Research Summary: California boasts one of the largest residential real estate markets in the United States, which has managed to thrive despite the turbulence experienced by the housing industry last year. The state's attractive climate, renowned landmarks, breathtaking natural surroundings, and strong economy contribute to the consistently high demand for housing. For insights on how California's real estate market is progressing, check out our research.

Key takeaways:

- Over the past 12 months, the California real estate market has witnessed the sale of 435,448 residential homes.

- In April 2023, California witnessed a decrease of 8.8% in home prices compared to the previous year.

- In May 2023, the median rent in California was $2,950, a drop of $50 from May last year.

- By March 2022, there were nearly 9,200 active listings of luxury homes in California, all of which had an initial listing price exceeding $1 million.

- In April 2023, homes for sale dropped 17.7% year-over-year to 70,639.

- Approximately 90% of Californians perceive housing affordability as a problem in the state.

- As of April 2023, the median sold price of single-family homes in the Los Angeles Metropolitan Area stood at $740,000.

- The sales forecast for existing, single-family homes may only reach 333,450.

For easier access, we broke down the data in the following ways:

Prices and Sales | Housing Market | Rental Market | Luxury Real Estate | Demand and Supply | Homebuyers | Regional Trends | Housing Market Forecast

Prices and Sales

California, known for its iconic cities, stunning beaches, and pleasant weather, has become a dream destination for many people. However, the state's high property values pose a significant challenge to affordability, hindering the realization of that dream for many. Real estate prices and sales in California are influenced by various factors, including economic recessions and unfortunate events that affect potential buyers. Let's explore below how the state's prices and sales have performed in recent years and beyond.

- Over the past 12 months, the California real estate market has witnessed the sale of 435,448 residential homes.

Among the cities in the state, San Jose and San Francisco stand out as the fastest-selling across the entire United States. With a total of 10,010,151 residential properties, California offers a substantial housing inventory. As of March 2023, the median sales price in the state reached $675,000.

- In Q4 of 2022, the share of households in California with the financial means to purchase a median-priced condo or townhouse experienced a sharp decline of 26%.

This represents a significant drop from the 36% recorded in the same period the previous year.

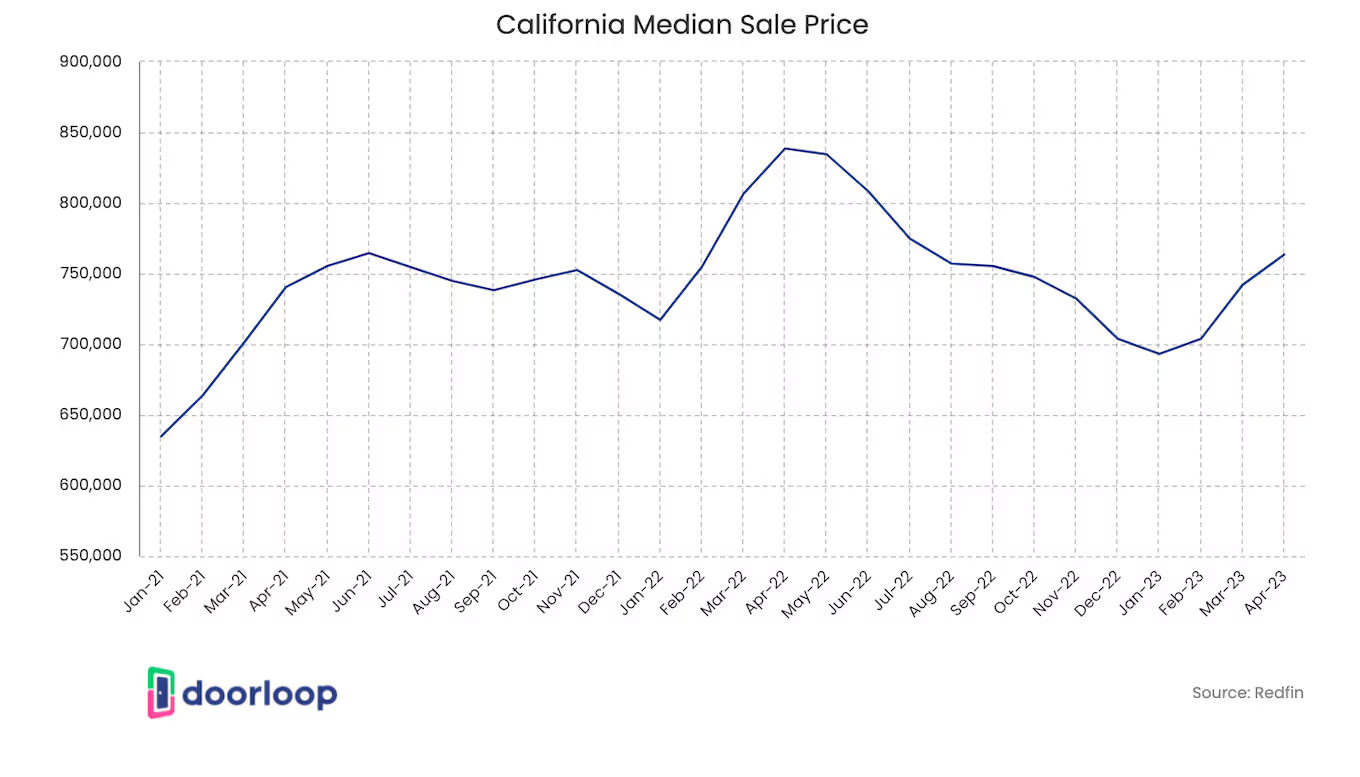

- In March 2023, California’s median home price was $791,490, down 7.0% year-over-year.

