Renting vs. buying is one of the most popular topics when it comes to the housing market.

Whether you are moving out of your parent's house or simply want to relocate, you have to choose the option that makes the most financial sense.

This is where the difficulty lies: choosing one.

If you are stuck on this question, or want to learn more about each one, look no further.

In this guide, we will be giving a complete overview of the differences, as well as the pros and cons, between renting and buying. In the end, we will also give some examples of cities where renting is better and some where buying is better to get you started with your search.

To begin, let's go over some of the key differences between renting and buying.

Renting vs. Buying: Key Differences

Before proceeding with the pros and cons of each one, it is essential to know the differences between renting and buying. Below, we have given a general overview of what renting and buying consist of, as well as some differences.

Renting

When you rent a property, you are paying someone else for permission to live on their property. This means that you essentially have no control over the property itself or the terms of your lease. However, it is incorrect to view renting as a waste of money until you're able to buy.

When renting, you are sure about the cost of your monthly payments. This means that things like interest rates and home prices do not affect your payments. Also, included in the down payment (security deposit) and rent of a property are many other things. This includes maintenance, repairs, property taxes, and much more.

For those just starting out, renting may seem like the more favorable option as they can save money on the plethora of expenses associated with owning a home. Below, we will discuss more on the expenses of each one.

Buying

Buying a property has its own benefits, but it also has drawbacks. One of the most important benefits of buying your own home or property is the sense of ownership. When you buy property, the property is yours and yours only. There is also a sense of stability that comes with this, as it would be difficult for your home to be taken away.

However, there are, of course, some drawbacks. One of the main drawbacks is the mortgage. Instead of paying rent, you will be making a mortgage payment every month. These mortgage payments are basically paying off the house that you just bought. Furthermore, the amount that you must pay can vary due to rising mortgage rates.

So, generally speaking, buying a house may not be the best move for those that are just starting out. This is especially considering the current market with its constant rising prices and the unstable stock market.

Now that we know a little about renting and buying, let's go into detail on some of the key differences.

Expenses

One of the most important differences that one must note when making this decision is the cost. Or, more specifically, the number of expenses that someone would have depending on if they go for buying or renting.

