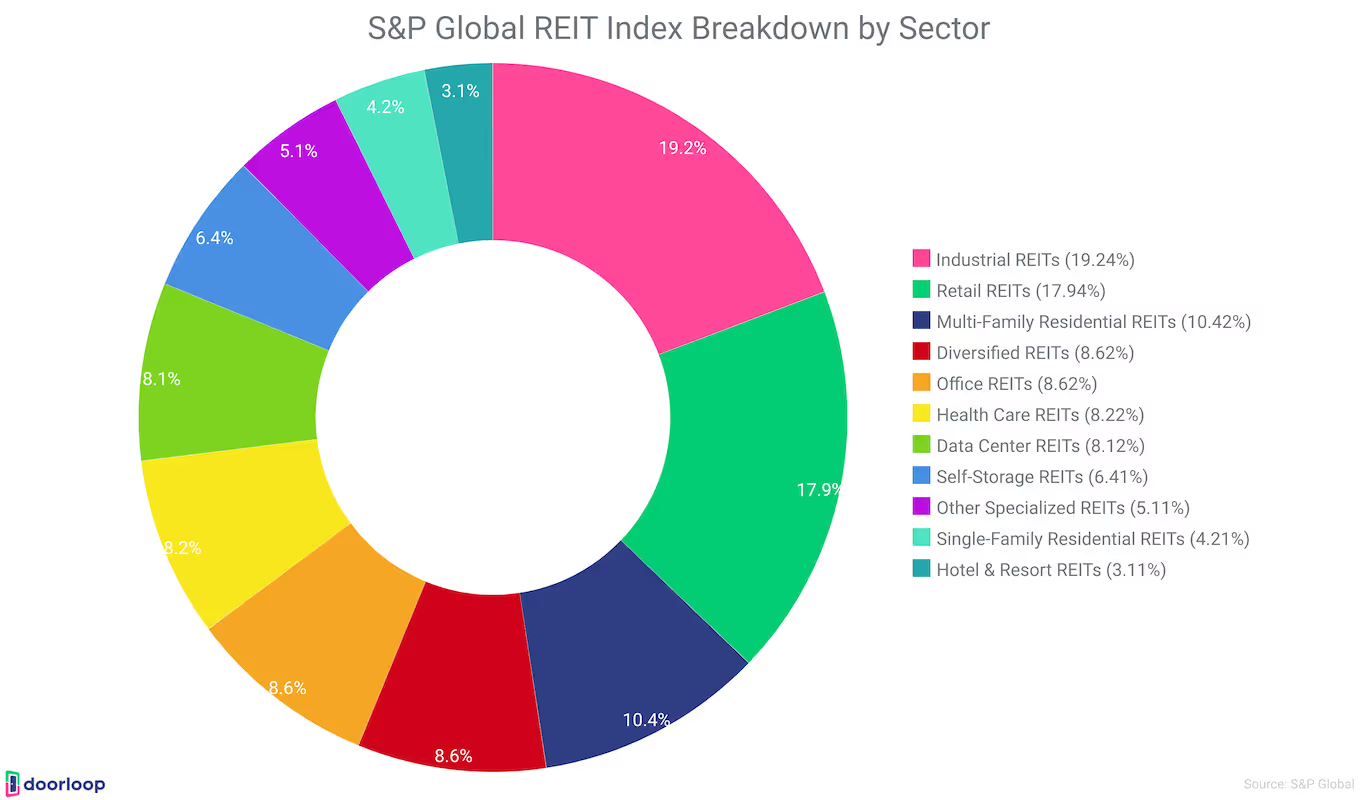

Global REIT Indices by S&P Global

S&P Global REIT serves as a comprehensive benchmark of publicly traded equity REITs listed in both developed and emerging markets.

- As of August 2023, the S&P Global REIT Index returned -3.06% over the past month, 3.57% over the past 3 months, and 2.95% year-to-date as of the most recent reading.