It was a 7.0% drop from the revised $851,130 median home price reported in March 2022. Further, there was a decline of 37.8% in the year-to-date statewide home sales.

- As of May 2023, the median home price for single-family homes in the state was recorded at $670,000.

Currently, there are 3,159 properties in foreclosure and 214 properties owned by real estate banks (REOs). Over the past 12 months, the median value of single-family homes reached $755,200.

- In March 2022, over one-third of active listings in California had a listing price exceeding $1 million.

This statistic underscores California's reputation for hosting some of the world's most expensive housing markets. The scarcity of housing supply is one of the contributing factors to the elevated property costs across the state.

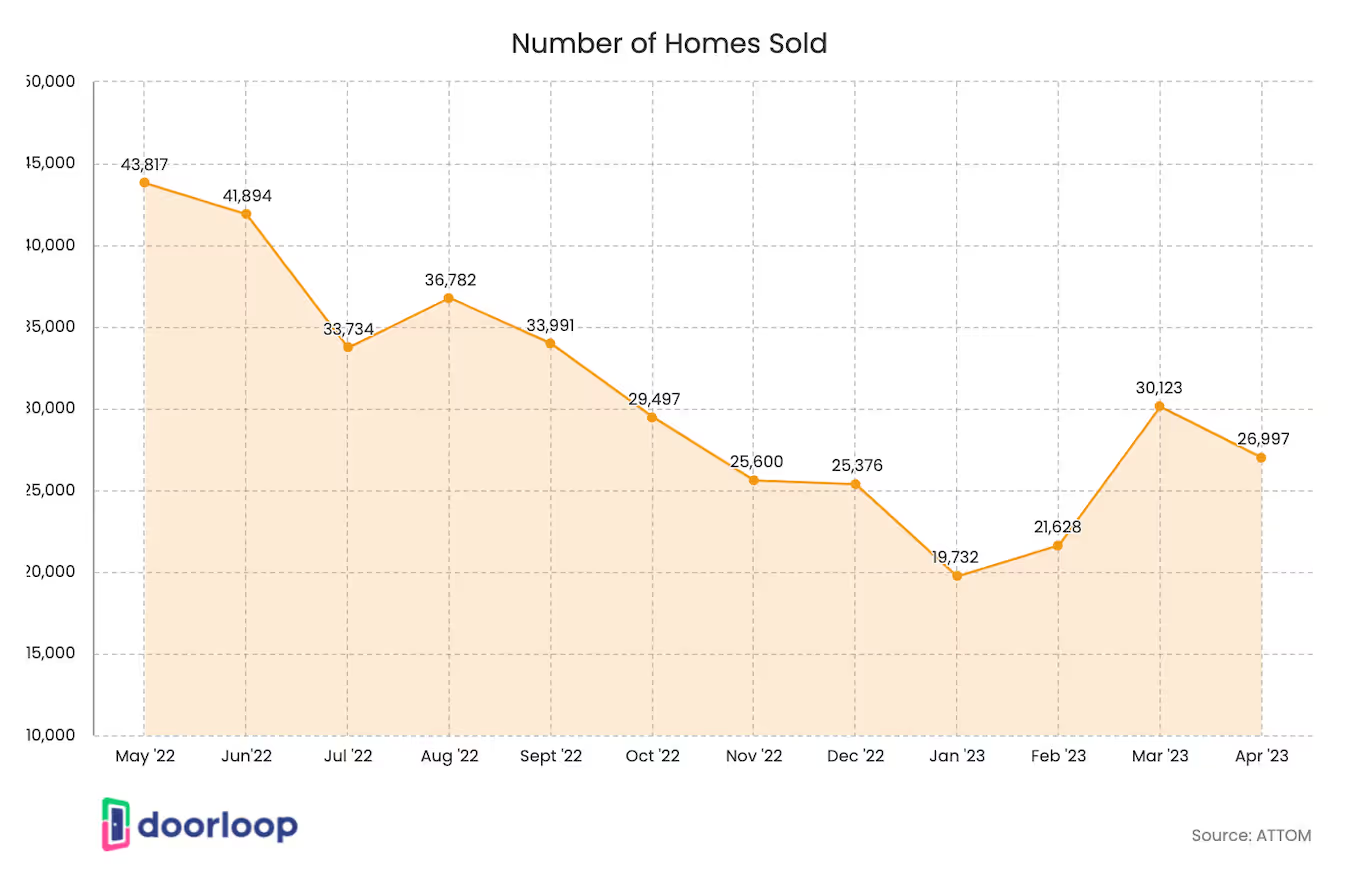

- In September 2022, the number of homes sold saw a 37.5% decline.

Additionally, there was a 0.5% year-over-year increase in the median sale price. The length of time homes remained on the market correlates to how difficult it is for buyers to obtain affordable housing.

- In November 2022, the state had a seasonally adjusted rate of 237,740 existing single-family home sales.

These existing, single-family home sales were a 47.7% drop from November 2021. Still, in November 2022, the statewide median home price in California was $777,500, a 0.6% decrease from the same month of the previous year.

- In April 2023, there were a total of 267,880 existing single-family home sales on a seasonally adjusted annualized rate.

