Research Summary: As the world reopens following a prolonged period of COVID-19 restrictions, an increasing number of people are becoming thrilled about booking their long-awaited vacations. The pandemic has brought about numerous changes, including travelers' expectations for their vacation experiences. These travel-related desires can be fulfilled not by traditional hotel or motel accommodations but only by short-term rentals. For an overview of our extensive research, please refer to the statistics below:

Key Takeaways:

- By the year 2026, the short-term rental market is expected to reach a valuation of $8,907.1 million.

- Approximately 45% of hosts reported that short-term rentals were instrumental in meeting their financial needs.

- As of April 2022, 18% of American adults had expressed their intention to stay at a vacation rental.

- In 2022, Booking.com achieved approximately 17.1 million downloads, solidifying its position as one of the most preferred options among travelers.

- The cleaning costs for 1-bedroom vacation rentals have experienced a surge of 25.08% since Q1 2021.

- In global comparison, it is projected that the U.S. will generate $19.39 billion in vacation rental revenue in 2023.

- It is projected that the cap rate for short-term rentals will increase to 7% in 2023.

- Short-term rentals experience greater demand in coastal areas compared to hotels, with a notable 17% difference.

- In 2021, there was a substantial surge of 28.0% in stays at unconventional and distinctive accommodations.

- San Diego is expected to experience a substantial decrease in the number of short-term rentals currently operating as a result of a new ordinance.

- By 2023, the short-term rental occupancy rates in the U.S. are projected to decline to 56.4%.

For easier access, we broke down the data in the following ways:

General | Hosts | Travelers | Websites | Costs | Revenue | Investment | Competition | Accommodations and Amenities | Growth Roadblocks | Trends and Predictions

General

The short-term rental industry has seen an unprecedented surge in growth, thanks to various contributing factors. The increasing use of online platforms, the rising demand for budget-friendly travel, and the growing popularity of short-term rentals are among the driving forces behind this remarkable expansion. Our research provides valuable insights into the current state of the industry, helping you better understand this booming market.

- By the year 2026, the short-term rental market is expected to reach a valuation of $8,907.1 million.

Moreover, the vacation rental market is predicted to experience a substantial compound annual growth rate of 19.1% from 2022 to 2032. This growth is driven by factors such as the thriving tourism industry and the growing popularity of vacation rentals. - In 2022, the average number of short-term rental listings in the U.S. reached 1,278,254.

This marks an increase of 20.5%, compared to the 1,059,929 listings in 2021. Furthermore, it is projected that this number will continue to rise to 1,424,441 in 2023.

- In 2022, the percentage of nights listed for vacation rentals reached its peak at 25.3%.

There have been significant changes in the percentage of listed nights in recent years. In 2021, only 5.7% of nights were listed. Additionally, it is predicted that by 2024, this percentage will increase to 9.0%, indicating a significant growth in the number of nights listed for short-term rentals.

Hosts

Hosting short-term rentals brings forth various challenges, including issues related to miscommunication and potential property damage. Consequently, a significant question arises: What is the perspective of property owners when it comes to short-term rentals? Here are some potentially helpful facts to consider.

- Approximately 45% of hosts reported that short-term rentals were instrumental in meeting their financial needs.

Nearly 50% of hosts disclosed that income from short-term rentals helped cover their expenses, while more than 20% of hosts stated that rental income prevented foreclosure or eviction.

