As a landlord or property manager, your tenants are probably the most important aspect of your rental property.

So, naturally, landlords seek out tenants with a solid financial responsibility and rental history.

However, sometimes tenants do not completely meet all of the requirements, which is when they may consider a co-signer.

Understanding what co-signers are and what they do is extremely important. So, in this article, we will be going over co-signers, including how to handle them and if you should even accept them.

To begin, let's go over what a co-signer is and what they do for the tenant.

What Is A Co-Signer?

A co-signer is someone who signs the lease along with the main tenant of the rental property.

This means that they take on part of the financial obligations that come with the apartment. This includes the responsibility to pay rent and follow the lease agreement closely.

In the eyes of a property manager or landlord, a co-signer acts as an extra level of security to ensure that the monthly rent payments are made on time and in their full amount. However, with this added responsibility, co-signers also gain the right to live in the rental property.

So, if the tenant is giving up part of the property to allow the co-signer to live there, why would they get one in the first place?

Below, we'll discuss some of the common reasons that a co-signer will appear in a home or apartment lease.

Why Do Tenants Bring On A Co-Signer?

One of the main reasons why a tenant will bring on a co-signer is because they do not meet the requirements of the rental property. This could be for many reasons, including:

- Little to no rental history

- Rough credit history

- Low or average credit score

- Incomplete security deposit

…or anything else that may not match the requirements on the rental application.

In these cases, the cosigner's credit score or rental property history can help the tenant score their dream apartment or begin their credit building journey. Thus, the co-signer is typically a close friend or a family member that is willing to share the financial responsibility of the rental property.

To some, this may sound similar to a guarantor, but they are actually pretty different. Below, we'll go over some of the main differences between a co-signer and a guarantor.