This represented a decrease of 36.1% compared to April of the previous year. Despite this decline, the year-to-date statewide home sales in April saw a more significant drop of 37.4%. The median home price in the state for April was $815,340, showing a 7.8% increase compared to the same month in the previous year.

Single-family home prices by region

<table><tr><th>State/Region/County</th><th>April 2023</th><th>April 2022</th><th>Price YTY% Chg</th><th>Sales YTY% Chg</th></tr><tr><td>Calif. Single-family home</td><td>$815,340</td><td>$884,680</td<td>-7.80%</td><td>-36.10%</td></tr><tr><td>Calif. Condo/Townhome</td><td>$635,000</td><td>$699,000</td><td>-9.20%</td><td>-38.60%</td></tr><tr><td>Los Angeles Metro Area</td><td>$740,000</td><td>$800,000</td><td>-7.50%</td><td>-37.50%</td></tr><tr><td>Central Coast</td><td>$1,020,000</td><td>$1,050,000</td><td>-2.90%</td><td>-42.80%</td></tr><tr><td>Central Valley</td><td>$460,000</td><td>$500,000</td><td>-8.00%</td><td>-36.70%</td></tr><tr><td>Far North</td><td>$385,000</td><td>$400,000</td><td>-3.80%</td><td>-41.80%</td></tr><tr><td>Inland Empire</td><td>$565,000</td><td>$580,000</td><td>-2.60%</td><td>-36.30%</td></tr><tr><td>San Francisco Bay Area</td><td>$1,250,000</td><td>$1,500,000</td><td>-16.70%</td><td>-38.50%</td></tr><tr><td>Southern California</td><td>$785,000</td><td>$837,000</td><td>-6.20%</td><td>-37.40%</td></tr></table>

Housing Market

While California's robust economy is often credited as a contributing factor to the ongoing success of its real estate market, it is not the sole determinant of the remarkable surge in property values compared to other states. Nevertheless, there have been recent obstacles hindering its growth, as various factors interact and sometimes counteract each other, resulting in fluctuations and downward pressures on property valuations in all major residential regions of the state. To gain a better understanding of California's real estate market, here are some insights from our research.

- In April 2023, California witnessed a decrease of 8.8% in home prices compared to the previous year.

The median price for the area was $764,100, and the number of sold housing units decreased by an average of 38.8% year-over-year. However, in April of this year, there were 21,580 residential units sold, which is a significant decline from the 35,282 units sold last year.

- In April 2023, home prices in Diamond Bar, California experienced a significant increase of 20.8% compared to the previous year.

The median price for homes in the area reached $1.0 million, and the average duration of time it took for homes to sell in the market rose to 51 days, up from 20 days the previous year. However, despite these changes, only 37 homes were sold in April this year, which represents a decline from the 46 homes sold in the previous year.

Metros with the Fastest Growing Sales Price

<table><thead><tr><th>Area</th><th>YoY Growth Rate</th><th>Median Sales Price</th></tr></thead><tbody><tr><td>Diamond Bar, CA</td><td>20.80%</td><td>$1,000,000</td></tr><tr><td>Sunnyvale, CA</td><td>6.80%</td><td>$1,950,000</td></tr><tr><td>Upland, CA</td><td>7.50%</td><td>$785,000</td></tr><tr><td>Redondo Beach, CA</td><td>7.50%</td><td>$1,532,000</td></tr><tr><td>Redding, CA</td><td>6.50%</td><td>$410,000</td></tr><tr><td>San Clemente, CA</td><td>6.60%</td><td>$1,855,000</td></tr><tr><td>Indio, CA</td><td>3.20%</td><td>$567,500</td></tr><tr><td>Rancho Mirage, CA</td><td>3.70%</td><td>$954,500</td></tr><tr><td>Hemet, CA</td><td>3.20%</td><td>$438,500</td></tr><tr><td>Tulare, CA</td><td>3.00%</td><td>$345,000</td></tr></tbody></table>

- In March 2023, sales dropped in 35 counties by more than 30% year-over-year.

Of the 51 counties, all but one were found to have a decline in sales compared to last year. Sales also plummeted by over 50% compared to last March in five counties.