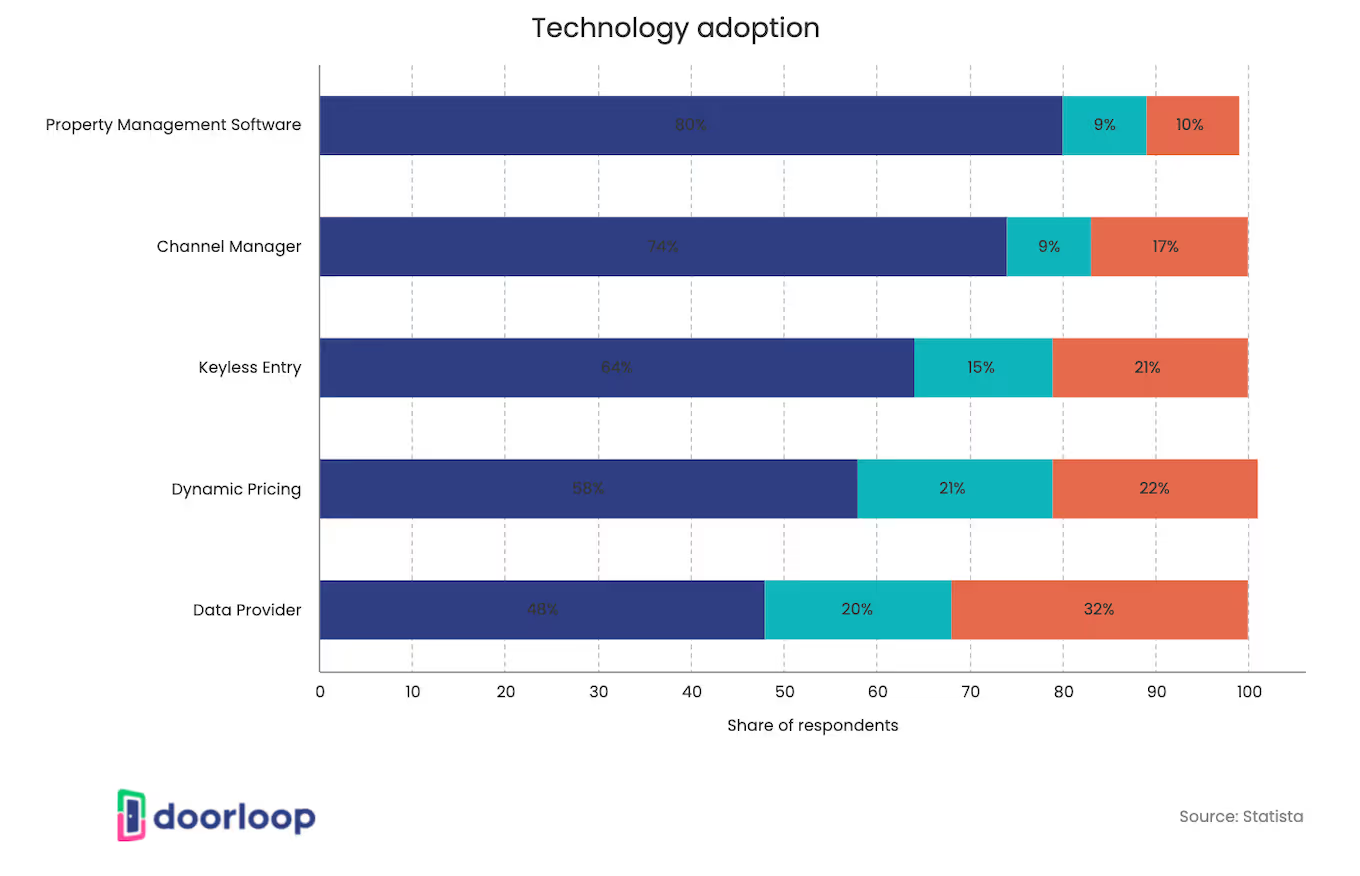

- Among vacation rental property managers, 82% expressed plans to implement keyless technology.

Additionally, 34% of them considered investing 11% to 25% more in technology compared to their current levels.

- Hosts with high cleanliness scores observed a notable increase of 2.3% in their occupancy rates.

In contrast, hosts with lower cleanliness scores experienced decreased occupancy rates. It is noteworthy that in 2021, hosts with high cleanliness scores saw a significant increase of 6.8% in their occupancy rates.

- By implementing Instant Book, hosts can experience an increase in occupancy rates ranging from 4.1% to 5.7%.

This feature not only guarantees a reservation for guests but also enhances your ranking on Airbnb's Search Engine Results Page. Moreover, having high-quality photos can further contribute to higher occupancy rates.

- The average American Airbnb host generates over $1,000 per month.

In 2021, new hosts in the U.S. earned an average of $13,800, representing an impressive 85% increase compared to the earnings of new hosts the previous year.

Travelers

Short-term rental advertisements are ubiquitous across the internet. Property owners can optimize their occupancy rates by creating ads that offer valuable information customized for their target audiences, such as families, couples, large groups, and business travelers. To delve deeper into the characteristics of short-term rental guests, here are some important facts to consider:

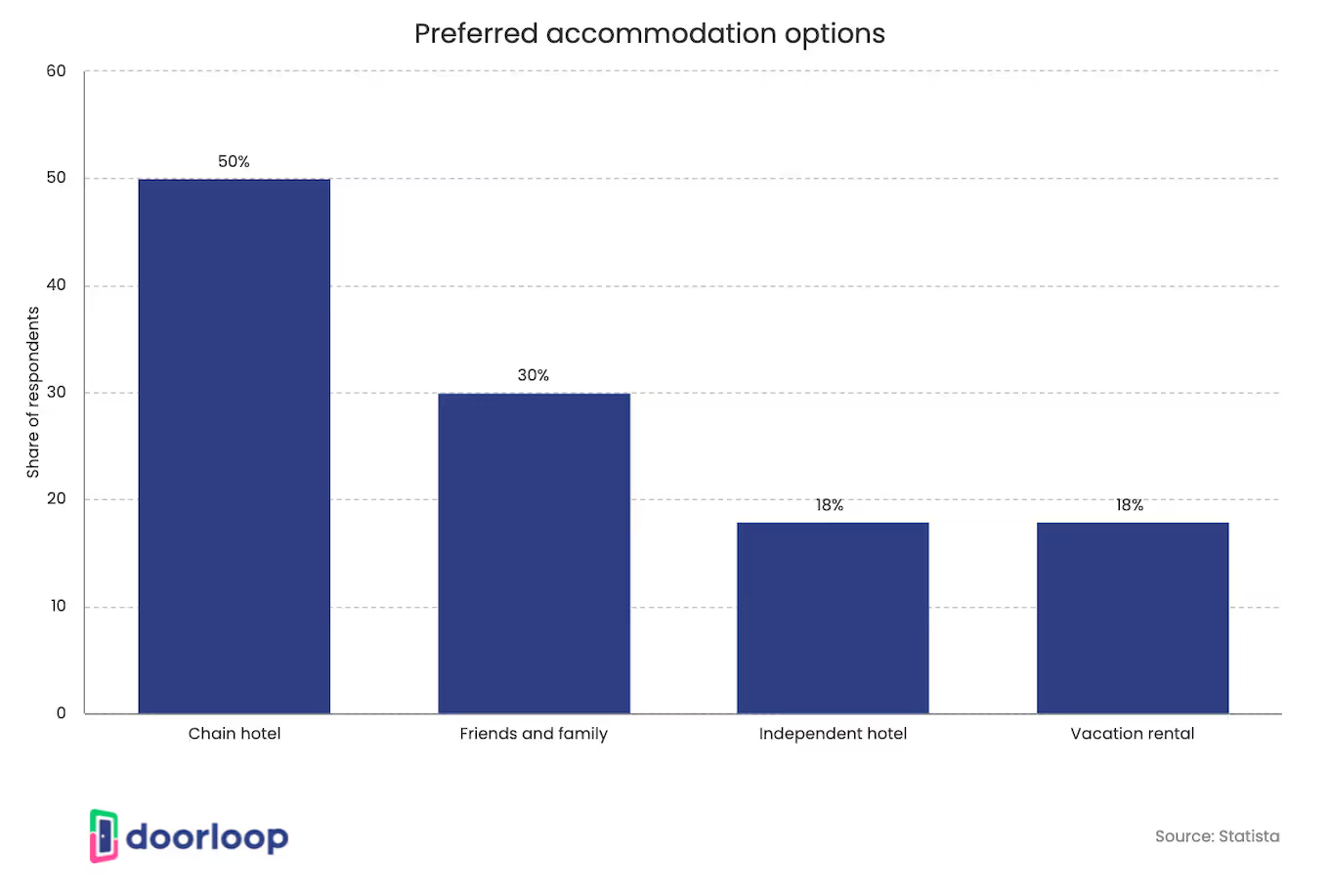

- As of April 2022, 18% of American adults had expressed their intention to stay at a vacation rental.