- The annualized return over the past year was -3.56%, while the annualized 10-year return was 5.46%.

- Over a 3-year period, the S&P Global REIT Index had an annualized return of 4.41%, while the 5-year annualized return was 1.95%.

- Based on sector breakdown, the largest allocations in the index are to industrial REITs (19.2%), retail REITs (17.9%), and multifamily residential REITs (10.4%).

- The smallest allocations are to hotel & resort REITs (3.1%), single-family residential REITs (4.2%), and specialized REITs (5.1%).

- The index is fairly well diversified across sectors like office, healthcare, data centers, and storage which each represent 6-8% weights.

REIT Valuations

Valuation metrics allow investors to assess whether REIT shares are over, under, or fairly valued compared to their underlying portfolio value and cash flows. Key valuation indicators include price-to-funds from operations (P/FFO) ratios and premiums/discounts to net asset value (NAV).

The following statistics provide insights into the current valuations of major retail REITs based on these important metrics:

- Agree Realty is estimated to have the highest P/FFO among retail REITs in 2023 (17.84%) and 2024 (17.1%).

- Simon Property Group's market cap fell from $52.5 billion to $38.6 billion from Dec 2021 to Dec 2022.

- Simon Property Group had -5.7% 1-year return in Feb 2023.

- In 12 months to Feb 2023, Getty Realty had the highest return among retail REITs.

REIT premiums and discounts to net asset value (NAV)

- As of July 3, 2023, publicly traded US equity REITs traded at a median 18.2% discount to estimated net asset value (NAV) per share, down from 23.3% discount at the end of May.

- Office REITs traded at the largest discount to NAV of 44.1%, followed by hotel REITs at 32.9% and regional mall REITs at 28.4%.

- Of the top 10 largest REIT discounts, 6 were office-focused.

- Hudson Pacific Properties had the largest discount of 77.9% below the estimated NAV of $20.50 per share.

- Casino and data center REITs traded at median premiums to NAV of 3.5% and 3.2%, respectively as of July 3.

- Of the top 10 largest REIT premiums, 6 were healthcare-focused, and 1 was casino-focused.

- Welltower had the largest premium at 42.2% above the estimated NAV of $57.30 per share.

REIT capital structure, balance sheet metrics, and debt profile

A REIT's capital structure and debt profile provide critical insights into the company's financial health and valuation. Key metrics analyzed in this section include debt-to-assets ratios quantifying leverage, weighted average debt maturities illustrating refinancing needs, and the mix of fixed versus floating rate debt showing interest rate sensitivity. Prudent management of leverage, debt maturity schedules, and interest rate exposure provides REITs with financial flexibility and supports stability in valuations. Comparative analysis of these capital structure statistics enables assessment of balance sheet strength across the diverse REIT industry. The metrics highlight how effective debt management and conservative financing promote resilience even during rising interest rate environments.

- REIT leverage (debt-to-assets) has remained below 40% since 2011 and stabilized around 30-35% since 2016.

- As of Q3 2022, REIT leverage was 34.5% with an average debt maturity of 83.5 months (7+ years).

- REIT leverage spiked to 64.7% during the Global Financial Crisis in 2009 when asset values fell.

- REITs have increased share of fixed-rate debt from 73% in 2005 to over 85% in 2021-2022. Well-termed, fixed-rate debt limits REIT exposure to rising interest rates.

- Average REIT debt maturity rose from 59 months in 2005 to a peak of 89 months in 2021.

- Lower leverage improves REIT's competitive position for property purchases versus more leveraged buyers.

- Share of fixed rate debt for REITs increased from 73% in 2005 to over 85% in 2021-2022.

- The average interest rate on REIT debt fell from 5.9% in 2005 to 3.6% in Q3 2022.

- The weighted average interest rate on REIT debt has fallen from 5.9% in 2005 to 3.6% in Q3 2022 (NAREIT)

- Long debt maturities & fixed rates limit REIT exposure to rising rates.