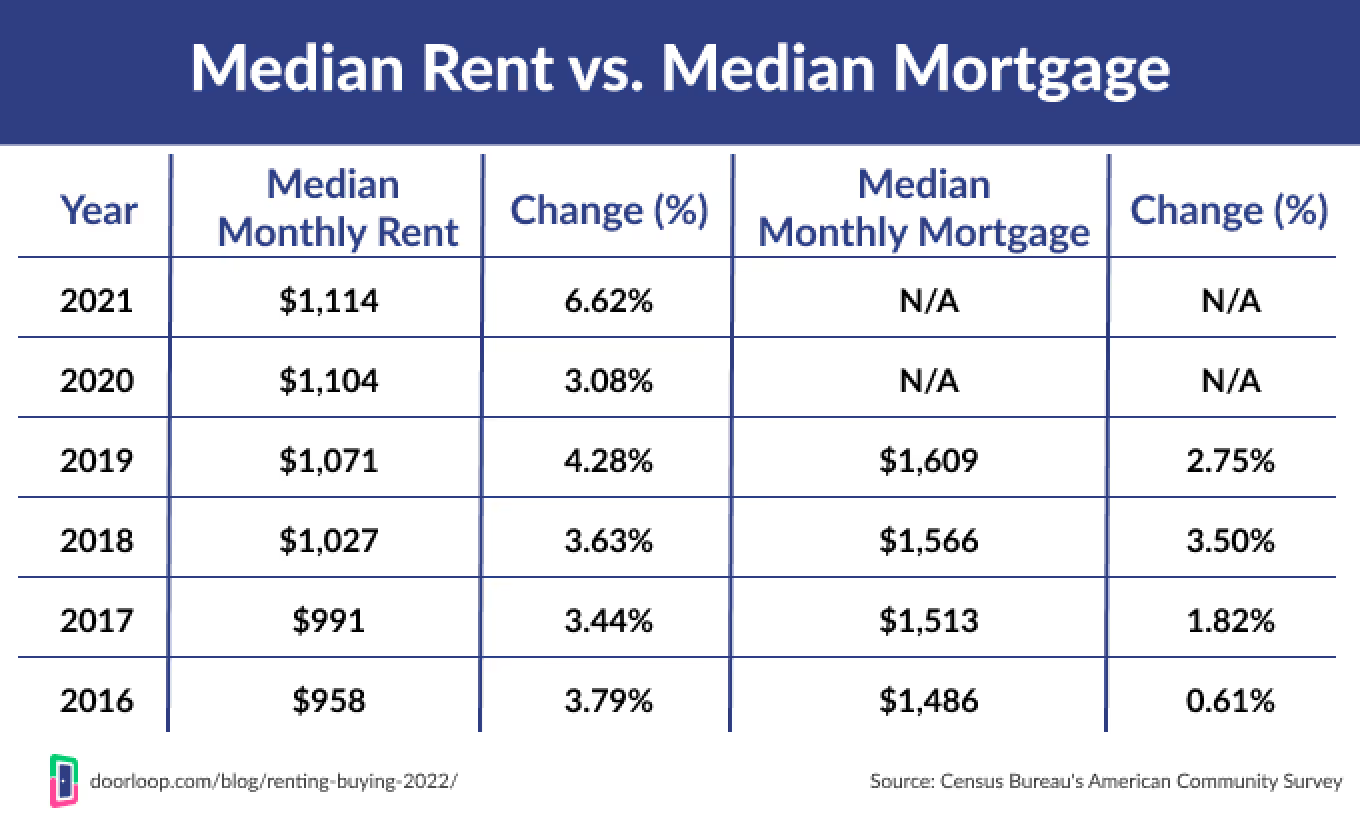

First, we will compare the most basic expenses, the rent and the mortgage payment. As seen in the table above, mortgage payments are historically more expensive than rent payments. This means that, in most cases, someone will be paying more to actually own a house than to rent one.

However, to gain a more complete idea of the expenses, we cannot just compare those payments. There are various other expenses associated with each one. Some of the other expenses associated with renting include:

- Application Fees

- Security Deposit

- Moving Costs

- Insurance

- Utilities

...and the potential for many more. It is important to note that some of these other expenses, like the utilities, are sometimes covered by the rent. There are also tons of other expenses, like pet deposits or appliances, that can come up when renting.

When buying a property, some of the associate costs include:

- Down Payment

- Closing Costs

- Property Taxes

- Insurance

- Maintenance/Repairs

- Utilities

- Moving Costs

..and, again, the potential for many more. When you put these two side-by-side, they may seem similar, but the difference in cost is pretty high. For example, when renting, the renter is typically not responsible for maintenance or repairs. However, when buying a property, the buyer is completely responsible for everything. This can but a significant dent in a buyer's budget if they are not careful.

Taxes

Another one of the great benefits of buying a home is the tax benefits. The U.S. government has various benefits for homebuyers that may sway renters towards buying.

One of the main benefits is the mortgage interest deduction. This allows homeowners to deduct the interest paid on a mortgage from their taxes. Homeowners are allowed to deduct up to $750,000, but these deductions must be used to buy, build, or improve their homes.

Some of the other tax benefits that exist include the mortgage insurance deduction, SALT deduction, tax-free profits after sale, and the standard deduction. All of these are meant to encourage people to buy a house or any property.

Maintenance/Repairs

As mentioned above, owning a home means that you are responsible for all of the maintenance on the property. And, unfortunately, the money spent on these repairs are often not reflected in housing prices. This means that in maintenance and repairs alone, your monthly home payment can increase significantly.

This does change, however, if the home is part of an HOA community. Over the past few years, there have been an increasing number of homes sold that form part of an HOA. These communities often take care of maintenance and repairs, but only to a certain extent. Not only are the repairs limited, but the community fee can be up to a few hundred dollars a month.

On the other hand, renters usually do not need to worry about these things. The landlords are typically responsible for all maintenance and repairs, meaning the tenant only has to submit a request for maintenance to be done.