The accommodation preferences among Americans vary significantly, with a range of options being considered. Additionally, approximately 30% of these adults indicated their intention to stay with friends and family.

- The number of adult users on Airbnb was projected to reach 45.6 million by 2022.

The platform's surging popularity can be attributed to various factors, including its provision of cost-effective lodging options and its offering of distinctive and exceptional accommodations.

- A survey has revealed that 36% of respondents expressed their preference not to use Airbnb.

Among these participants, who were from Europe and the U.S., privacy concerns emerged as a significant factor influencing their decision to avoid using the travel service.

- The number of first-time visitors on Airbnb has increased by 25% since the pandemic began.

In 2020-2021, over 40% of Airbnb guests were new to the platform, indicating a significant shift in the travel industry.

- Around 93.06% of American adults place some level of significance on sustainable travel.

Notably, individuals in the Middle Atlantic region, which includes states like New York, New Jersey, and Pennsylvania, consider environmentally friendly travel to be either somewhat or highly important.

- Approximately 82% of adults in the U.S. indicate a tendency to prioritize eco-friendly choices when planning their travel.

Within this percentage, which represents 210 million people, 29.84% of respondents express a strong commitment to sticking with eco-friendly options despite any inconveniences that may arise. Additionally, 51.73% of American adults mention that they prioritize eco-friendly decisions as long as they don't encounter any significant inconveniences.

- Approximately 64.84% of women stated that cost is a significant factor they consider when booking travel.

In contrast, only 53.82% of men emphasized cost as the most important factor, while 39.14% of men prioritized time and convenience. Notably, both men and women expressed equal importance regarding sustainability and carbon footprint when making travel decisions.

Websites

Websites play a crucial role in facilitating the various phases of transactions between hosts and travelers in the short-term rental industry. They serve as reliable platforms for property owners to connect with their target audience and for guests to find suitable accommodations for their travels. With numerous large platforms available, it is essential to have a comprehensive understanding of them. To gain valuable insights, we invite you to explore our research.