Rental Market

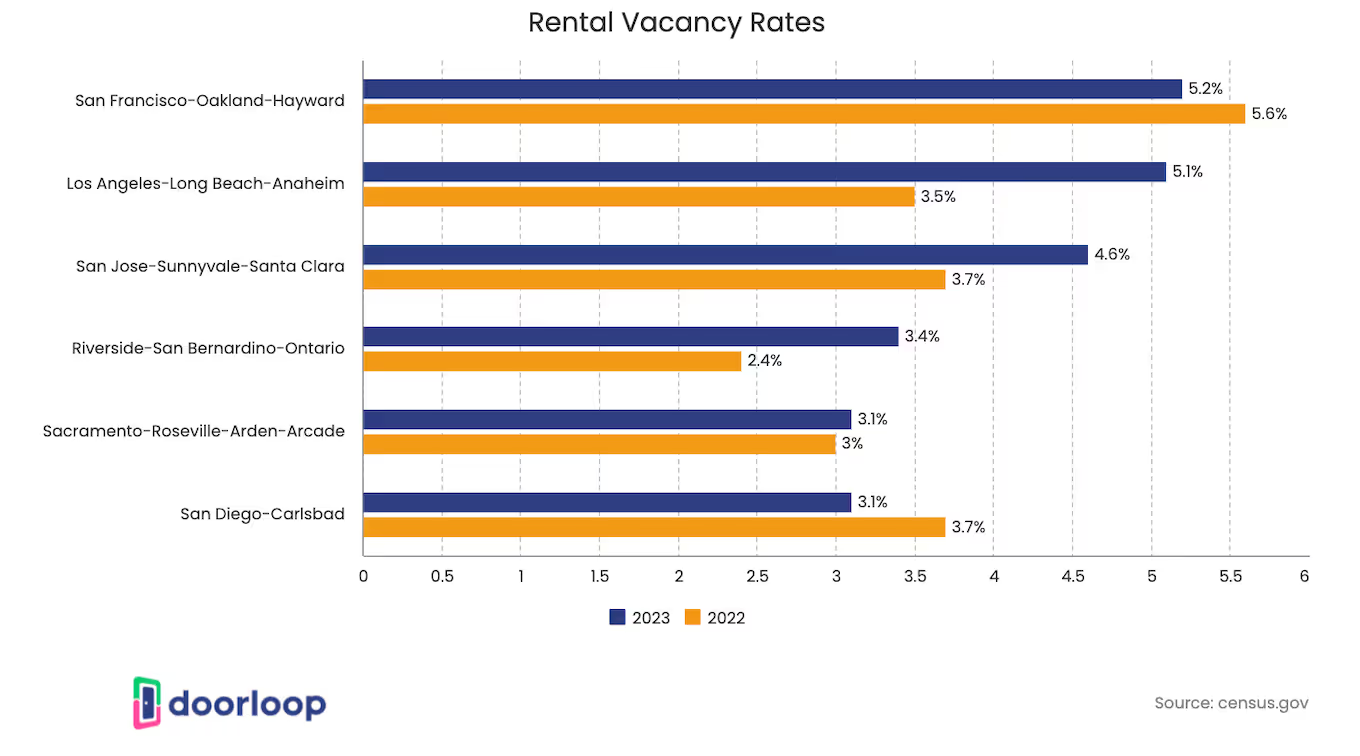

Generally, the various factors that influence high real estate rental costs include inflation, a shifting workforce, a shortage of vacant rental properties, homeownership barriers, and an increasing demand for renters to live alone. However, in California, the rental scenario is different from that of many other states. One reason is that it is expensive to live in the state, and in turn, Californians, in comparison to their income, spend the highest rents in the country. Let’s show you some figures to see the different angles of the California real estate market:

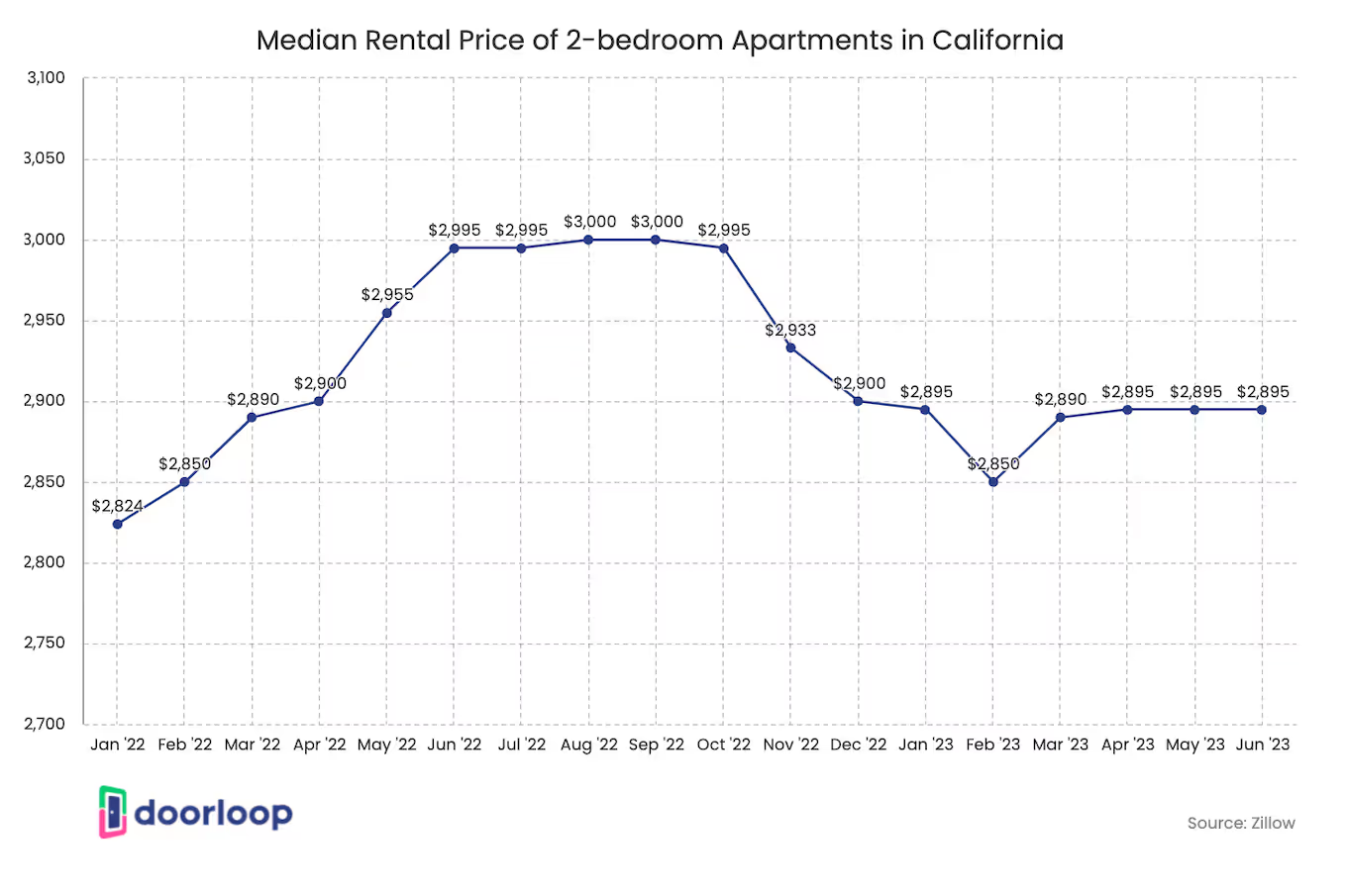

- In May 2023, the median rent in California was $2,950, a drop of $50 from May last year.

May 2023’s median rent of $2,950 was $4 more than April 2023, and $784 more than the national median. Further, there are currently 56,110 rentals available in the state.

- California’s average renter spends $2,151 for a one-bedroom apartment and $2,567 for a two-bedroom (Source: Apartments.com)

As of January 2025, the average monthly rent in California is approximately $1,826 for studio apartments, $2,151 for one-bedroom units, $2,567 for two-bedrooms and $3,248 for three-bedrooms.

However, rents vary significantly across regions. The Bay Area for example stands out as one of the most expensive markets where the median rent reaches $3,200 which is about 60% above the national median ($2,000), reflecting the area's higher demand and cost of living compared to other parts of the United States.

- In 2022, the highest fair market rent for a two-bedroom accommodation in San Francisco reached $3,198.

This made San Francisco the most expensive metropolitan area to live in California during that year. Additionally, in order for renters to afford a two-bedroom housing unit, the minimum hourly wage requirement was $61.5.

- In 2022, the average monthly rent for a two-bedroom apartment in California was $2,028.

This indicates that the rental cost is not affordable for renters with a 30% area median income or those who have full-time jobs earning the mean renter wage. It is important to note that California's rental prices for two-bedroom apartments rank as the second highest among all other states in the United States.

- The year-over-year rent stood at 1.7% in 2023, the lowest of its levels since March 2021.

Starting from 2021, the year-over-year rent growth has been slowing down. In April, the national rent index experienced a modest increase of 0.5%, while the vacancy index reached 6.8%, indicating an ongoing upward trend.

Luxury Real Estate

California luxury real estate is characterized by top-of-the-line amenities, prime locations such as hilltop estates offering breathtaking views, and stunning homes equipped with lavish and technologically-advanced features. These properties provide unparalleled lifestyle experiences. However, along with these highly desirable and prestigious features, comes a significant price tag. This price encompasses the costs of acquiring the property as well as its ongoing maintenance. Some statistical facts below could shed light on what goes on behind the glimmers of California luxury real estate:

- By March 2022, there were nearly 9,200 active listings of luxury homes in California, all of which had an initial listing price exceeding $1 million.

During the second quarter of 2021, the number of luxury home sales in California reached its highest point, surpassing 30,000. However, in the third quarter of the same year, the number of luxury home sales dropped to approximately 19,000. In the fourth quarter of 2021, around 19,000 home sales in California exceeded the $1 million mark.

- The highest-priced home sale in California this year reached a staggering $55 million.

This remarkable sale involved an extravagant mega-mansion situated in the prestigious Beverly Park neighborhood, renowned for its luxurious residences and upscale offerings. The purchase of this property stands as the most expensive home transaction in the entire state of California, demonstrating the immense wealth and opulence among certain residents. - As of April 2023, the number of newly listed luxury single-family homes in California amounted to 17,713.

During this period, a total of 14,483 luxury homes were sold, with a median sale price of $1,325,000. The sales ratio, which represents the percentage of homes sold compared to the total number of listings, stood at 29.73%. On average, properties remained on the market for 17 days before being sold.

- As of April 2023, luxury single-family homes in California were selling at an average of 99.11% of the listed price.

Additionally, there was a median luxury threshold price of $950,000 while the median sales price for luxury homes remained at $1,325,000.

- In January 2023, there was a significant decline in high-end home sales in San Diego, with a year-over-year decrease of 58.5%.

Similarly, other regions in California also experienced declines in high-end home sales during the same period. San Jose saw a decline of 59.0%, Riverside experienced a drop of 59.8%, and Anaheim had a decrease of 59.3% year-over-year.

It is worth noting that coastal markets in California, known for their luxury properties, have been particularly affected, witnessing some of the largest drops in high-end home sales.

- As of the first quarter of 2023, the luxury real estate market in California had a median price per square foot (PSF) of $1,298.

During the same period, the lowest price per square foot recorded in the luxury real estate market in California was $183. On the other end of the spectrum, the highest price per square foot reached an impressive $6,631.

Demand and Supply

California has long been known for its high demand for housing and low inventory. And with millennials and retirees being indubitably drawn to the state’s warm climate, property values increase from the limited supply of housing. This scenario has made having a home in California unaffordable to many. To look deeper into California’s housing demand and supply, check out the findings of our research:

- In April 2023, homes for sale dropped 17.7% year-over-year to 70,639.