- REIT interest expense as a share of NOI dropped from 37% in 2009 to 18.9% in Q3 2022.

- Long debt maturities and fixed rates limit REIT exposure to higher interest rates (NAREIT)

- Lower leverage has reduced REIT interest expense as a share of NOI from 37% in 2009 to 18.9% in Q3 2022.

- All property sectors have lowered interest/NOI ratio since 2005, led by residential, data centers, and retail.

- Timber and data centers have the lowest interest/NOI ratios below 10%.

- 87.2% of REIT debt was fixed rate as of Q3 2022.

- All property sectors reduced the interest/NOI ratio since 2005.

- Residential REITs saw the largest interest expense/NOI reduction of 22 basis points since 2005.

REIT Market Outlook and Forecast

- Fitch has downgraded its 2023 U.S. REIT outlook to Deteriorating from Neutral. The downgrade reflects tightening CRE lending conditions and ongoing pressure on REIT valuations and fundamentals from high interest rates and economic headwinds.

- Fitch expects the U.S. to enter a recession in late 2023, ending the favorable operating environment in 2021-2022.

- The REIT market is projected to see 2.6% year-over-year growth in 2023.

- The REIT market is forecast to grow at a CAGR of 2.8% from 2022 to 2027.

- The market size is estimated to increase by $333.01 billion from 2022 to 2027.

- Top REIT manufacturers globally include Omega Healthcare Investors, Iron Mountain, Federal Realty, STAG Industrial, W.P. Carey, and others.

- The 3 main types of REITs are equity REITs, mortgage REITs, and hybrid REITs.

- North America held the largest REIT market share in 2023. Other major regions for REITs are Europe, Asia-Pacific, South America, and Middle East & Africa.

Conclusion

REITs have evolved into a major component of the real estate industry and investment landscape. The statistics presented showcase the expansive size and scope of the REIT market, strong historical performance and dividend yields, growth in global adoption, and diversity across property sectors. While recent economic uncertainty has posed challenges, prudent capital management has positioned leading REITs to navigate volatility. The compiled data and metrics provide a robust fact base for analyzing REIT fundamentals.

FAQ

How large is the REIT industry in the United States?

U.S. REITs own nearly $4.5 trillion in gross real estate assets as of 2021. Public U.S. REITs alone account for $3 trillion in assets.

How many properties do REITs own?

REITs owned over 535,000 properties in 2021. Major property types include offices, malls, warehouses, apartments, hotels, medical buildings, cell towers, and more.

How much income do REITs generate for investors?

In 2021, REITs paid an estimated $92.3 billion in dividends to shareholders.

What is the benchmark index for tracking the REIT sector?

The FTSE Nareit U.S. All Equity REIT Index tracks over 200 publicly traded REITs and is a widely followed benchmark.

How have REITs performed in 2022-2023?

After declines in early 2022, REITs rebounded +7.41% in June 2023, led by small cap outperformance.

Which REIT sectors have struggled the most recently?

Infrastructure and office REITs have been the worst-performing property sectors so far in 2023.

How do REIT valuations compare to net asset value?

REITs trade at discounts to NAV, especially office & hotel REITs. Hudson Pacific traded at 77.9% below the estimated NAV.

How have REITs managed leverage over time?

REIT leverage has stayed below 40% since 2011. Lower leverage has reduced interest expense ratios.

What is the global REIT market outlook?

The global REIT market is forecast to grow at 2.8% CAGR from 2022-2027 to $333 billion.

How many countries have REIT legislation?

REIT legislation has been adopted in over 40 countries worldwide. All G7 countries have REITs.

What are the main REIT sectors globally?

The largest REIT sectors are residential, retail, office, industrial, specialized, diversified, and healthcare.

What is driving global REIT growth?

The adoption of the U.S. REIT approach in more countries is fueling growth in listed real estate securities.

How much capital do mortgage REITs provide?

Mortgage REITs supply over $1 trillion in financing by investing in real estate mortgages and mortgage-backed securities.

.svg)

.svg)