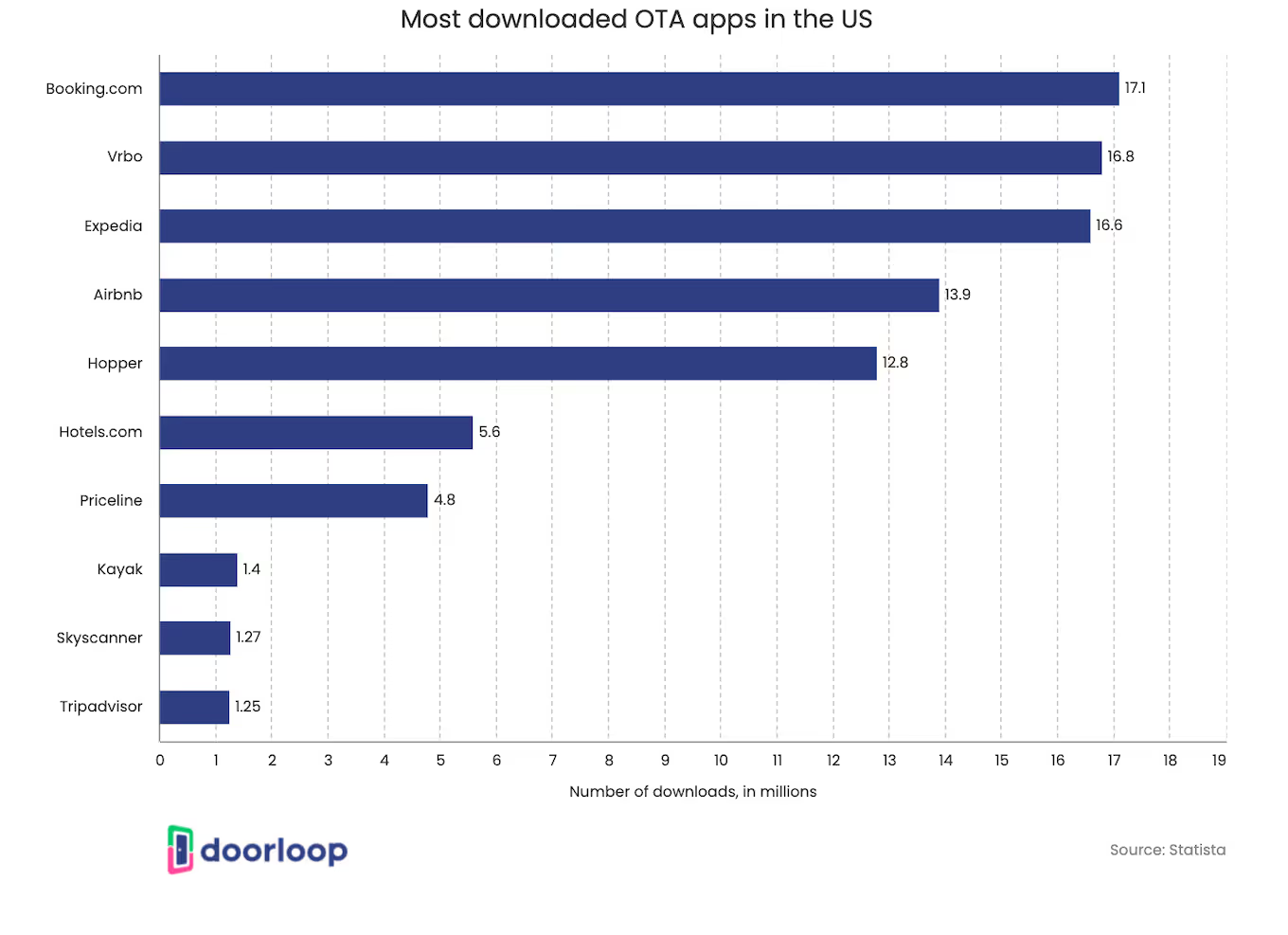

- In 2022, Booking.com achieved approximately 17.1 million downloads, solidifying its position as one of the most preferred options among travelers.

The platform's mobile app also experienced remarkable success, securing the top spot on Apptopia's list of the most downloaded online travel agency (OTA) apps in the U.S. This achievement surpassed its previous ranking of third place and showcases the widespread popularity of the app.

- In September 2022, the number of active Airbnb rentals exceeded 6.1 million listings, surpassing the pre-pandemic period by 19.2%.

Despite only two years passing since the onset of the pandemic, the supply of active Airbnb rentals has skyrocketed. This surge in supply is one of the after-effects of the pandemic, as travelers now tend to explore less populous destinations.

- In 2021, first-time users contributed around 40.8% of the total Airbnb reviews, indicating a significant increase from the previous year's 24%.

This surge is thought to be attributed to the pandemic-induced demand for more expansive vacation lodgings among travelers.

- Approximately 63% of travelers consider direct booking reservations on a campground website as the most popular method for making reservations.

Additionally, 85% of travelers express a strong preference for having technology available at campgrounds. This tech-centric approach is particularly embraced by Gen Z and millennials, who prioritize using technology for reserving campsites and communicating with campground staff.

Costs

Investing in a vacation rental property offers the potential for substantial returns. However, like any other investment venture, it is crucial to consider certain factors to maximize the chances of success in the short-term rental market. Key considerations include understanding and planning for recurring costs and unforeseen expenses associated with owning and operating this type of accommodation. To gain insights into these costs, take a look at our research:

- The cleaning costs for 1-bedroom vacation rentals have experienced a surge of 25.08% since Q1 2021.

Similarly, cleaning costs for 2-bedroom rentals have increased by 24.71%, and for 3-bedroom rentals, the increase is 19.67%. The average national cleaning cost for a 1-bedroom rental is $64.50, while a 2-bedroom rental costs $85.37 to clean, and a 3-bedroom rental's cleaning cost is $116.14.

<table><tr><th>Room type</th><th>Low</th><th>Moderate Low</th><th>Median</th><th>Moderate High</th><th>High</th></tr><tr><td>Studio/1 Bedroom</td><td>$18</td><td>$30</td><td>$55</td><td>$95</td><td>$140</td></tr><tr><td>2 bedrooms</td><td>$50</td><td>$75</td><td>$105</td><td>$150</td><td>$210</td></tr><tr><td>3 bedrooms</td><td>$75</td><td>$100</td><td>$150</td><td>$200</td><td>$295</td></tr><tr><td>4 bedrooms</td><td>$100</td><td>$150</td><td>$200</td><td>$275</td><td>$370</td></tr><tr><td>5+ bedrooms</td><td>$133</td><td>$180</td><td>$250</td><td>$350</td><td>$455</td></tr></table>

- In 2022, vacation rental companies face average turnover costs of nearly $4,000 per property when it becomes vacant.

A survey conducted with multifamily managers in the U.S. highlighted the costs they encounter, including concessions, rental income loss during the vacancy period, and unit repair expenses. These costs are primarily driven by the reduction in rental income.

- In 2022, cleaning fees for vacation rentals amounted to a total of $8.1 billion.

During that year, short-term rental owners and hosts dedicated 13% of their overall earnings to ensure and maintain cleanliness in their rented properties. It is worth noting that 15% of vacation rentals waive cleaning fee charges.

- In 2022, the average cleaning fee for a private or shared room was $47 per stay.

Cleaning fees often correspond with the size of the property as larger spaces require more intensive cleaning. For a home with five or more rooms, the average cleaning fee reached $333.

Revenue

These two-sided marketplaces, where hosts and travelers transact through booking platforms, have emerged as dominant players in the online booking industry. With their sustained growth, there is no doubt that they will continue to wield significant influence in the travel business. Now, let's examine the performance of the top companies in this sector and delve into the facts.

- In global comparison, it is projected that the U.S. will generate $19.39 billion in vacation rental revenue in 2023.

This indicates that the country is expected to contribute the majority of the overall revenue in the vacation rental market this year. - In September 2022, San Diego was ranked as the top destination for accommodation listings on the Airbnb website, with an average price of $316 per night.

This represents the highest average price among the selected cities in the U.S. On the other hand, Seattle had the lowest average price of $196 per night among the selected cities.

- In 2022, the U.S. accounted for nearly 61% of Tripadvisor's overall income.

According to the regional breakdown of the company's revenue, the U.S. emerged as the most profitable region, accounting for approximately 65% of the total revenue.

- Approximately 68% of Expedia’s total earnings come from the U.S.

In 2022, the Seattle-based company generated most of its annual income in the United States.