With regards to newly listed homes, there were 26,836 newly listed properties in April 2023, representing a substantial decrease of 38.3% compared to the previous year. The average months of supply remained relatively stable at 2 months, showing no change compared to the previous year.

It is worth noting that across the entire United States, there were a total of 72,289 residential homes available for sale.

- In March 2022, the median sales price in the San Francisco Bay Area surpassed 12.2% of the initial listing price of a single-family home.

Condo buyers also faced steep prices, spending an average of 7% above the list price. These increases were a result of the robust demand for California properties, which also led to significant price spikes for single-family homes across the state.

- In March 2023, the median home price increased to $791,490.

This healthy increase happened for the first time in seven months. It only shows that the demand for housing in California has remained steadfast, with quicker home sales and enhanced sales-to-list price ratios.

- In April 2023, the average number of homes sold in California experienced a significant year-over-year drop of 38.8%.

This amounts to a total of 21,580 homes sold, marking a decrease from the 35,282 homes sold in April 2022. Additionally, home prices in California declined by 8.8% compared to the previous year, with a median selling price of $764,100.

- As of March 2023, there was a significant decline in unsold inventory in the Bay Area, reaching an extremely low level of 1.6 months supply.

Similarly, the Central Valley also experienced a notable drop in unsold inventory, with the supply decreasing to 2.0 months compared to the same period the previous year.

Homebuyers

The competitive real estate market in California is influenced by various factors, including changes in homebuyers' housing preferences, which were significantly impacted by the pandemic. Affordability is also a major consideration for homebuyers, with many finding it difficult to afford a home in the lavish golden state. To gain insights into homebuyers in California, consider the following statistics:

- Approximately 90% of Californians perceive housing affordability as a problem in the state.

Furthermore, 43% of individuals residing in California have contemplated leaving the state due to concerns regarding housing affordability.

- The percentage of realtors who anticipate sales growth in the foreseeable future has decreased to 54.2%.

This represents a notable drop from the previous week's survey, which reported a higher percentage of 60.9%. Conversely, there has been an increase in the number of realtors who expect prices to rise, with 27.4% expressing this sentiment. This figure has seen an 8.2% increase compared to the previous week's survey results.

- As of April 2023, only about 25% of consumers believed that it was a good time to buy a home, which is consistent with survey responses from the previous year.

However, approximately 59% of respondents deemed it a good time to sell, which is a 4% increase from the previous year's response of 55%.

- Over two of five Realtors, or 43.6%, witnessed a change in buyers’ preferences when it came to property type.

Further, 39% of them revealed buyers opted for a bigger home. Other changes include preferred options for a property with more rooms. Buyers also tended to be less concerned with the commute time to work.

- Around 25% of buyers reported that their decision to purchase a property was driven by their dissatisfaction with renting.

Moreover, 19% of buyers mentioned that their choice to buy a property was motivated by a desire to reside in a better residential area. Many first-time buyers found purchasing a home more practical and advantageous compared to continuing to rent.

- In Q3 2022, 18% of households in California could afford a median-priced home worth $829,760.

This was a 24% decline from the third quarter of the previous year. The minimum income required to make monthly payments of $4,820 amounted to $192,800 annually.

- Approximately 27% of home buyers in California were able to purchase a condo or townhome with a median price of $630,000.

To afford a monthly payment of $3,660, which is typical for a home at that price range, homebuyers needed to have an annual income of at least $146,400.

Regional Trends

There have been transformations and evolution encapsulating the California real estate industry, and with these changes came the variation per region in the real estate trends of the state. These may include low inventory, skyrocketing home costs, and soaring property demands. To stay informed about the regional trends in California, here are some of the statistics as of April 2023.

- As of April 2023, the median sold price of single-family homes in the Los Angeles Metropolitan Area stood at $740,000.

The amount was a decline from the $$800,000 median sold price in April of the previous year. From April 2023 to the same month of 2022, the area’s price per square foot went from $424 to $461. Its median time of stay on the market dropped from 25 days to 13 days.

- In April 2023, the Central Coast region had a price per square foot (PSF) of $563 for existing single-family homes.

This represents a decrease compared to the April 2022 price PSF, which was $589. Additionally, the median sold price for existing single-family homes in the Central Coast declined from $1,050,000 in April of the previous year to $1,020,000 in April of this year.

- In April 2023, existing single-family homes in the Far North region had a median time on the market of 3.0 days.

This represents an increase compared to the 15.0 days they spent on the market in April 2022. Furthermore, the median sold price of homes in the Far North area decreased to $385,000 in April 2023, down from the median sold price of $400,000 recorded in April 2022.

- In April 2023, the median sold price of existing single-family homes in the Central Valley region was $460,000.

This indicates a decrease compared to the median sold price of $500,000 recorded in April of the previous year. The median time these homes spent on the market in April 2023 increased to 19.0 days, a notable jump from the 8 days of market time observed in April 2022. Additionally, the price per square foot (PSF) in the Central Valley fell to $272 in April 2023, down from $295 in April 2022.

- In the Inland Empire, the price per square foot of single-family homes was $301 in April 2023.

In the previous year, the region had a price PSF of $320. The median sold price of existing condos and townhomes in April 2023 was $565,000, a drop from $580,000 in April 2022. Properties stayed on the market for 32 days, a decline from the 15 days of median time on the market in 2022.