So, now that we know all about some of the key differences between renting and buying, let's discuss some pros and cons of each one.

Pros And Cons Of Renting And Buying

Although we have already discussed some benefits and drawbacks of each one, there is still a lot to go over. In this section, we will be discussing the pros and cons of both renting and buying. So, without further ado, let's get right into it.

The Pros Of Renting

First, let's go over some of the pros of renting a property.

Flexibility

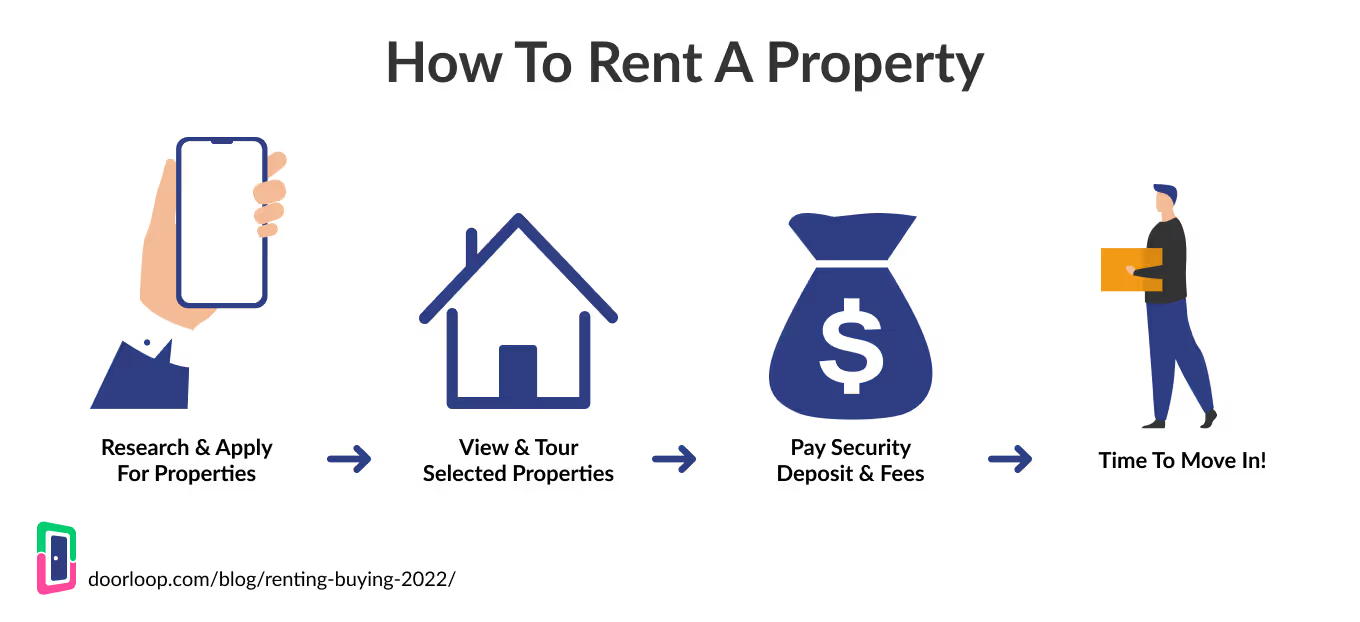

The first benefit of renting a property is that there is increased flexibility. This means that the renter can more easily move away from the property if they please. The only thing holding a renter back from leaving is the lease agreement, which always has an expiration.

However, those who buy property are more tied down to the property. They cannot stop making mortgage payments without their credit score decreasing or their home being foreclosed. Also, for a buyer to move from a property, they have to go through the whole process of selling the property. This process can take months as opposed to simply waiting for a lease to terminate.

Fewer Expenses/Responsibilities

Another great benefit of renting a property is that there are less expenses and responsibilities. As seen above, there are far more expenses associated with buying property than renting. Some of the expenses and responsibilities that buyers have that renters don't include:

- Property Taxes

- HOA and Condo Fees

- Homeowners Insurance

- Maintenance/Repairs

...and so many more. These are just a small number of expenses and responsibilities that homeowners must deal with that renters do not. So, not only will you be spending less money, you will be less stressed about managing the property.