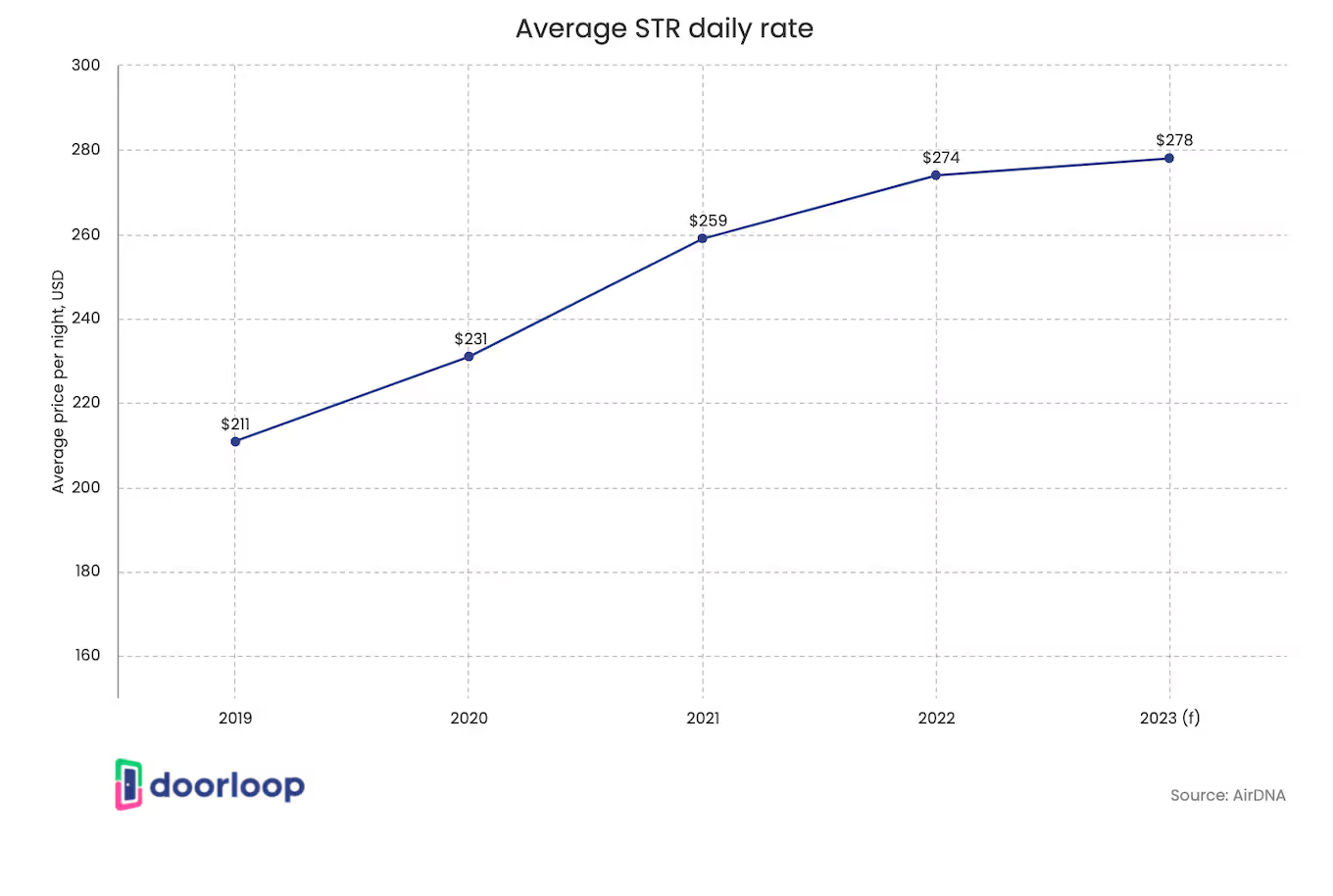

- The projected average daily rate (ADR) for short-term rentals is expected to reach $278.19 in 2023.

This represents a slight increase compared to the average daily rate of $273.53 in 2022. Furthermore, the predictions suggest a decrease in the percentage change of ADR, from 5.6% in 2022 to 1.7% in 2023.

Investment

There is no doubt that short-term rental investment has emerged as a rapidly growing trend. With an increasing number of travelers choosing vacation homes over hotels, many investors are actively seeking properties to rent out. However, it is important to recognize that choosing the right location plays a critical role in achieving success in this endeavor. Our research provides valuable insights to assist you in making informed decisions regarding short-term rental investments.

- It is projected that the cap rate for short-term rentals will increase to 7% in 2023.

This anticipated growth, driven by the growing demand for vacation rentals and the rising number of guests, creates a favorable investment opportunity in this sector. Additionally, the expected improvement in real estate profitability metrics enhances the appeal of such investments.

- Short-term rentals have a notable influence on home appreciation, contributing to an average increase of 17% to 20% across the United States.

Further studies that accounted for factors like market popularity and other variables found a positive, albeit modest, effect ranging from 1% to 4% on both the overall market and specific tourist destinations.

- In 2022, there were more than 660,000 multifamily listings on Airbnb or Vrbo that were listed as short-term rentals (STRs) in the United States.

These short-term rentals are primarily located in apartment infrastructures and are commonly found in the largest cities across the country. Over the past two years, the number of short-term multifamily rental listings experienced a marginal decrease of only 2%, although there was a significant variation observed among different markets.

- In small city/rural areas, the demand for short-term rentals saw an average growth of 25%.

However, resort/destination markets and small cities experienced a decline in occupancy rates. It is important to mention that although there was a growth in demand, it did not match the increase in available listing nights, which saw a 32% rise.

- As of April 2022, there was a gradual recovery in occupancy rates for urban areas, with an increase of up to 4.9%.

Notably, some of the largest cities in the United States, such as Boston (+24.1%), New York City (+19.7%), and Washington, D.C. (+37.5%), showed the highest growth rates.