- As of April 2023, the median listing home price in Oakland stood at $786,500.

This represents no change compared to the previous year, indicating a flat year-over-year trend in listing prices. In terms of price per square foot, the median listing home price in Oakland was $581. The median home sold price in Oakland was $857,500. Furthermore, homes in Oakland were typically sold for 3.88% above the asking price.

- In April 2023, the home prices in Fresno were up 0.1% compared to last year.

With a median price of $391,000, all homes in Fresno sell after an average of 23 days of stay on the market. It is worth mentioning that last April, it was 8 days. Compared to the 459 homes sold last year, April 2023 only had 324 home sales.

- In April 2023, home prices in Santa Clarita experienced a decline of 5.4% compared to the previous year.

The median price for homes in Santa Clarita was $735,000. Homes in Santa Clarita typically stayed on the market for 37 days before being sold. Further, a total of 179 homes were sold in Santa Clarita, which signifies a decrease compared to the 293 houses sold in the same month the previous year.

- Home prices in Fontana experienced a decline of 7.8% in April 2023 compared to the previous year.

The median price for homes in Fontana was $590,000. Homes in Fontana typically stayed on the market for an average of 40 days before being sold. Further, a total of 87 homes were sold, which signifies a decrease compared to the 133 homes sold in the same month the previous year.

- In April 2023, the Los Angeles Metropolitan area’s median sold price of existing condos and townhomes reached $605,000.

This was a decline from April 2022’s median sold price of $635,000. Its median time on the market was 25 days, a jump from 12 days in April 2022. Its price PSF fell to $500 from $514 last April.

- In the Central Coast, the price per square foot of existing condos and townhomes was $642 in April 2023.

In the previous year, the region had a price PSF of $623. Its median sold price of existing condos and townhomes in April 2023 was $740,000, a drop from $790,000 in April 2022. Properties stayed on the market for 11 days - a decline from the 8.5 days of median time on the market in the previous year.

- The median time existing condos and townhomes stayed on the market in Central Valley in April 2023 was 15.0 days.

This was an increase in the previous year’s 8.5 days existing condos and townhomes stayed on the market. The area’s median sold price was $301,000, a drop from April 2022’s $325,480 median sold price.

- The Far North’s median sold price of existing condos and townhomes in April 2023 was $265,000, a drop from $277,500 in April 2022.

Existing condos and townhomes stayed on the market before being sold for 49.5 days, a significant increase from the previous year’s 11.5 days. Its price per square foot also declined to $203 from April 2022’s price PSF of $222.

- The median sold price of existing condos and townhomes in the Inland Empire as of April 2023 was $490,000.

The amount was a drop from the $500,000 median sold price in April of the previous year. From April 2023 to the same month of 2022, the area’s price per square foot fell from $338 to $353. Its median time of stay on the market dropped from 39.5 days to 19.0 days.

- In April 2023, the San Francisco Bay Area had a price per square foot (PSF) of $676 for existing condos and townhomes. This represents a decrease from the PSF of $765 recorded in April 2022.

Furthermore, the median sold price for condos and townhomes in the San Francisco Bay Area declined to $780,500 in April of the current year. This marks a decrease from the median sold price of $942,000 in the same month of the previous year.

- In South California, the median sold price of existing condos and townhomes in April 2023 was $615,000.

This year’s median sold price was a drop from April 2022’s $640,000. The area’s price PSF also fell to $516 from $536. Existing condos and townhomes stayed on the market for 20 days - a decline from the 10 days of median time on the market in April 2022.

- In April 2023, San Mateo in the San Francisco Bay Area had the highest median sold price for existing single-family homes in all of California, reaching $1,970,000.

However, it's important to note that this median sold price represented a decrease from the figure of $2,401,000 recorded in April 2022. The median time these homes spent on the market in April 2023 was 11 days, which indicates an increase compared to the 8 days observed in the previous year.

- Lassen Far North had the lowest median sold price of $252,950 in existing single-family homes as of April 2023 in all of California.

In April 2022, the area had a median sold price of $245,000.existing single-family homes stayed on the market for 43 days - a significant drop from April 2022's 70 days of stay on the market.

Housing Market Forecast 2024

While the California real estate market has soared high in the past years, it appears that due to certain factors, its prices and demands may plummet throughout 2024. Inflation, increased costs of construction products and services, and plummeting property inventory levels are the driving forces of increasing prices, which impacts affordability and eventually demand. It is also worth mentioning that however the California real estate industry goes in 2024, it may depend on the housing market in every region. See the statistics below:

- The sales forecast for existing, single-family homes may only reach 333,450.

In 2022, there was a projected pace of 359,220 in existing, single-family home sales, and this prediction for 2024 is apparently a drop of 7.2% from that projection. It was also 19.2% lower than the 444,520 home sales in 2021.

- When it comes to the median home price, it is projected to drop by 8.8%.

This means that the median home price will potentially spiral down to $758,600. It is worth mentioning that in 2022, there was a projected 5.7% increase to $831,460 from $786,700 in 2021.

- From the projected 19% in 2022, housing affordability is expected to decline to 18% in 2024.

This may be potentially influenced by the state’s unemployment rate projected to reach up to 4.7% from 2022’s 4.4%, potentially reducing buying power.

- In 2024, it is projected that existing, single-family home sales would amount to a total 33,450 units.