The Cons Of Renting

As with everything, there have to be some drawbacks. Below, we have listed some of the drawbacks of renting a property.

Lack Of Ownership

Although this is not really a tangible drawback, the lack of ownership associated with renting property can be a dealbreaker for some people. It is also the feeling of paying for someone else's property that some people do not want to go through.

This is opposed to paying a mortgage. When you are making mortgage payments, you are essentially buying your property piece-by-piece. Every payment is another piece of the property that is completely yours.

Lack Of Control Over Property

As a result of not having ownership of the property, renters do not get to control it either. This means that, since the property is not yours, you cannot do what you want to it. These restrictions can stop renters from doing things like:

- Painting the walls

- Changing the floor

- Hanging things from the walls

- Replacing furniture

- Getting new appliances

Restrictions like these essentially prohibit the tenant from giving the property a "personal touch".

So, now that we have discussed some of the pros and cons of renting property, let's discuss some of the pros and cons of buying.

Pros Of Buying

Below, we have listed some of the greatest benefits of buying property as opposed to renting.

Complete Control

One of the greatest differences between buying and renting is that buying property gives you complete control of it. This means that the homeowner can do whatever they want to the property because it is completely owned by them.

There is also a greater sense of stability when the property is bought instead of rented. When renting a property, the landlord can decide to sell the property or modify lease terms at any time. But, when the property is bought, the only thing that can take that property away is the bank.

Builds Equity

Another one of the benefits of buying a property instead of renting it is that it can build equity. Ever since 2008, the housing market has been on a steady, upwards trend. This means that homeowners could have earned thousands of dollars from the value of their homes in the past decade.

This, obviously, does not happen when renting. When renting a property, the tenant is essentially helping the landlord build wealth by covering their mortgage payments.

These are some pretty great benefits to buying a property, but what are some of the drawbacks? Let's get right into it.

Cons Of Buying

Just like with renting, there are a number of drawbacks to buying a property. Below, we have listed some of the most significant ones.