- In 2023, Indialantic, Florida is projected to achieve an impressive occupancy rate of 70%.

This U.S. location ranks at the top of the list for the best short-term rental market investment opportunities in the said year. Projections indicate an average daily rate of $348 and a potential revenue of $84,000.

Best Short-Term Rental Investment Markets in 2023

<table><tr><th>Location</th><th>Typical Home Value</th><th>Occupancy</th><th>Average Daily Rate</th><th>Average Revenue</th></tr><tr><td>Fairbanks, Alaska</td><td>$148,000</td><td>65%</td><td>$198</td><td>$49,000</td></tr><tr><td>Evansville, Indiana</td><td>$116,000</td><td>61%</td><td>$129</td><td>$27,000</td></tr><tr><td>Rockford, Illinois</td><td>$117,000</td><td>61%</td><td>$175</td><td>$39,000</td></tr><tr><td>Springfield, Illinois</td><td>$118,000</td><td>62%</td><td>$133</td><td>$29,000</td></tr><tr><td>Burdett, New York</td><td>$244,000</td><td>56%</td><td>$345</td><td>$77,000</td></tr><tr><td>Williamstown, Kentucky</td><td>$179,000</td><td>69%</td><td>$238</td><td>$56,000</td></tr><tr><td>New Haven, Connecticut</td><td>$261,000</td><td>63%</td><td>$207</td><td>$48,000</td></tr><tr><td>Ellsworth, Maine</td><td>$267,000</td><td>73%</td><td>$290</td><td>$67,000</td></tr><tr><td>Cheboygan, Michigan</td><td>$205,000</td><td>60%</td><td>$304</td><td>$69,000</td></tr><tr><td>North Woodstock, New Hampshire</td><td>$285,000</td><td>53%</td><td>$293</td><td>$63,000</td></tr><tr><td>Montgomery, Alabama</td><td>$123,000</td><td>56%</td><td>$157</td><td>$30,000</td></tr><tr><td>Two Harbors, Minnesota</td><td>$245,000</td><td>63%</td><td>$294</td><td>$72,000</td></tr><tr><td>Gainesville, Florida</td><td>$234,000</td><td>56%</td><td>$218</td><td>$46,000</td></tr><tr><td>Saint Ignace, Michigan</td><td>$166,000</td><td>62%</td><td>$252</td><td>$50,000</td></tr><tr><td>Bardstown, Kentucky</td><td>$182,000</td><td>64%</td><td>$206</td><td>$46,000</td></tr></table>

- In Q2 2022, short-term rentals in coastal areas saw an impressive surge in demand of over 40%.

This rise in demand significantly boosted revenue earned per unit in these markets. Additionally, some U.S. locations experienced a noteworthy increase in apartment rents, surpassing 25% in 2022.

Competition

Short-term rentals have been gaining prominence in the hospitality industry, challenging the traditional dominance of hotels. They provide travelers with more affordable alternatives and the opportunity to have unique and personalized travel experiences. As the popularity of this type of accommodation continues to rise, it has sparked controversy as its rivalry with hotels intensifies. The following research and statistics will provide valuable insights into this competitive landscape.

- Short-term rentals experience greater demand in coastal areas compared to hotels, with a notable 17% difference.

Moreover, this type of accommodation is 10% more popular in mountainous destinations. These findings indicate that the short-term rental industry has the potential for success by targeting small towns and resorts.

- As of June 21, 2020, hotel RevPAR was down by a staggering 64.8% compared to the previous year, while short-term rental RevPAR only decreased by 4.5%.

This is largely due to the short-term rental sector's ability to maintain stable ADR, which remained level year over year with a slight increase.

- As of June 21, 2020, regional hotels experienced an average weekly occupancy increase of 13.1%, compared to 7.1% in urban markets.

Looking at the period from the COVID low point to the week ending June 21, 2020, hotel occupancy increased by an impressive 210.4% in regional markets, while urban hotels saw a much lower increase of 98.9%. Meanwhile, in the Rentals HC sector, the average weekly increase in occupancy was 5.7% in regional markets and 3.4% in urban markets.

- A recent survey found that a majority of respondents (60.4%) believe that hotels will start exploring alternative accommodation choices, such as short-term rentals, in their business models.

On the other hand, 22.6% of those surveyed think that hotel chains will acquire property management companies to expand their services.

- The survey results indicate that an overwhelming majority (83.2%) of the respondents think that travelers who have been booking short-term rentals since the pandemic began will continue to prefer them over hotels even after the pandemic ends.

In contrast, 16.8% of the participants said they would revert to booking hotels.

Accommodations and Amenities

Accommodations and amenities play a vital role in shaping the travel experience and determining the success of a vacation rental business. They are also crucial factors that can greatly impact the conversion of a first-time guest into a regular customer. Here are some statistics highlighting the popularity of vacation rental services:

- In 2021, there was a substantial surge of 28.0% in stays at unconventional and distinctive accommodations.

The year saw a discernible change in guest preferences, with a growing interest in unique lodging options that diverged from the typical choices of houses, apartments, and condos.

- According to a recent survey, approximately 36% of respondents indicated that glamping is the most popular form of camping, closely followed by 35% of respondents who voted for tent camping.

Interestingly, the survey revealed a generational difference, with Millennials showing a preference for tent camping, while Gen Z expressed a greater inclination towards glamping.

- In 2022, the average cost of renting an RV for a trip was $1,270, according to Outdoorsy.

This amount reflects an increase compared to the average costs of $1,185 in 2021 and $1,175 in 2020. Additionally, a survey revealed that 91% of respondents had plans to embark on a road trip in 2022. The popularity of RVing is on the rise due to its affordability and attractive amenities, including air conditioning, toilets, and pet-friendly options.

- In June 2022, there were around 37,000 AirBnb listings in the city of New York.