This forecast was a 7.2% drop from 2022’s forecasted pace of 359,220.

- A forecast for 2024 suggests that California’s median home price would have an 8.8% drop to $758,600.

In 2022, there was a projected 5.7% increase in California’s median home price to $831,460. From the projected 19% drop in housing affordability in 2022, it is expected that the decline would only be 18% in 2024.

Conclusion

Over the past few years, the California real estate market has been doing quite well despite the volatile changes in the housing industry. Experts have predicted that the market will become more balanced, giving buyers more negotiating power. However, these predictions do not guarantee that home prices will decrease this year due to the ongoing changes in the housing market.

It is worth noting that some buyers who purchased properties during the pandemic may experience a little bit of remorse, realizing that they not only overpaid but also have neither equity nor own a property they really want.

Interest rates are expected to skyrocket throughout the year, causing prices to drop slightly. This could potentially boost sales, but it is unlikely to alleviate inventory issues. By the end of the year, interest rates may drop, and buyers may become more selective, opting for high-quality homes despite the higher rates. The sales volume for 2024 will likely be influenced by the severity of the price decline in 2023.

FAQS

Are home prices dropping in California?

In Q1 2023, there was a decline in home prices that led to an increase in affordability levels. During this period, housing affordability in California has peaked compared to the previous quarters.

Is the California real estate market cooling down?

The California real estate market has a history of volatility, with periods of high demand and rising prices, as well as slower periods. Recently, limited supply and high demand have caused home prices to increase, but there are signs that the market may be cooling down.

Are housing prices rising in California?

Based on Q1 2023 data, housing prices in California are rather dropping than increasing. However, some projections suggest that home price changes may fall in the second quarter and may also vary according to different regions and cities as well as factors like fluctuations, interest rates, and economic conditions.

Where home prices are rising the fastest in California?

Home prices are rising the fastest in the San Francisco Bay Area. For existing single-family homes, its median sold price increased to $1,228,000 in March this year from $1,050,000 in the previous month. Next to the San Francisco Bay Area is Central Coast with a median sold price as of March 2023 of $922,500, and then followed by Los Angeles Metro which had $735,000 in March 2023.

How many Californians can afford a home?

In the first quarter of 2023, 20% of California households could afford a median-priced home amounting to $760.260. Affordability may vary according to area, but compared to the national average of 40%, California's housing market appears to be less affordable, with an index of 20%.

Is rent going down in California?

Throughout its history, California has consistently ranked among the states with the highest rental prices, particularly in major cities like San Francisco, Los Angeles, and San Diego. However, the rental market in California has undergone some changes due to the COVID-19 pandemic. Some areas have seen a decrease in rent prices due to a reduction in demand and an increase in vacant properties. It is important to note that California's median rent of $2,950 is $800 higher than the national median. Every year, California experiences around a 2% increase in rental prices, and experts suggest that this trend will continue into 2023. In Southern California, the average rent price for a one-bedroom apartment is 18% higher compared to last year.

What is the rent cap law in California?

California's AB 1482, also known as the Tenant Protection Act of 2019, sets statewide regulations limiting rent increases on certain types of rental properties. The law, effective since January 1, 2020, applies to properties at least 15 years old not exempt from the law, capping rent increases at 5% plus the local inflation rate (typically around 2-3%) per year for increases taking effect on or after March 15, 2019. Landlords must provide tenants a written notice of any rent increase at least 30 days before it takes effect.

What is California doing about rent control?

California has taken steps to address affordable housing by passing rent control laws such as the Tenant Protection Act of 2019 (AB 1482). AB 1482 established a statewide rent cap and just-cause eviction protections for tenants, limiting annual rent increases to 5% plus local inflation for rental units at least 15 years old, with exemptions for newer units and some government-subsidized housing. AB 1482 also prohibits landlords from evicting tenants without just cause. Several California cities have also implemented their own rent control measures.

What is the most unaffordable city in California?

Los Altos, California's median household income of $250,000 makes it the wealthiest city in the state. However, this financial prosperity comes at a cost, as Los Altos is also considered the least affordable city in California due to its high housing prices. The average home price in Los Altos is $4.7 million, which is out of reach for most people.

What is the highest rent increase allowed in California?

In California, landlords can increase rent without a specific limit, except for properties covered by rent control or rent stabilization ordinances. However, the Tenant Protection Act of 2019 (AB 1482) established a statewide rent cap that limits annual rent increases for properties at least 15 years old and is not exempt from the law to 5% plus local inflation. This cap applies to rent increases taking effect on or after March 15, 2019, and landlords must provide tenants a written notice of any rent increase at least 30 days before it takes effect.

Who is exempt from California rent control?

Certain types of rental properties in California are exempt from statewide rent control regulations established by AB 1482. These exemptions include:

New construction: Rental properties with a certificate of occupancy issued within the last 15 years.

Single-family homes: Owned by individuals, not corporations or REITs.

Duplexes: Owner-occupied with one unit occupied by a tenant.

Government-subsidized housing: Subject to certain government restrictions, such as financing or subsidies from federal, state, or local government programs.

Sources

- attomdata.com

- car.org

- redfin.com

- statista.com

- redfin.com

- worldpopulationreview.com

- apartmentlist.com

- luxuryhomemarketing.com

- luxuryhomemarketing.com

- realtor.co

.svg)

.svg)

.svg)