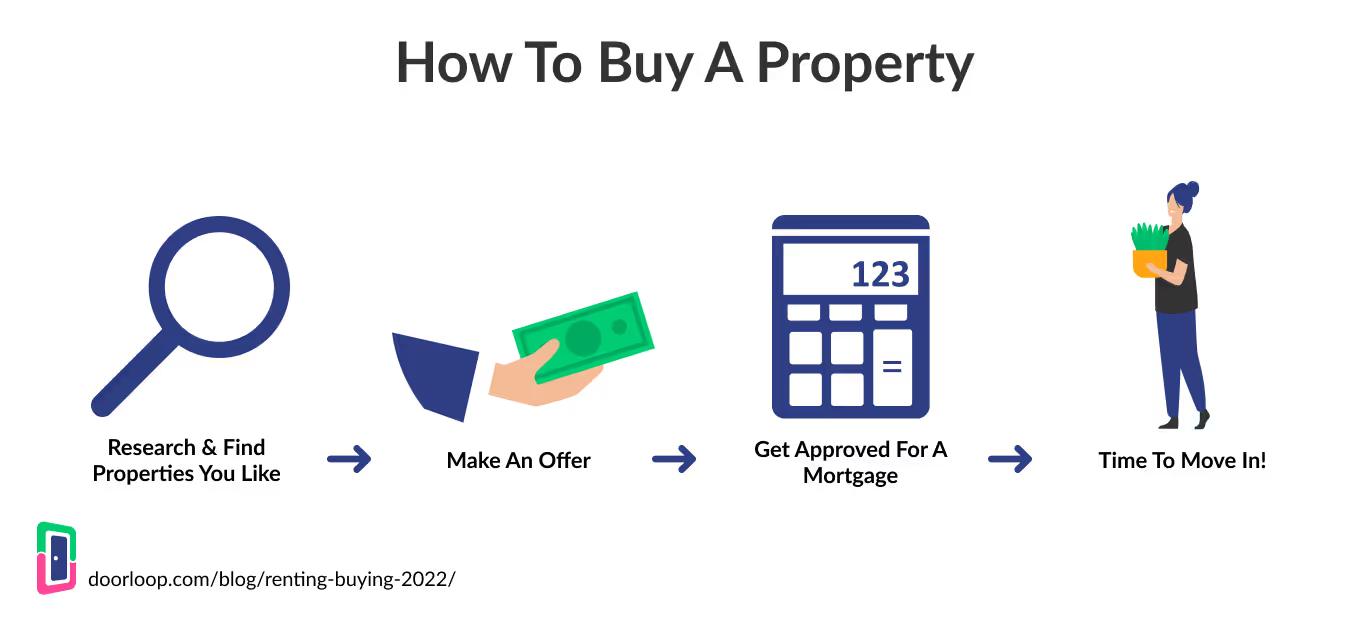

Less Flexibility

Real estate investments are known as illiquid assets. This means that you cannot easily liquidate them, or, sell them. For this reason, owning property gives you less flexibility in your life.

This is especially true for those who move around the country for work. Buying a property would put you in a commitment of 10-30 years unless you decide to sell it. If the owner decides to sell the property, it could take another couple of months to get it sold. During that time, mortgage payments still need to be made and the owner is typically forced to stay with the home for that time.

More Expenses And Responsibilities

One of the most unfortunate drawbacks of owning property is the added expenses and responsibilities. As discussed above, owning a property has way more expenses than renting one. And, on top of that, it places much more responsibility on the owner.

So, not only does the property owner have to pay more, but they also have to remain more stressed about the property than the renters do.

By now, you may have more of an idea about which route you would want to take. If you are still unsure, that's completely natural. It's a big decision!

However, if you are sure about whether you want to rent or buy, we can take a look at some of the best cities for renting and for buying to give you an idea of where renting and buying can take you.

The Best Cities For Renting

If you have your mind set on renting property, consider these two cities where the price of renting property is significantly lower than that of buying a property.

For those of you who want to know about the best cities for real estate in genera, take a look at DoorLoop's Top 12 Real Estate Markets.

New York City, New York

It's no surprise that The Big Apple is one of the best places to rent as opposed to buying. After all, the average price of a home in New York City, specifically Manhattan, is over 1 million dollars. That price tag calls for some pretty hefty mortgage payments.

However, you can get those same skyline views at a fraction of the price by renting. Now, this does not mean that the rent in New York City is cheap... at all. The average rental payments in New York City sit at around 3-5 thousand dollars a month. Again, this is not cheap at all, but it is extremely cheap compared to the monstrous mortgage payments if you buy the property.

San Francisco, California

San Francisco is also a city that sits at the top of the list of most expensive cities in the United States. But, the astronomical home prices make the city a great place for those who want to enjoy these properties at a discount.

Currently, average home prices in San Franciso are sitting at around 7-8 hundred thousand dollars. That will cost you a good deal every month in mortgage, but the rent is far cheaper. These properties rent for an average of 3-5 thousand dollars a month, which is much less than the mortgage for a $750,000 property.

Best Cities For Buying

Now that we have gone over some of the best cities for renting, let's talk about some cities where it is actually better to buy property.

Birmingham, Alabama

When looking at the national median home prices and rents, it is still cheaper to rent a home than to buy one. However, the gap is very small, and getting smaller. One of the cities where it is actually cheaper to buy a home than to rent it is Birmingham, Alabama.

In Birmingham, the cost of buying a starter home is around 44% cheaper than renting it. This means that for people looking to buy property at low prices, Birmingham may be the place to start looking.

Oklahoma City, Oklahoma

Another city that is great for buying property is Oklahoma City. In Oklahoma City, the median monthly mortgage payment, including property taxes, is around $750. This is about 28.6% cheaper than the price of the monthly rent, which is around $1,051.

Conclusion

In conclusion, the only person who can answer the question of renting vs. buying is you. There are so many factors that go into making the decision that it is impossible to declare one better than the other. That is why it's vital that you do as much research as possible to find the best deal for you, whether it be renting or buying.

.svg)

.svg)