Among these, over 21,000 listings were for entire homes and apartments, making them the most prevalent type of accommodation available in the city.

- In 2022, a substantial 74% of campers made adjustments to their travel plans.

Among these campers, three out of ten individuals decided to increase the frequency of their camping trips while decreasing their participation in other types of travel. Furthermore, approximately 39% of campers canceled previously planned trips in order to prioritize camping experiences.

Growth Roadblocks

The short-term rental industry has witnessed substantial expansion by catering to the evolving needs and preferences of modern travelers. However, like any industry, it has encountered obstacles that have impeded its progress. Here are some essential factors that have influenced the growth trajectory of the short-term rental industry.

- San Diego is expected to experience a substantial decrease in the number of short-term rentals currently operating as a result of a new ordinance.

An ordinance has been put into effect in San Diego, capping the number of short-term rental permits at approximately 5,400 citywide. This new regulation will result in a significant decrease, nearly cutting the current count of around 12,300 rentals in San Diego in half. Similar to San Diego, other major U.S. cities such as San Francisco, New York, and Atlanta have also implemented strict regulations on short-term rentals, leading to a significant impact on the industry in these areas.

- Airbnb bookings in April 2020 were down by 70% compared to the same period in the previous year.

In April 2020, there were 4.7 million bookings - a decrease from the 15.7 million bookings compared to the previous year. Additionally, active listings on Airbnb were down by 6% year-over-year to 7.9 million in April 2020 from 8.4 million listings in the previous year.

- The demand for short-term rentals in urban areas was still struggling as of April 2021, with a decline of over 40% compared to the year before the pandemic.

However, there are positive signs on the horizon - industry experts predict that urban travel will begin to recover in the latter part of 2021, with a more robust recovery expected in 2022. In fact, they expect that urban demand will fully recover to pre-pandemic levels by 2023.

- Two years ending 2020, an average of 4,200 RV fires were reported to US fire departments each year, resulting in 15 deaths, 125 injuries, and $60.3 million in losses.

Recreational vehicles, or RVs, which are a popular accommodation option for short-term rentals, can present risks to occupants. RV fires fall under the safety and security concerns that could potentially hinder short-term rental growth.

- Of the 120,109 Airbnb venues, 80% reported having smoke detectors, but only 58% reported having carbon monoxide detectors, 42% reported having fire extinguishers, and 36% reported having first aid kits.

Safety deficiencies were found in many venues, with less than half having CO alarms, fire extinguishers, or first-aid kits even though they had smoke alarms.

Trends and Predictions

In recent years, the vacation rental industry has encountered obstacles that have impeded its growth. Nevertheless, factors like the increasing number of internet users, the thriving sharing economy, and the demand for affordable accommodations have significantly contributed to its rapid market expansion. However, it remains imperative to consider the sustainability of this growth trajectory in the future. To gain insights into this matter, we invite you to explore our research.

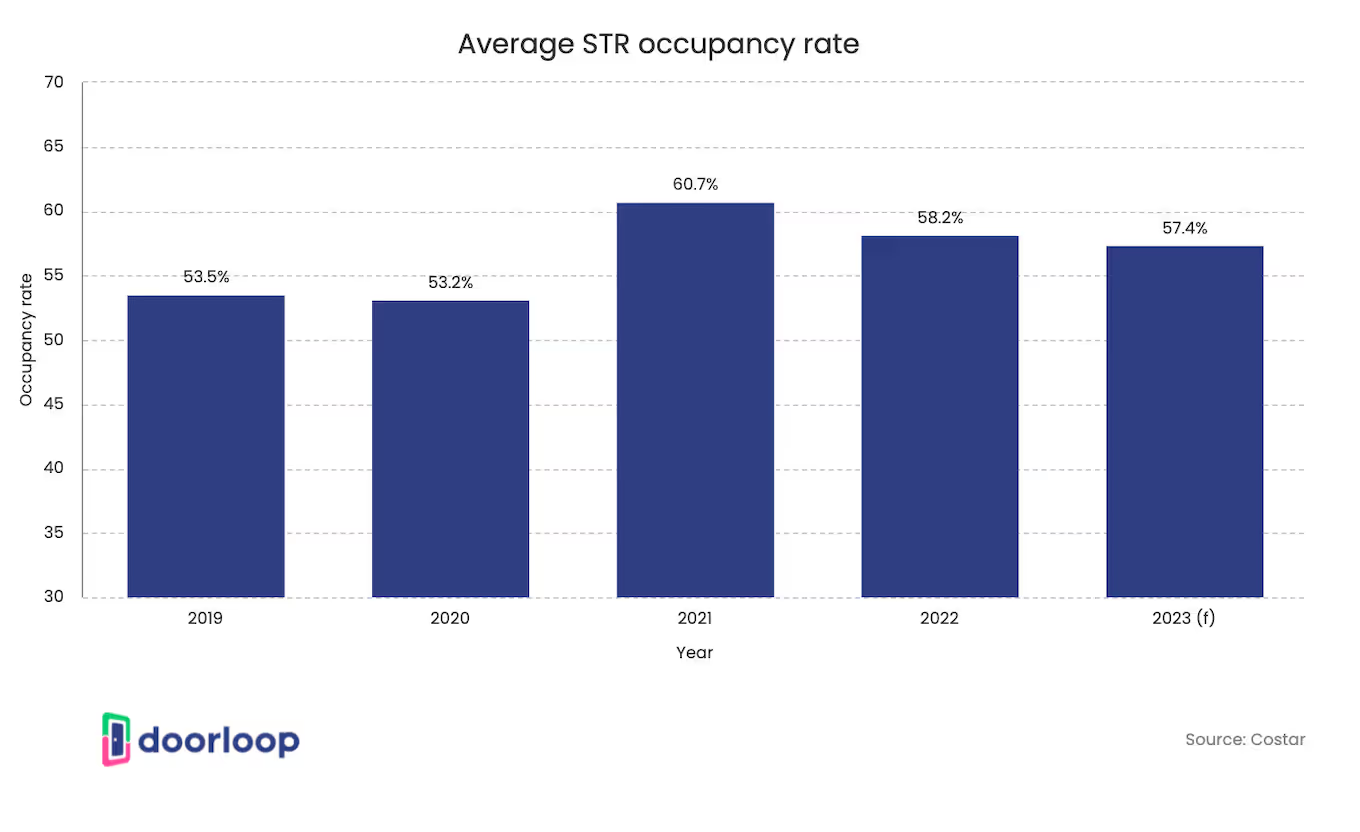

- By 2023, the short-term rental occupancy rates in the U.S. are projected to decline to 56.4%.