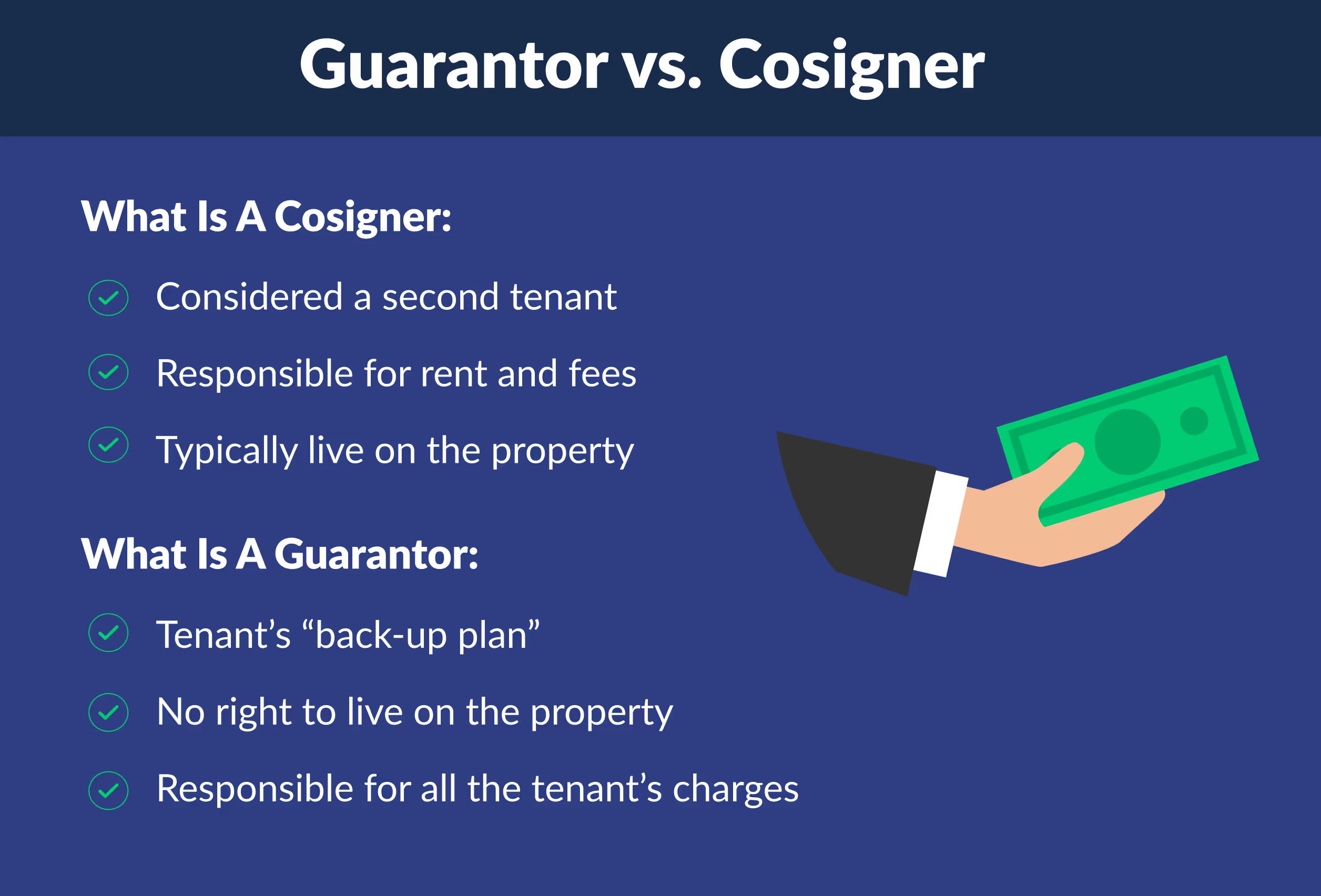

Co-Signer vs. Guarantor

A guarantor, similar to a cosigner, is an individual who does take on the responsibility of the monthly rent if the tenant is unable to.

The main difference, however, is that the guarantor is not considered a tenant and is therefore not allowed on the property.

Thus, the guarantor ends up serving as a back-up plan for landlords and property managers in the case that the tenant stops paying rent. The guarantor will also be responsible if the tenant fails to pay for any other fees or charges from the rental property.

So, now that we know what a co-signer is and what they do, you, as a landlord, may be asking yourself:

Should I accept tenants with a co-signer on the lease?

Luckily for you, we will be going over all of the pros and cons of having a co-signer in the next section.