This projection indicates a consistent drop from the occupancy rate of 60.3% in 2021 and 58.3% in 2022, posing a looming threat to the short-term rental industry.

- The valuation of the U.S. vacation rental market stands at $14.32 billion, and it is anticipated to reach an impressive value of $21.53 billion by 2026.

This exponential growth is fueled by the rising popularity of vacation rentals, which offer affordability, pet-friendly options, and home amenities. These factors have significantly contributed to the industry's expansion as more and more travelers are choosing vacation rentals over traditional lodging options.

- The number of users in the home-sharing economy is expected to surpass 68.2 million by 2023.

In the United States, the industry experienced a significant decrease in the number of users, dropping to 23.3 million in 2020 due to the pandemic's impact. However, with travel returning to normalcy, the number of users is expected to experience a significant surge.

- By 2023, the demand for short-term rentals is projected to experience a 5.5% increase in booked days.

Despite concerns about a potential recession, the industry is expected to strengthen and continue its trend of increased listings and competition. However, in the same year, the industry is only expected to see modest ADR gains of 1.7%.

- By 2023, the average occupancy rate for short-term rentals is projected to be 56.4%.

Although this is slightly lower than the rates in 2021 and 2022, which were 60.3% and 58.3%, respectively, it still represents a significant improvement compared to the rates observed in 2020. - By 2027, it is projected that the number of users in the vacation rentals segment will reach 62.99 million.

Additionally, user penetration, which is forecasted to be 18.5% in 2023, is expected to decrease slightly to 18.3% in the same year. The vacation rental market is anticipated to experience an annual growth rate of 1.49%, resulting in a projected market volume of $20.57 billion.

- In 2023, Airbnb's average available listings are projected to reach 1,424,441, marking an increase from the company's average of 1,278,254 available listings.

However, the occupancy rate, which stood at 58.3% in 2022, is expected to decline to 56.4%.

Conclusion

In recent years, the U.S. vacation rental industry has witnessed significant growth. However, the industry has undergone changes, leading to a new set of challenges that rental owners now face. These changes include shifts in travel behaviors and the economic environment. Despite a decline in gross bookings during the initial stages of the pandemic, there was an increase in the number of owners entering the short-term rental industry to capitalize on available revenue opportunities. As the latter half of 2021 and 2022 progressed, the industry settled into a more sustainable pace. While vacation rentals continue to outperform hotels in terms of growth, there are concerns about factors such as inflation that may hinder its progress in the future.

FAQS

What is the market size of short-term rentals?

In 2022, the vacation rental market in the U.S. reached a size of $19 billion. It is expected that in 2023, the U.S. vacation rental market will reach $18.63 billion. Looking ahead to 2026, the market is projected to exceed $20 billion.

How many homes are short-term rentals in the US?

Obtaining the exact number of homes being used as short-term rentals in the US can be challenging due to hosts using multiple platforms and some not being registered with local authorities. However, in 2021, it was estimated that there were approximately 1.3 million vacation rental homes in the US, with 1,985,280 professionally managed short-term rental properties across the country. By 2022, the number of vacation rental listings in America had increased to around 1.5 million.

Who is the largest short-term rental owner?

The largest segment of short-term rental owners in the U.S. consists of individual investor landlords, commonly referred to as 'Mom and Pop.' Out of the approximately 50 million rental housing units in the country, around 41% or roughly 20.5 million units are owned by these individual investors.

What is a good cap rate for an Airbnb?

A cap rate of 8% or higher is generally considered good for an Airbnb property, but this can vary depending on local market conditions, investor goals, and risk tolerance. In some markets, achieving cap rates of 10% or higher is possible, while others may have lower cap rates due to higher property values and operating expenses.

However, the cap rate is just one factor to consider when assessing the profitability of an Airbnb property. Investors should also consider occupancy rates, rental income, operating expenses, and the potential for property value appreciation over time.

What is the 50% rule on Airbnb?

The 50% rule is a commonly used guideline among Airbnb hosts to help estimate their potential profitability. It suggests that hosts should strive to keep their operating expenses, such as mortgage, property taxes, insurance, utilities, maintenance, and cleaning fees, at or below 50% of their gross rental income. By adhering to this rule, Airbnb hosts can maintain a healthy profit margin while ensuring that their expenses do not exceed their rental income.

However, it's important to note that the 50% rule is not a hard and fast rule that will work for every Airbnb host. The profitability of an Airbnb property depends on various factors such as location, demand, competition, and seasonality. Therefore, hosts should thoroughly evaluate their operating expenses and estimate their potential rental income to determine a more tailored approach to profitability.

Sources

- futuremarketinsights.com

- airdna.co

- airbnb.com

- seetransparent.com

- statista.com

- thevacationer.com

- rmscloud.com

- turno.com

- globest.com

- guesty.com

- outdoorsy.com

- koapressroom.com

- avalara.com

- rentresponsibly.org

- usfa.fema.gov

- bmj.com

- daedal-research.com

.svg)

.svg)