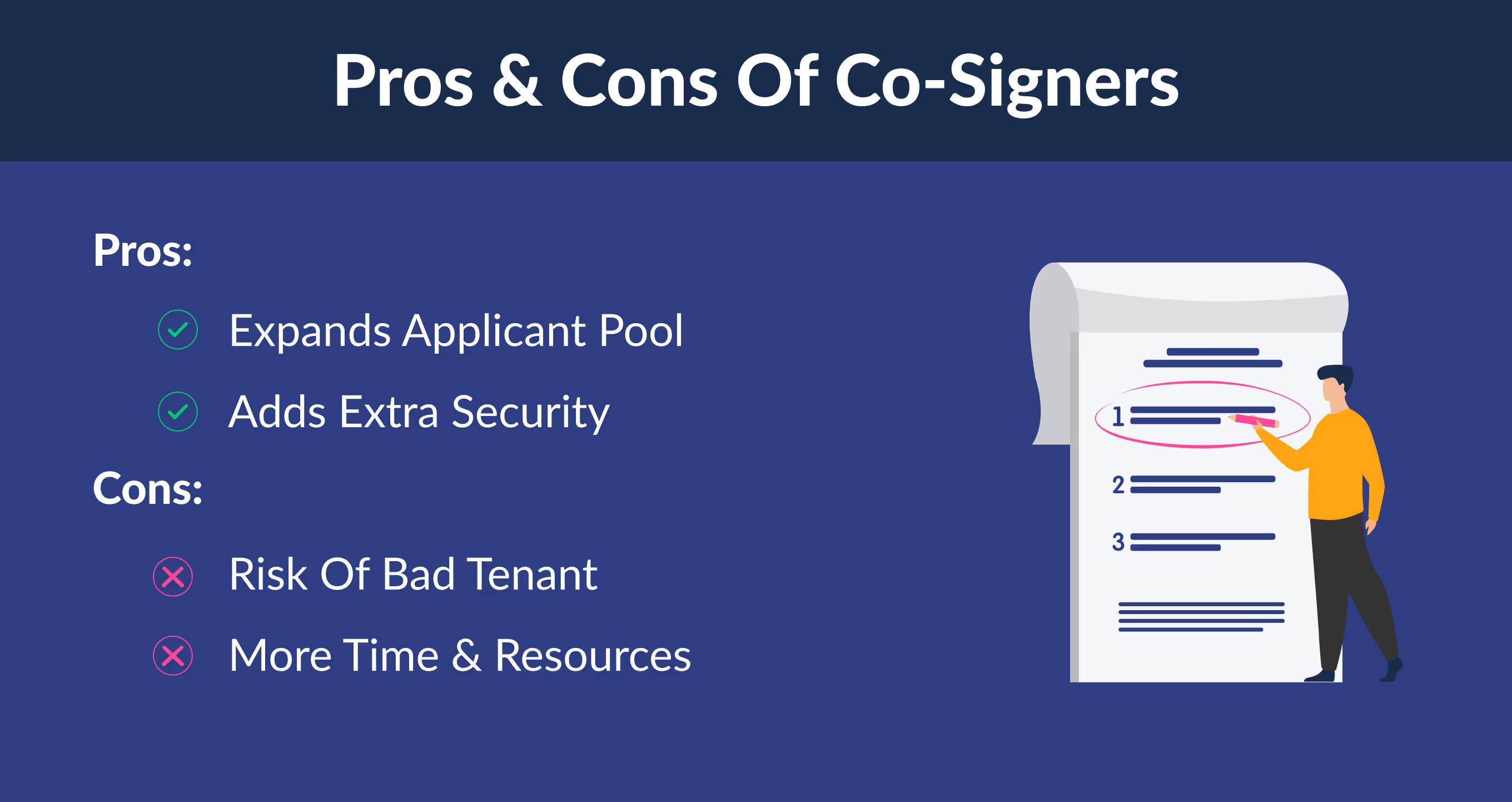

Pros & Cons Of Co-Signers

As mentioned before, landlords and property managers are always looking for ways to ensure that they choose the best tenants. So, accepting a co-signer may be a tricky decision.

To help with that decision, we've outlined all of the pros and cons of accepting co-signers on the lease agreement down below.

Pro: Expands Applicant Pool

When a landlord accepts a co-signer on the lease agreement, they are essentially expanding their applicant pool to younger individuals or first-time renters.

On the surface, these renters may seem risky, but they may actually end up being quality tenants. This is because, since they are young, first-time renters, they are going to be more cautious with the rental property and diligent with the rent payments.

Pro: Adds Extra Security

As mentioned before, one of the main benefits of accepting a co-signer is the added level of security. This is because the co-signer is acting as a second income in the property which means that it is more likely that all of the payments and fees will be completed on time.

So, as a landlord, you will be enjoying a less-risky rental experience and, as a tenant, you'll get to split the financial responsibility with someone else.

Con: Tenant May Be Risky

Although many tenants with co-signers are quality tenants and there's no reason to believe otherwise, there is still a small risk that the tenant is no good.

Whether the tenant is taking on a co-signer because of a low credit score or because they can't pay the rent completely, the landlord is still running the risk of these characteristics coming out during the rental period.

However, as mentioned before, the co-signer mitigates this risk by having a good credit score and helping cover the month's rent.

Con: More Time & Resources

Along with taking on more risk, landlords also have to devote more time and resources to applicants with co-signers.

This is because, instead of conducting the tenant screening process on just the tenant, they have to do it on the co-signer as well. Doing this may work out well for landlords with a limited applicant pool, but can become tedious for those with more options.

After thinking about some of the pros and cons of co-signers, landlords may want to come up with a solution to enjoy all the benefits of having one, but with less risk.

This is where co-signer services come in.

These services have become very common, and it's important that landlords understand their significance. So, in the next section, we will go over what a co-signer service is and what it does.

What Is A Co-Signer Service?

If a landlord requires a co-signer, but the tenant doesn't have access to one, they may look to invest in a co-signer service.

A co-signing service is a company that will essentially act as a co-signer or guarantor for a tenant. This means that they will pay the tenant's lease if they are ever unable to. However, these companies sometimes have requirements as strict as the landlord's.

Also, these properties typically have large upfront costs that a tenant ha top pay for the service. This cost can be either a set, concrete fee or a percentage of the rent that the tenant will be paying.

There are some risks, however, to hiring a co-signing service. Below, we will go over some of these risks in more detail.

Risks Of A Co-Singer Service

Below, we will go over some of the risks involved with hiring a co-signer service for a tenant's lease agreement.

Very Expensive

A co-singer service can be extremely expensive for a tenant. This is especially true for tenants that have rent payments that are already very expensive.

On top of these rental payments, they pay a fee to the service and another percentage for any additional fees. This can add up to a lot of extra expenses for the tenant each month and can become unsustainable.

Doesn't Cover Entire Lease Term

Another risk involved in paying for a co-signing service is that they only guarantee the rental payments for a certain amount of time. This period of time can be anywhere from 90 to 180 days, which means that it will be only 3 to 6 months of coverage.

This can be seen as very risky for landlords since the tenant will have no coverage for a large portion of the 12-month lease period.

Bottom Line

When a tenant requires a guarantor or cosigner, it means that they may have no other way to be able to rent a property.

But, this does not mean that you should treat them differently.

If the applicant shows qualities of a good tenant, but they require a cosigner or guarantor, then they should definitely be considered for the rental property.

.svg)

.svg)